What is a real estate drip campaign?

Real Estate Drip Campaign consists series of customized, scheduled, and automated contact activities, or drips, that investors use to optimize lead follow-up. Each activity is scheduled and executed without additional work from the real estate investor.

From automated calls and SMS to ringless voicemails and automated email marketing, the scheduled activities take place over time, a little here, a little there, like a dripping faucet.

REsimpli users can choose from a variety of real estate drip campaign templates or create customized marketing campaigns. Streamline follow-up and build better relationships.

Stop missing out on potential motivated seller leads. Set up drips to work for you.

Miracle deals happen: an investor is in just the right place, at just the right time, and meets an extremely motivated seller who is ready to sell now. True success, however, doesn’t come from closing one miraculous deal.

To unlock real success and sustainable business growth in real estate, investors need to close great deals consistently.

Locating target properties is just the first step. The key to real estate success is consistent, quality lead follow-up.

Discover the power of lead follow-up and drip campaigns.

Did you know that only 2% of sales occur during the first contact with a lead? Out of all of the first phone calls that investors make, or direct mailers they send, only 2% of those contact attempts lead to our s0-called “miracle deals.”

Real estate is a numbers game.

Let’s break it down:

If you were to send out 10,000 Direct Mail pieces, you may hear back from 100 people. Of the 100 people that do call back, you might get incredibly lucky and speak with one or two ready-to-sell motivated homeowners and close one deal.

If you don’t follow up with the other 99 leads, you could be leaving a lot of money on the table.

Let’s do some quick maths with two scenarios.

First scenario: You spent $5,000 in Direct Mail marketing and landed one deal. Considering your average revenue per deal is $15,000, your ROI would be:

Return on Investment (ROI) = $15000/$5000=3x

Cost per Deal = $5000/1= $5000

What if you were able to close one extra deal from the same campaign without spending any extra money?

Let’s do the math again…

Second Scenario: You spent $5000 on direct mail. You closed 2 deals this time and made a revenue of 2*$15000=$30000

Return on Investment (ROI) = $30000/$5000= 6x

Cost per Deal = $5000/2= $2500

Converting one extra deal means doubling down your ROI and cutting down your Cost per Deal to half.

This is where the power of drip campaign comes in. It helps you convert more deals from your existing 99 leads by automating the follow-up process eventually resulting in much higher ROI.

How many lead follow-up attempts should you make?

The number of deals real estate investors close directly correlates to the number of contact attempts they make. Whether contacting past clients or leads from your target audience, the lead response rate increases the more you reach out.

real estate success rates compared to lead contact attempts:

- 1st attempt: 2%

- 2nd attempt: 3%

- 3rd attempt: 5%

- 4th attempt: 10%

Investors start to really see success rates grow after their fifth contact attempt. In fact, 80% of deals occur between the 5th and 12th attempts.

If you give up on a lead too early, it could cost you, and your small business, big time.

How many real estate investors follow up with leads?

When a lead comes in, a switch flips in the minds of most investors: it’s all about the money. The faster you reach out to a motivated seller, the higher the likelihood that you’ll close a deal.

You would think that all investors have fast fingers and are quick to call leads back, but that isn’t the case.

44% of investors never follow up with prospects, and 25% give up after the second attempt. 12% of investors make three contact attempts or more, with only 8% of all investors contacting leads five times or more, even though the majority of deals close after five or more attempts.

Why don’t investors follow up with leads?

Investors may not touch base with leads for a variety of reasons, such as:

- They have a fear of rejection.

- They lack automated tools.

- They have a difficult sales plan in place.

- They have a small business without enough help.

If you miss the initial call from a lead, reconnecting can be difficult, but the investors with the most success are persistent.

They keep calling. They send direct mail. They follow up, and then they do it again.

Over and over.

Investors reach out to leads consistently, or they set up a drip campaign to do the hard work for them.

real estate drip campaign examples

Outperform competitors with REsimpli real estate drip campaigns.

Although it can feel disheartening, to reach out repeatedly with no response, investors who reach out to non-responsive leads consistently have an advantage over investors who give up quickly.

Swooping in on the competition’s missed opportunities is a great way to become the foremost investor in a seller’s mind, but who has the time to make hundreds of phone calls each day or design, print, and send dozens of direct mailers each week?

