Every profitable real estate deal starts with data.

The investors who consistently win aren’t the ones knocking on the most doors; they’re the ones who find the right doors first.

In today’s market, that requires nationwide property data: verified, searchable information that covers every state, county, and parcel without jumping between disconnected platforms. Yet most investors still waste hours combining county records, spreadsheets, and third-party lists before they can even run comps or send a campaign.

Definition: “Nationwide property data means searchable public-record and/or MLS information across all 50 states, with enough county-level depth to build accurate seller lists and run comps without jumping between multiple tools.”

The rise of specialized data software has changed that. Modern platforms now merge public records, MLS feeds, mortgage and lien data, ownership details, and neighborhood analytics into one searchable interface, making it possible to spot distressed assets, estimate ARV, or launch outreach campaigns in minutes.

For active investors (wholesalers, flippers, and BRRRR operators doing 1–4+ deals a month) the right platform can be the difference between chasing leads and owning your pipeline.

But here’s the nuance most reviews miss: “Nationwide” doesn’t mean every county is equally fresh. MLS rights vary. Some tools emphasize research depth; others focus on speed or marketing integration.

This guide compares the 7 best nationwide property data software platforms, based on real coverage, use cases, and investor workflows. You’ll see which tools actually deliver nationwide data and which ones turn that data into conversations that close.

And if you’re looking for a single platform that connects data, marketing, and deal flow, REsimpli’s List Builder stands out as the only solution that lets you pull lists, clean them, and launch outreach from the same dashboard.

Because in this market, data alone doesn’t win deals, speed does.

tl;dr

- Nationwide property data gives investors verified access to ownership, mortgage, and MLS information across all 50 states — helping you find motivated sellers faster.

- The best nationwide property data software combines coverage, freshness, and automation — turning raw records into actionable conversations.

- Tools like PropStream, DataTree, ATTOM, PropertyRadar, DealMachine, and Privy offer strong data layers but still require multiple apps to complete your workflow.

- REsimpli is the only all-in-one platform built for investors — uniting List Builder, List Stacking, Skip Tracing, Speed to Lead, AI-powered follow-ups, dispo, and accounting under one roof.

- With REsimpli, you can pull nationwide data, clean lists, contact owners, automate follow-ups, and track ROI — without exporting anything or juggling integrations.

If you’re serious about doing more deals with fewer tools, explore REsimpli’s pricing plans and start your 30-day free trial today.

What Does Nationwide Property Data Include?

When investors talk about nationwide property data, they’re referring to a mix of public records, MLS listings, and proprietary datasets—compiled across thousands of counties in all 50 states. The depth and freshness of these records determine how accurately you can target motivated sellers, price deals, and forecast profit margins.

Here’s what a complete nationwide dataset typically includes:

1. Public Property Records

Core county data: ownership details, parcel IDs, assessed values, tax history, mortgage and lien information, and transfer documents. These records form the foundation for every list an investor builds: absentee owners, inherited properties, or tax-delinquent homes.

2. MLS Data

Active, pending, and sold listings from Multiple Listing Services across the U.S.

This layer provides comparables (comps), days on market, and listing activity which is critical for evaluating ARV (After Repair Value) and understanding local pricing trends.

3. Mortgage, Lien & Foreclosure Data

Tracks loans, defaults, and foreclosure filings. For investors, this data highlights distressed or high-equity properties before they hit the open market.

4. Owner & Contact Information

Every profitable campaign depends on reaching the right person. Tools with built-in Skip Tracing features can automatically append phone numbers and verified email addresses, reducing bounce rates and wasted dials.

5. Property Characteristics

Square footage, lot size, number of beds and baths, year built, zoning type, and building permits. This layer fuels accurate comparables and filters for niche strategies—like targeting small multifamily or vacant land. You can also collect on-the-ground data with Driving for Dollars.

6. Market & Neighborhood Analytics

Demographics, rental estimates, school ratings, and local appreciation trends. Advanced tools use these insights to help investors identify emerging markets or zip codes with strong resale potential.

7. Transaction & Buyer Insights

Some platforms enrich property data with cash buyer lists, investor activity maps, or transaction history. These features make it easier to understand who’s actively buying in your market and what types of properties they prefer.

A complete nationwide data platform should offer all seven layers, updated at least weekly, with the ability to export, filter, and segment lists by motivation or equity.

That’s why seasoned investors now choose software that combines data coverage with built-in analysis and outreach tools instead of juggling multiple exports and spreadsheets.