What is Automated real estate drip campaigns?

Automated real estate campaigns consists series of customized, scheduled, and automated contact activities, or drips, that investors use to optimize lead follow-up. Each activity is scheduled and executed without additional work from the real estate investor.

From automated calls and SMS to ringless voicemails and automated Email campaign for real estate agents, the scheduled activities take place over time, a little here, a little there, like a dripping faucet.

REsimpli users can choose from a variety of drip campaign templates or create customized marketing campaigns. Streamline follow-up and build better relationships.

Stop missing out on potential motivated seller leads. Set up drips to work for you.

Drip campaigns are part of the sales team.

A drip campaign acts like an automated salesperson that works on your behalf, 24-7. They identify what needs to be done, when it needs to be done, and make it happen.

Picture an automated virtual assistant with access to your marketing strategy, to-do list, specific instructions, and infinite energy

With REsimpli’s built-in automated drip campaigns, busy real estate investors can set it and forget it.

The sequence you set continues to work for you, even when you’re not around. Using automated drips, you can keep up with leads and drive traffic to your business, even when you’re away from your desk or out of the office entirely.

You may not have time to individually SMS 998 leads, but REsimpli does.

What is a drip sequence?

A campaign’s drip sequence is the sequence that automated software follows; it is the order of events in a drip campaign. If the campaign is a faucet, each drip in the sequence is an additional attempt to reach the seller, slowly but steadily continuing over time.

You may be waiting to hear back on an offer, for example, but aren’t having luck getting in touch with the owner. Set up a chronological sequence of contact activities and reminders, to ensure that the lead doesn’t get lost or forgotten and that no deals fall through the cracks

What actions do drip campaigns include?

Most investors create sequences that include multiple different contact methods. The most common drip campaign activities include phone call reminders, SMS, ringless voicemail, direct mail, and email drip campaigns.

Investors choose which communications to include in the campaign and in which order by assigning leads to a particular campaign.

Are email drip campaigns effective?

While email drip campaigns are popular marketing efforts in many industries, real estate investors have more success with telephone calls, SMS, and direct mail than email automation.

How do you use a drip campaign?

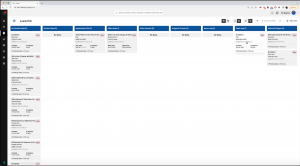

When a new lead comes in, the first thing you want to do is add the lead to a drip campaign, either by selecting an existing campaign or by creating one of your own.

In addition to new leads, drips are also powerful tools for continuing communication efforts with homeowners you’ve spoken with before but who are not responding now.

REsimpli users can assign a new lead to a campaign in just a few steps.

Step 1: Open the lead.

Search for the lead in your system to open and locate existing leads. If the lead doesn’t exist already, create a new lead with the information you have.

Step 2: Skip trace for missing property information.

Skip trace the lead to fill in missing property information, such as missing phone numbers or an absent mailing address.

For example, you may have received a missed call, but the owner’s not responding to return calls. Skip trace to find an updated email address or current mailing address so you can attempt to contact via other methods.

Step 3: Add the lead to a campaign.

Depending on the level of communication you’ve had with a seller, your contact needs will change. For example, you’d communicate differently with a seller that you’ve made an offer to than you would if you were following up regarding an appointment.

Common campaign name examples include: Real estate drip campaign sample

- Made Offer-No Response

- Reschedule Appointment-No Response

- Website Lead

- Direct Mail Lead

- Long-Term Follow-up

Select an existing campaign that suits the lead type and current situation. The actions detailed in the campaign sequence will automatically be applied to the new lead.

Step 4: Set the campaign’s start and end date.

Determine when the first and last drip action will take place, as well as the frequency of actions in-between.

If you don’t want the first action to take place immediately, add a delay. A delay of one week, for example, tells the CRM to kick off the campaign in one week.

Step 5: Set it and forget it

Confirm the details of your campaign, and you’re done! You’ll receive automated task reminders when it’s time to give the lead a call. As REsimpli completes scheduled activities, the system tracks the lead status, contact attempts, and any notes added along the way.