How to Evaluate Nationwide Property Data Software

Not all “nationwide” tools are created equal. Two platforms can cover the same 50 states but vary drastically in update frequency, county-level depth, and how easily you can turn that data into deals.

When evaluating nationwide property data software, use this seven-point checklist:

1. Coverage and Data Sources

Confirm true 50-state coverage, not just “nationwide marketing claims.”

Look for platforms that combine public records + MLS data + mortgage/lien information, refreshed weekly or monthly. Gaps at the county or MLS level can skew your targeting accuracy.

2. Data Freshness and Cadence

Some counties update daily; others, quarterly. Verify when property records were last refreshed and how often MLS feeds sync.

For investors running high-volume direct mail or SMS campaigns, outdated records can mean wasted spend and duplicate outreach.

3. Filter Depth and Search Granularity

A serious investor tool should let you filter by absentee ownership, equity percentage, mortgage age, property type, foreclosure status, or sale date.

The more granular your filters, the easier it is to isolate motivated sellers.

4. Data Hygiene and Deduplication

Building lists is only half the battle; cleaning them is what drives ROI.

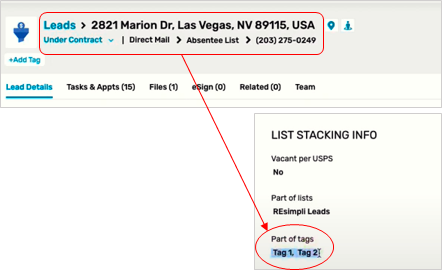

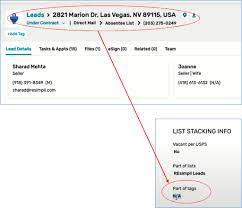

Tools like List Stacking allow you to merge, de-dupe, and score leads based on multiple motivation signals (for example: absentee + high equity + tax delinquent).

5. Built-in Skip Tracing

Without contact info, even the best property list is useless.

Native Skip Tracing saves time and cost by automatically appending verified phone numbers and emails, so you can launch outreach instantly.

6. Workflow & Marketing Integration

The best data software doesn’t just stop at export.

Check whether it lets you trigger SMS, email, or direct-mail campaigns without leaving the platform, or if it forces you to juggle CRMs, dialers, and Zapier automations.

7. Pricing Transparency and Limits

Some tools price per record; others limit monthly pulls or exports. Understand your use case, whether you need deep research data (DataTree, ATTOM) or volume list pulling (PropStream, REsimpli) before committing.

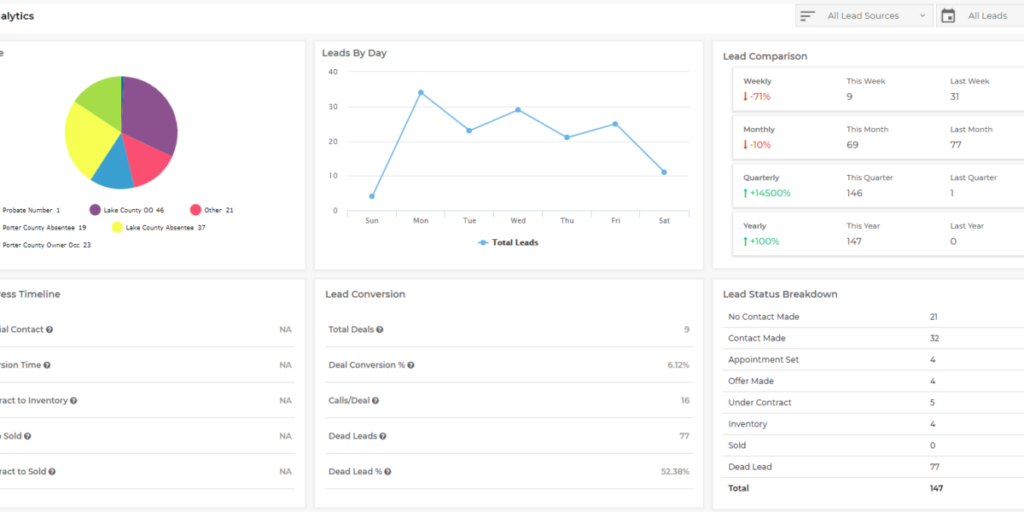

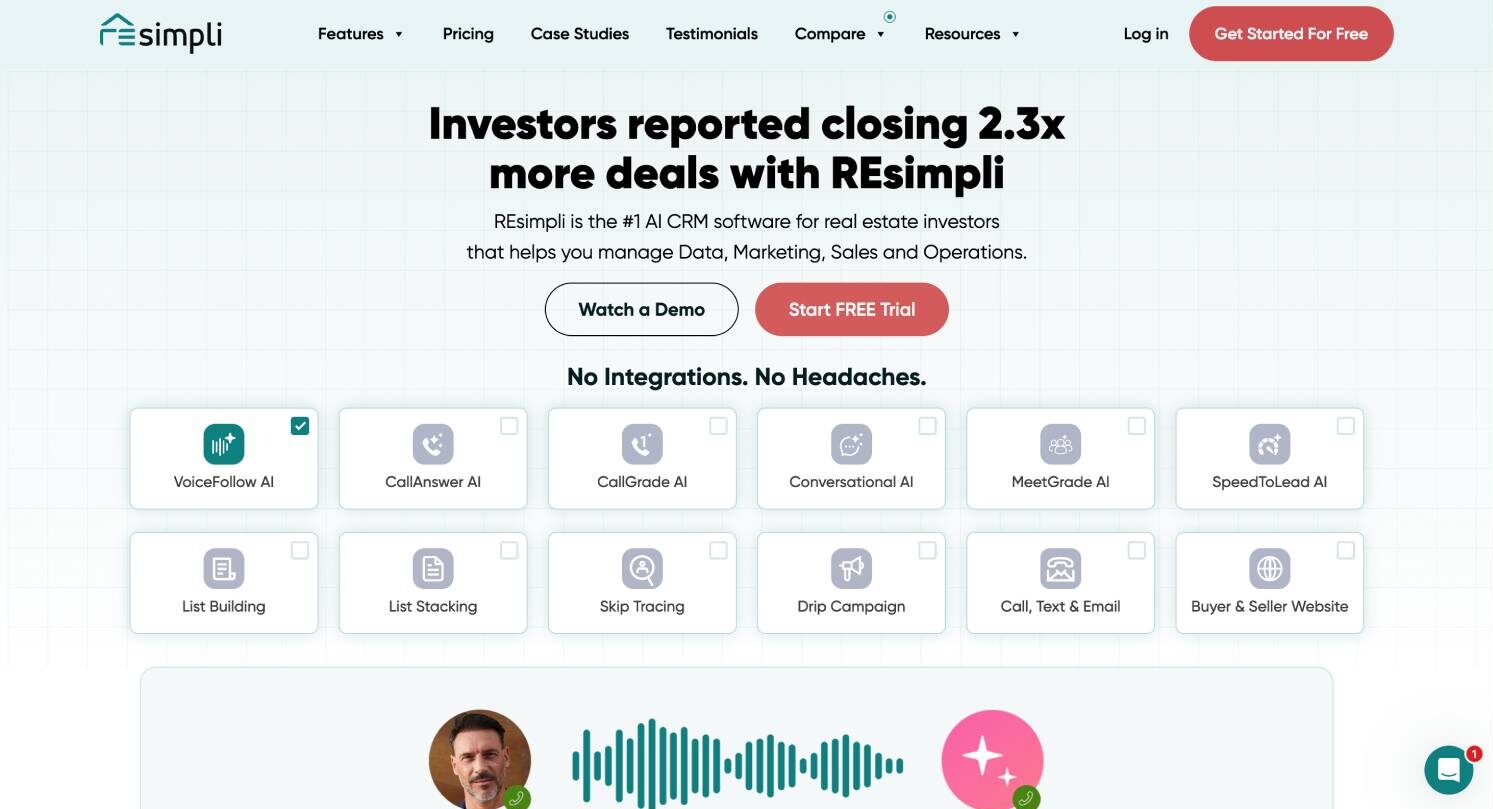

1. REsimpli – Best All-in-One Nationwide Property Data Platform

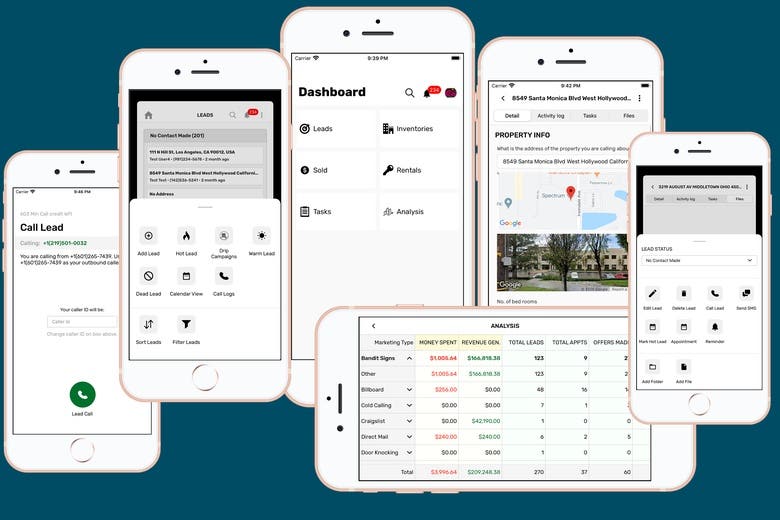

When it comes to nationwide property data, most platforms stop at list pulling. REsimpli goes further. It connects data, marketing, and deal flow in one system.