If you receive a no-contact request from a homeowner, simply remove the lead from the assigned campaign.

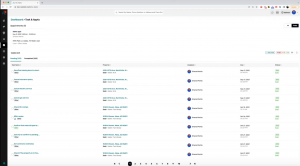

Creating new customized drip campaigns

In addition to assigning leads to created campaigns, REsimpli users can create new custom campaigns designed to fit the homeowner’s contact preferences and communication style, as well as the investor’s objective.

To create a new campaign, open a lead. Instead of attaching the lead to an existing campaign, create a new drip campaign instead.

Naming new campaigns

Give new campaigns an informative name, making it easy to identify the purpose and target of the drip.

example campaign names include:

- No name/No Address: A call came in, but you have no name or address for the caller.

- Text drip campaign real estate: You received a lead text, but have not had direct contact yet.

- Contact made-No Appointment: You have spoken with the lead, but have not scheduled an appointment.

- Offer-Went Dark: You made the homeowner an offer, but have not heard back yet.

Setting up the campaign’s sequence

Select the first action you want to attach to the lead and schedule it.

For example, you may want to give the lead a follow-up call in one week. If so, select a telephone call as the first action in the sequence. Next, confirm the date and time for the call. As the scheduled drip approaches, REsimpli will send you call reminders.

If you’ve already had contact with a homeowner, and are calling to follow up, add any relevant lead notes to remind you of important details to cover during the call or to remind you of previous discussions. Lead notes make it easy to keep track of and share lead details with your team.

Scheduling automated drips

In addition to sending automated call reminders, REsimpli automatically completes a variety of contact attempts on your behalf.

automated drip Actions include:

- Text messages

- Direct Mailers

- Ringless Voicemails

- Automated emails

- Additional task reminders

Select the next action you want to add to the sequence. Select the date, time, and frequency that you would like the automated action to occur. At the scheduled time, REsimpli completes the action and logs drip activity in the CRM.

Detailing campaign parameters

In addition to selecting the date and time that drip actions will take place, REsimpli users are in complete control of how and when the campaign occurs.

Fully customizable, the CRM allows you to set a variety of drip parameters, such as:

- Delay duration

- Msg frequency

- Office hours/availability

- Duration of campaign

- When/where calls are routed

Tell the system to skip holidays and weekends so you don’t bother homeowners over the holidays or during weekend family time. If the drip falls on a holiday, REsimpli reschedules it to take place on the next business day instead.

Personalizing your drip campaign

Select SMS text or email body from preloaded templates and select which lead details you would like to pre-populate into your message from the message field list. There are a variety of pre-populated message fields users can add, including:

- First name,

- Last name,

- Date,

- Property Address, and more.

Select from the list of built-in message options, or write your own messages, designed to appeal to the type of seller you’re targeting.

Personalized marketing text messages

If you receive a missed call from a no-name lead, your SMS copy may look something like this:

“Hello, this is Robin. I’m sorry I missed your call. I’m just curious if you had any interest in selling your property? If not, my apologies for disturbing you.”

If you’ve made an offer to a lead, but then they went dark, your SMS will likely include a more detailed message, such as:

“Hi, Tom. It’s Robin from Max House Buyer. Have you had a chance to think about the offer I made for you recently? I’m still VERY interested in the property on Dealing Avenue. If you’re ready to sell, give me a call at 555-323-2232. If you’re still thinking things over, no biggie.”

What sequence should drip campaigns follow?

Campaign sequences vary depending on the type of seller you’re trying to contact and the contact information available in the lead.

Choose the right contact methods.

If the lead includes a landline number and mailing address, but not a cell number, you wouldn’t add text messages to the sequence. You would include call task reminders and direct mail instead.

Are you contacting a lead for the first time? Consider starting with a welcome call reminder, followed by an SMS, and then a direct mailer. Leave a ringless voicemail for the homeowner before starting the cycle again.

Schedule subsequent contact attempts in intervals so that you stay top of mind with homeowners without getting on their nerves

Create specialized campaigns.

Investors can create as many campaigns as they want, adjusting the action sequence, changing message text, and tweaking important elements as needed.