It’s an AI-powered CRM for real estate investors that replaces the usual stack of Podio, CallRail, BatchLeads, and Zapier. You can pull lists, clean and stack them, skip trace for free, call, text, email, send direct mail, and manage dispo (all without leaving the platform).

Check out the 9 most powerful AI Agents built for real estate investors here.

Key Data Features

- List Builder: Pull targeted nationwide lists based on filters like absentee ownership, equity, mortgage age, or property type.

- List Stacking: Merge and de-dupe records across multiple lists; filter by motivation (e.g., absentee + pre-foreclosure + tax delinquent).

- Skip Tracing: Instantly find verified phone numbers and emails tied to property owners (built directly into the platform).

- Driving for Dollars: Capture on-the-ground leads with GPS tagging and route history from the mobile app.

- Cash Buyer Database: Access active buyer lists nationwide to speed up dispo cycles.

REsimpli Value Proposition: REsimpli lets investors pull lists, clean and stack them, find verified contact info, and launch calls/SMS/email/direct mail from the same place—then track dispo and accounting. Fewer logins, faster deals.

AI Agents That Automate Follow-Up

REsimpli’s edge isn’t just data, it’s speed. Nine built-in AI Agents automate what used to take hours:

- SpeedToLead AI: Auto-calls new leads within seconds of form submission.

- VoiceFollow AI: Runs follow-up calls and SMS threads automatically.

- CallAnswer AI: Get inbound calls answered directly and handled by AI.

- LeadScore AI: Prioritizes new leads based on past deal data.

- Conversational AI: Instantly replies to incoming texts with AI-powered SMS

- Call Grade AI: It grades every seller call, showing what worked and what didn’t (without manual review)

- Meet Grade AI: It automatically grades in-person seller meetings, so your team can close more (with less oversight).

- KPI Insights AI: AI scans your KPI data and gives you smart, actionable insights.

- REsimpli Translate AI: Translate messages with one click

These AI Agents turn raw data into booked appointments while you focus on closing.

Why REsimpli Stands Out

- True all-in-one system: from data → marketing → sales → accounting.

- No third-party integrations required — “No Integrations. No Headaches.”

- Comes with 2.3× more deals claim, based on investor case studies.

- Includes high-value monthly credits:

- 10,000–50,000 skip tracing records (worth up to $7,500/mo)

- 10,000–50,000 list pulling credits

- Cash buyer searches on every tier.

- 10,000–50,000 skip tracing records (worth up to $7,500/mo)

Best For

- Real estate investors ranging from solo teams to large scale operations of 10+deals a month..

- Wholesalers and flippers who need nationwide data and instant lead response.

- Anyone tired of juggling separate CRMs, dialers, and skip tracing platforms.

Pricing

- Plans start at $149/month, with generous built-in free skip tracing, list pulling, and cash buyer searches.

- Higher tiers unlock unlimited stacking, advanced AI agents, and team features.

- Try it risk-free: Start your 30-day free trial →

Verdict

REsimpli is the only tool on this list that handles the entire data-to-deal loop from sourcing and enrichment to outreach and accounting. Many investors still use niche data providers, but they run everything through REsimpli to manage follow-up, marketing, and performance tracking from one place.

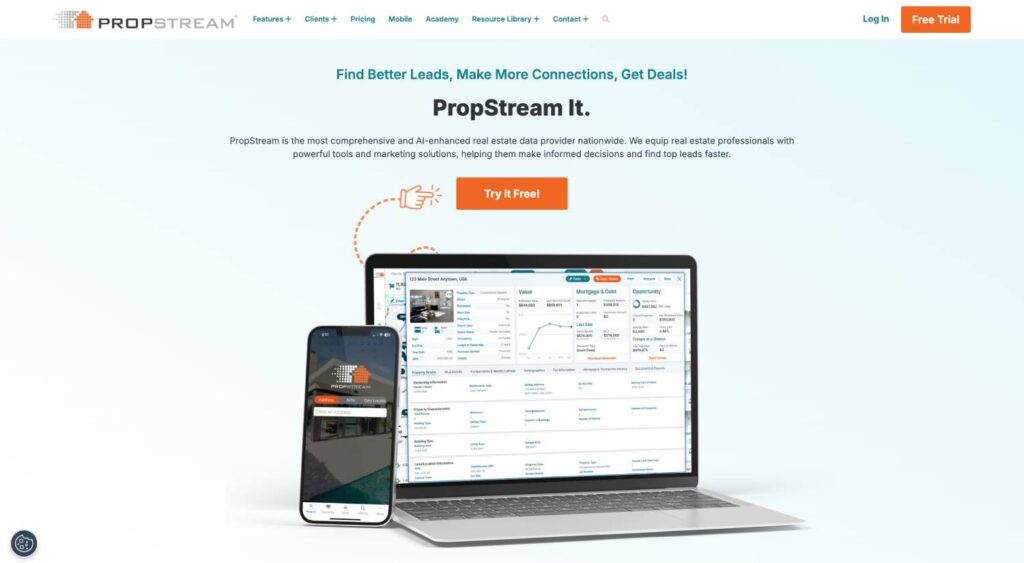

2. PropStream – Best for MLS + Public Records in One Dashboard

PropStream has long been the benchmark for nationwide property data coverage.

It combines MLS listings, public records, mortgage data, and property analytics into one searchable interface—making it a go-to for investors who primarily want to research, analyze, and pull lists at scale.

Its nationwide database covers over 155 million properties across all 50 states, including off-market and distressed leads. You can filter by foreclosure stage, ownership type, equity percentage, loan balance, and more.

Key Data Features

- MLS + public record integration across most U.S. counties.

- Pre-foreclosure, auction, and bank-owned filters for distressed properties.

- Vacancy indicators, equity filters, and lien tracking.

- Built-in comping tool for estimating ARV.

- Owner contact information (via paid skip tracing add-on).

- Heatmaps to visualize local trends and investor activity.

Pros

- Massive data coverage with advanced filters.

- Strong map interface and custom list export options.

- Ideal for high-volume prospecting and quick list creation.

Cons

- Skip tracing and marketing tools are add-ons, not native.

- MLS coverage and update frequency vary by region.

- Workflow still requires exporting data into another CRM for follow-up.

Best For

Investors who want access to raw nationwide data for research and list building—especially those who already use another platform (like REsimpli) for follow-up, marketing, and automation.

Buyer-Beware Box:

“Nationwide ≠ identical everywhere. Counties update at different cadences. MLS rights vary. Always verify freshness, export limits, and whether skip tracing is native or an add-on before you commit.”

Pro Tip:

If you’re using PropStream purely for data, pair it with REsimpli’s Speed to Lead or List Stacking to automate outreach and avoid duplicate records.

3. First American DataTree – Best for Deep Public Records & Document Images

First American DataTree is one of the most authoritative public record databases in the U.S. It’s built for professionals who need granular property data, not just investor-ready lists.

Powered by First American’s nationwide title and mortgage datasets, DataTree provides detailed ownership history, recorded documents, parcel maps, and transaction data across nearly every U.S. county. It’s a trusted source for due diligence, underwriting, and research rather than list-based marketing.

Key Data Features

- Nationwide access to property, mortgage, lien, and deed records.

- Document image retrieval for title documents, deeds, and liens.

- Parcel mapping with boundary overlays and assessor data.

- Verified owner history with transfer and encumbrance details.

- Automated valuation models (AVMs) and market analytics.

Pros

- Exceptional accuracy and document-level detail.

- Ideal for deep research, verification, and compliance.

- Integrates well with title and appraisal workflows.

Cons

- Not designed for investors focused on list building or marketing.

- Interface is data-heavy, with a steeper learning curve.

- Skip tracing and automation features are not included.

Best For

Title professionals, underwriters, and experienced investors who prioritize data depth over workflow automation.

For real estate investors, DataTree is often used alongside a CRM like REsimpli, where the data can be stacked, cleaned, and enriched through built-in Skip Tracing to power outreach and follow-up.

4. ATTOM (Nexus) – Best API Access to Nationwide Property + Neighborhood Data

ATTOM powers some of the biggest names in real estate tech. Its Nexus platform and Property Data API provide comprehensive, ready-to-license nationwide datasets that combine property, mortgage, deed, tax, and neighborhood information.

Unlike other tools on this list, ATTOM isn’t designed only for individual investors—it’s a developer-grade data backbone built for companies that need to integrate property intelligence into their own apps or CRMs. Still, smaller investing teams increasingly use its self-serve tools for advanced analysis and custom dashboards.