Professional investors tend to work with a multitude of campaigns to target different audiences (e.g., motivated sellers, clients, or first-time homebuyers). A portion of their drips are often highly specialized; they were created for a specific purpose, and are only used to reach a target audience or specific property owner type.

How are drip actions triggered?

Typically, all drip actions are executed on the date and time that they were scheduled to occur (unless affected by a holiday or similar circumstance). Some drip campaigns, however, may be affected by the seller’s actions or behavior.

If a lead receives an automated SMS and responds with a request to opt-out, the investor is notified and can remove the lead from the remainder of the automated SMS sequence.

If a homeowner shows interest in a recent piece of marketing or an offer, but never answers return calls and gets annoyed when you text, switch up the game plan.

Remove the lead from the remaining SMS sequence, and consider trying drip emails instead. Keep the homeowner warm with lead nurturing emails, reminding them of their current opportunity and the interested buyers excited to hear from them.

How successful are drip campaigns?

70-75% of REsimpli users report success closing deals as a result of consistent follow-up. At Max House Buyers, LLC, 2.5 deals are closed each month as a result of follow-up from their drip campaigns.

But don’t take our word for it…

Utilizing drip campaigns give investors a massive advantage over real others who are contacting leads manually.

Take it from Ryan, an investor with Crushing REI and Lakeshore Home Buyer, who has a lot of experience working with different CRMs.

Like many investors, Ryan struggled to keep up with leads for years. He wasn’t busy closing deals, so he had the time, but he was still struggling to stay in touch with leads. After switching to REsimpli, and harnessing the power of automated drips, Ryan pulls in dozens of new leads each week. He’s consistent, he’s organized, and he’s closing major deals.

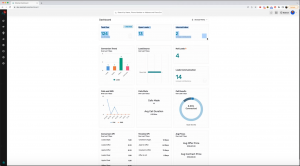

As of August, Ryan has already closed four deals this year, earning $50,000 so far in 2022 alone. He’s turned cold leads into warm leads, warm leads into hot leads, and hot leads into deals, with just a few clicks.

After a lead from 2021 canceled their appointment, Ryan was having trouble reaching the once motivated seller, Chris. After adding Chris to an automated drip, Ryan received an enthusiastic response to his 5th SMS message and closed a $26,900 deal.

“Would I have got that deal if I didn’t put Chris on a drip campaign? Probably not. It’s all about timing with motivated sellers and if you miss out on that timing you often times miss out on the deal. Chris was talking to a few other “we buy houses” companies and it was my quick response and competitive offer that won him over.” – Ryan