Key Data Features

- Nationwide parcel coverage: 155+ million U.S. properties with unique ATTOM IDs.

- Ownership & mortgage data: current owner, lien positions, loan type, origination, and maturity details.

- Neighborhood analytics: demographics, crime rates, school scores, and walkability indexes.

- Market trends: sale prices, turnover, and rental benchmarks by zip or census tract.

- API & bulk delivery: JSON, CSV, or web dashboard access for integration into investor tools.

Pros

- Extremely rich dataset with a consistent schema such as persistent unique identifier, standardization process, flexible bulk data delivery, etc. across all states.

- Perfect for building internal dashboards or analytics-driven decision models.

- Enterprise-grade accuracy with licensing options for resale or app embedding.

Cons

- More technical setup—built for developers, not plug-and-play users.

- No built-in marketing, skip tracing, or campaign automation.

- Pricing depends on record volume and API calls, not flat subscriptions.

Best For

Investors, analysts, or proptech founders who want to integrate nationwide property and neighborhood data directly into custom systems.

For active real estate teams, ATTOM’s data pairs well with REsimpli’s AI Agents and Speed to Lead workflows—turning raw property data into actionable lead response and follow-up sequences inside one unified platform.

5. PropertyRadar – Best for Investor Automation + Market Intelligence

PropertyRadar blends nationwide property data with powerful list-building and automation features built for small business users and investors. Where many tools stop at exports, PropertyRadar shines at segmenting micro-markets, monitoring changes, and triggering actions when properties or owners match your criteria.

Key Data Features

- Nationwide coverage with county-level public records and owner profiles.

- List Builder with granular filters (equity, ownership type, length of ownership, mortgage age, transfer activity).

- Geospatial tools (geo-fencing, polygons, radius targeting) for hyperlocal lists.

- Change alerts that watch lists for events (new liens, listings, ownership updates) so you can act immediately.

- Built-in automations to push new matches to outbound workflows (email, postcards, webhooks/Zapier-style actions).

Pros

- Excellent for market intelligence and staying ahead of changes.

- Flexible geography and filter logic to target small pockets with precision.

- Event-driven automation cuts manual list maintenance.

Cons

- Outreach stack is lighter than a full CRM; you’ll still need a system for dialing/SMS/email/dispo/accounting.

- MLS comps are not the core strength compared with Privy/PropStream.

- Pricing scales with data/automation use cases.

Best For

Operators who want to own a few markets with surgical precision—nurturing geo-fenced lists, reacting to changes, and feeding hot records straight into a deal machine.

Workflow tip: Many investors feed PropertyRadar’s dynamic lists into REsimpli to run List Stacking, Skip Tracing, and automated follow-up (dialer, SMS, email, direct mail) from one place—keeping the research/monitoring power while centralizing conversations and KPIs.

6. DealMachine – Best for On-the-Go Owner Data + Driving for Dollars

DealMachine is built around mobile-first acquisition. Its Driving for Dollars workflow lets you capture properties from the street, auto-pull owner records, and launch outreach from your phone. For investors who prospect neighborhoods, it’s one of the fastest ways to turn field time into leads.

Key Data Features

- Nationwide owner/property lookups tied to GPS pins and route history.

- Instant mailers from the app (postcards/letters) to contacted owners.

- Batch record search for desk-based list work.

- Team features for assigning routes and tracking coverage.

Pros

- Best-in-class mobile capture and routing for D4D.

- Fast path from property discovery → owner data → mail.

- Easy for new field reps to use with minimal training.

Cons

- Research depth and MLS comps are lighter than pure data platforms.

- You’ll still need a central CRM for dialing/SMS/email/dispo/accounting.

- List hygiene (dedupe/stacking) usually requires another tool.

Best For

Investors who prospect in the field and want a simple, reliable D4D pipeline.

Workflow tip: Many teams capture D4D leads in DealMachine and then push them into REsimpli for List Stacking, Skip Tracing, and multi-channel follow-up—or they run the entire D4D motion inside REsimpli’s own Driving for Dollars to keep everything under one roof.

7. Privy – Best for MLS Comps + Investor Activity Tracking

Privy focuses on near-real-time MLS visibility and on-market speed. It’s popular with flippers and wholesalers who want to see investor-grade comps, track active buyers, and spot hot areas based on actual activity—not just static public records.

Key Data Features

- MLS-driven comping tools with photos, DOM, and price history.

- Investor activity overlays to identify where deals are moving.

- Alerts for price drops/new listings that match your buy box.

- Basic off-market filters via public records (varies by market).

Pros

- Strong for comping and on-market deal analysis.

- Useful “what investors are buying” lens to guide acquisitions.

- Alerts help you move quickly when the right listing appears.

Cons

- MLS coverage can vary by region; off-market data is not the core.

- Limited list-cleaning and bulk enrichment.

- You’ll need a CRM to run outreach, nurture, and dispo.

Best For

Flippers and wholesalers who rely on fast MLS comps and want to follow real investor activity in target markets.

Workflow tip: Use Privy for comping and on-market alerts, then pipe qualified leads into REsimpli to trigger Speed-to-Lead automations and manage the entire data → marketing → sales loop (dialer, SMS, email, direct mail, dispo, accounting) from one dashboard.

Replace Multiple Subscriptions with One Platform

Every investor knows the pain of juggling too many tools. One for list pulling. Another for skip tracing. A third for calling and texting. Then a CRM to track leads, a mail house for direct mail, and an accounting app to tie it all together.

This tool sprawl slows down your pipeline and eats into profits.

REsimpli replaces that entire stack with one all-in-one platform that connects your data, marketing, sales, and operations. From pulling motivated seller lists to making the first call, every step happens in the same system — no third-party logins, no integrations, no syncing issues.

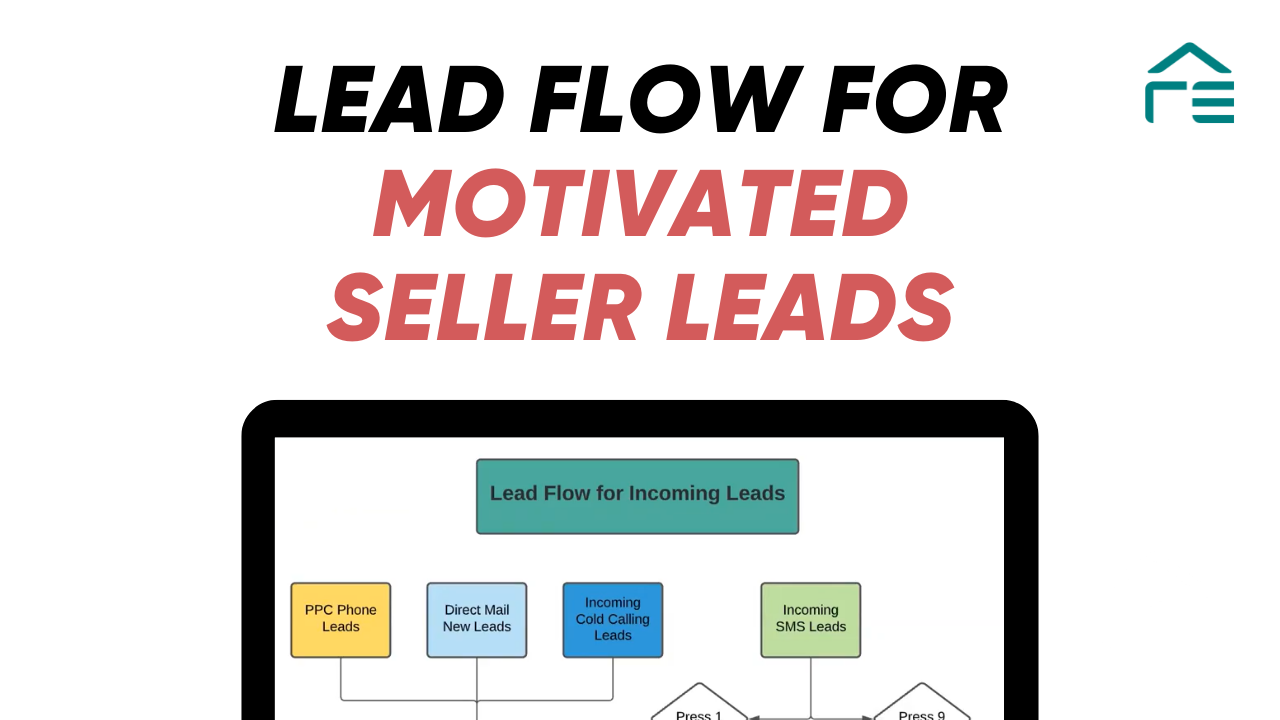

Here’s how it works in practice:

- List Builder: Pull nationwide records filtered by motivation, equity, ownership type, etc.

- List Stacking: Instantly clean and merge lists to remove duplicates and prioritize high-intent sellers.