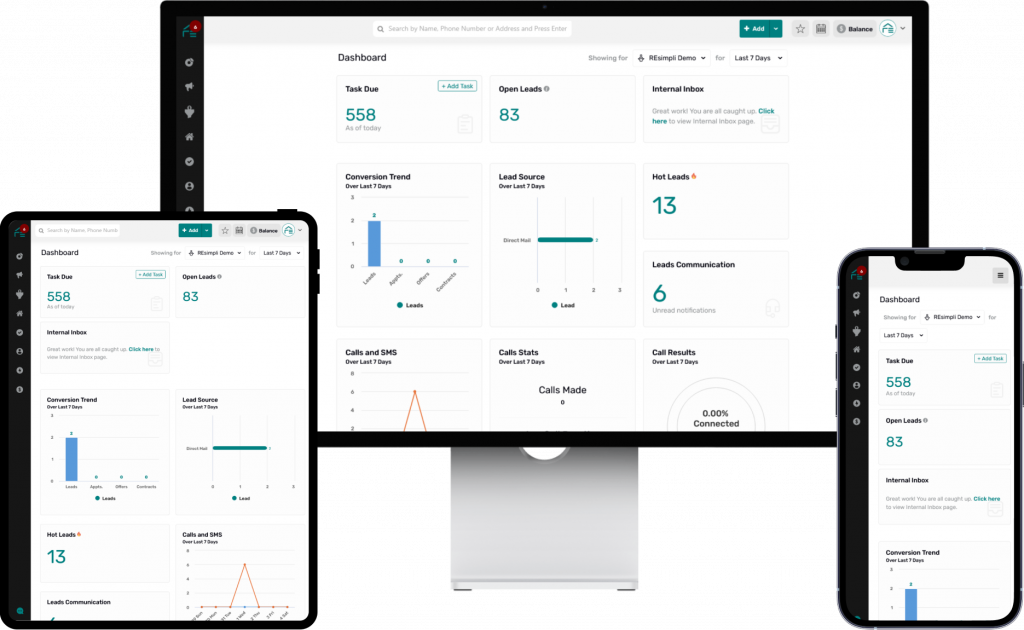

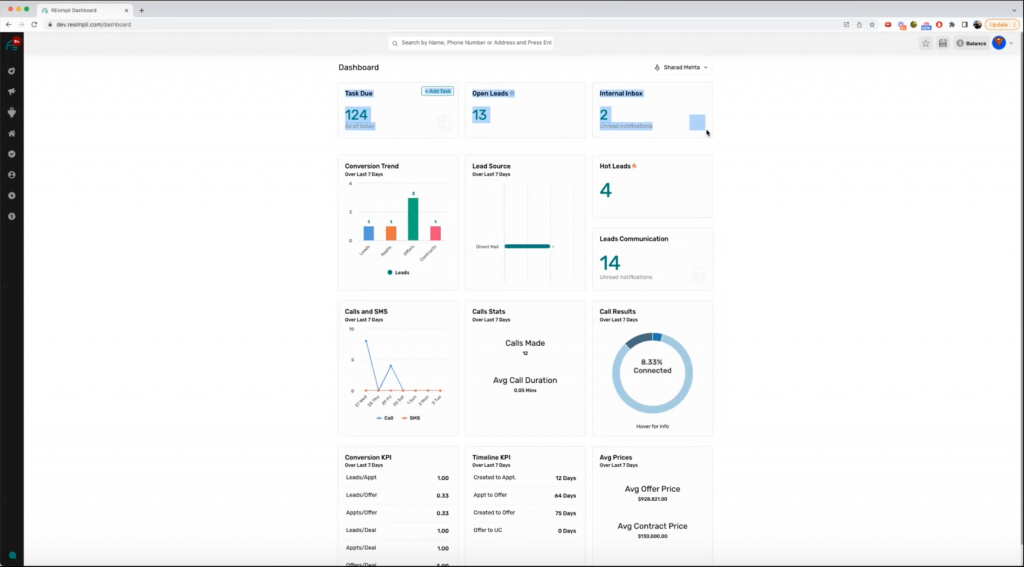

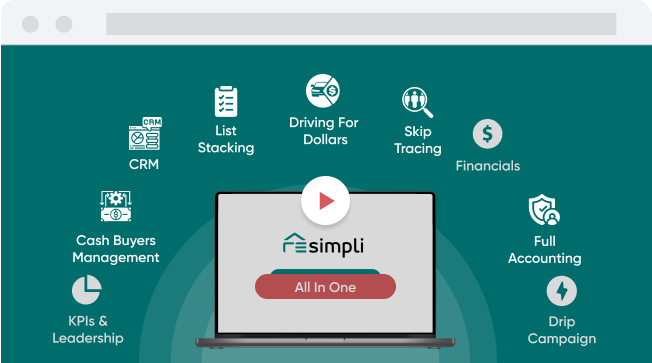

Optimize lead management with REsimpli

The only all-in-one CRM for real estate investors, REsimpli users have access to customizable drip campaigns, skip tracing tools, a built-in Driving for Dollars app, and so much more. A comprehensive business management system, REsimpli was created by real estate investors for real estate investors to help you through every step of the sales journey

Keep track of new contacts, existing contacts, buyer leads, real estate leads, property sales, contact attempts, and more–all in one place.

REsimpli users can quickly identify different drip campaigns to—

- Track lead activity,

- Analyze channel performance,

- Identify successful campaigns, and

- Maximize their marketing budget.

Organize your seller leads with drip tags, helping you categorize and track different lead and seller types. Thanks to REsimpli’s new Webform integration, you can now add lead tags and assign Webform leads to drip campaigns automatically through the CRM.

With automated drip marketing campaigns and completely customizable templates, REsimpli users create drips that fit their needs and business goals. Use built-in system tools, or build your own.

REsimpli’s automated services to work on your behalf so you can leave work at work when you depart the office for the day.