- Free Skip Tracing: Find verified phone numbers and emails in seconds, right inside the platform.

- Dialer, SMS, and Email: Launch outreach campaigns from the same place — no exporting or importing.

- Direct Mail: Send personalized postcards and letters without leaving your CRM.

- Speed to Lead: Automatically respond to new inquiries within seconds through voice or SMS.

- AI Agents: Handle inbound calls, grade conversations, follow up automatically, and score new leads.

- Accounting Dashboard: Track every deal, marketing cost, and ROI in real time.

The result? A faster, simpler, and more profitable workflow. Investors who used to spend hours switching between tools now manage everything in one system — pulling lists, contacting owners, following up, closing deals, and tracking revenue — all in REsimpli.

That’s why the brand’s promise is simple: “No Integrations. No Headaches.”

When you consolidate your stack, you don’t just save on subscriptions — you gain speed, accuracy, and control.

If you’re ready to simplify your deal flow, explore REsimpli’s pricing plans and start your 30-day free trial today.

How to Choose the Right Nationwide Property Data Tool

Choosing the right nationwide property data software comes down to one goal — finding motivated sellers faster than your competitors. But with so many tools claiming “nationwide coverage,” the real question is: which one actually helps you close more deals?

Here’s a practical way to evaluate your options:

1. Check True Coverage

Make sure the platform really covers all 50 states — not just a handful of counties. Look for tools that combine public records, MLS data, and mortgage history in one place. If a platform can’t pull consistent records nationwide, you’ll constantly run into missing data.

2. Review Update Frequency

Data that’s two months old is useless for outreach. The best software refreshes property and ownership data weekly or even daily, ensuring your campaigns hit live opportunities — not stale leads.

3. Test Filter Flexibility

Strong investor tools go beyond ZIP codes. You should be able to target by equity percentage, absentee ownership, property type, or foreclosure status to find sellers most likely to respond.

4. Prioritize List Hygiene

Even the best lists need cleaning. Features like List Stacking help you merge, remove duplicates, and focus on the highest-quality records. That means fewer wasted calls and a better ROI per campaign.

5. Evaluate Skip Tracing Options

Without accurate contact data, no list delivers results. Native Skip Tracing saves time and cost by automatically pulling verified phone numbers and emails — so you can launch your outreach instantly.

6. Look for Built-in Marketing and Automation

If a tool requires exporting lists to run campaigns, it’s already outdated. Modern systems like REsimpli include dialing, texting, emailing, direct mail, and Speed to Lead automation under one roof. It’s the only way to move from record to real conversation without friction.

7. Understand Pricing and Limits

Some providers charge per record; others limit monthly pulls or exports. Compare credit allowances, skip tracing rates, and automation features before subscribing. The best platforms make pricing transparent and predictable as you scale.

A Simple Framework That Works

If you’re setting up your stack or rebuilding from scratch, start simple:

- Use List Builder to pull nationwide data based on your criteria.

- Run List Stacking to remove duplicates and highlight top leads.

- Enrich with Skip Tracing to find phone numbers and emails.

- Launch an automated outreach campaign using Speed to Lead so no inquiry goes unanswered.

That’s the same data-to-deal flow top investors follow — and the exact reason why REsimpli has become the go-to nationwide property data solution for serious real estate professionals.

If you’re comparing tools, start with what matters most: accuracy, automation, and actionability.

Because at the end of the day, the best nationwide property data software isn’t the one with the most rows — it’s the one that helps you close the next deal faster.

Conclusion

The difference between an average investor and a consistent deal-maker often comes down to how quickly they act on data. Nationwide property data gives you that edge but only if the software you choose turns raw records into real conversations.

Tools like PropStream, DataTree, ATTOM, PropertyRadar, DealMachine, and Privy each bring something valuable to the table. PropStream offers breadth, DataTree brings depth, ATTOM powers enterprise-grade analytics, and DealMachine excels at on-the-go prospecting.

But if you want a single platform that does more than pull lists — one that helps you clean, enrich, contact, and convert — REsimpli is the standout choice.

It connects every part of your workflow:

- Pull nationwide data with List Builder

- Clean and prioritize leads using List Stacking

- Append verified contact info via Skip Tracing

- Launch campaigns through built-in dialer, SMS, email, and direct mail

- Respond instantly with Speed to Lead

- Manage follow-ups, dispo, and accounting inside the same dashboard

That’s the difference between using a tool and running a system.

In real estate investing, data is everywhere but speed is rare. REsimpli helps you close that gap.

If you’re ready to simplify your acquisition process, explore the pricing plans and start your 30-day free trial today.