TL;DR

- This framework teaches real estate investors how to merge Tax-Delinquent, Code Violation, and Vacant lists into one clean, high-signal dataset — and then auto-build call queues inside REsimpli.

- By combining these three distress signals, deduping at the owner/property level, enriching with skip tracing, and automating follow-ups through call and drip sequences, investors get more live conversations with fewer wasted dials.

- S.T.A.C.K. = Source → Tag → Append → Clean → Kickoff

- Stack first, then scale. Most investors scale bad data. We scale signal.

Why this framework matters

Every real estate investor has lists but few have systems.

Most teams pull Tax-Delinquent lists here, Code Violations there, and Vacants from another tool. They upload each to a CRM, blast them, and wonder why connect rates stay under 10%. The problem isn’t effort, it’s noise.

When you stack these lists the right way, noise turns into signal.

A property that’s tax-delinquent, vacant, and has a code violation is practically raising its hand saying, “Call me.” That’s the data gold REsimpli helps you uncover and act on instantly.

This guide walks you through The S.T.A.C.K. Framework — a repeatable, software-first system that takes your raw lists and transforms them into deal-ready, prioritized call queues:

- Source: Pull Tax-Delinquent, Code, and Vacant lists from county or data portals (or inside List Builder).

- Tag: Label by market, source, and recency window.

- Append: Enrich with skip tracing (Skip Tracing) for phone numbers and emails.

- Clean: Dedupe by owner/property, run USPS/NCOA hygiene, remove opt-outs.

- Kickoff: Build ranked call queues, launch dialers, and enroll backups in drips — all in one platform.

It’s not theory. It’s an operating system for real estate investors who want to spend less time chasing cold data and more time talking to warm sellers.

“Speed beats volume. The right 100 calls out-convert the wrong 1,000.”

Why “Stacking” These Three Lists Wins Deals

Before automation, before dialing, before skip tracing — the biggest lever in lead generation is data quality. Stacking isn’t about adding more records. It’s about finding the overlap — where motivation compounds.

When a property appears on multiple distress lists, it sends a clear signal:

something’s wrong, and the owner’s likely ready to sell.

A Tax-Delinquent record means missed payments.

A Code Violation signals neglect or disrepair.

A Vacant tag means the property is sitting idle, burning costs.

Each one alone shows pain. Together, they scream opportunity.

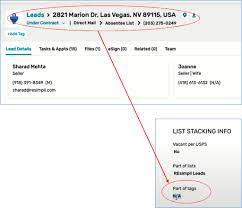

And when you manage this process inside List Stacking, you don’t just combine spreadsheets — you create a live, dynamic intelligence layer that shows which leads deserve your first call.

Overlap = Signal: Why Tax-Delinquent ∩ Code ∩ Vacant Jumps the Line

Think of every list as a layer of motivation.

When a property shows up in all three, the probability of distress spikes. These triple-stack records consistently convert faster and cheaper than single-source leads.

That’s why the first rule of stacking is simple:

“If a record shows up on Tax-Delinquent + Code + Vacant, it gets called first.”

Here’s what each list contributes to the stack:

| List Type | What It Means | Where to Pull | Signal Strength |

|---|---|---|---|

| Tax-Delinquent | Owner behind on property taxes | County Treasurer / Assessor | High – Financial Distress |

| Code Violations | Property cited for maintenance or safety issues | City Code Enforcement | High – Deferred Maintenance |

| Vacant | No occupancy, USPS flagged inactive | USPS, REsimpli List Builder | High – Owner Neglect |

When these lists intersect, you’re no longer cold calling — you’re calling properties already in pain. That’s the power of list stacking.

Contact-Rate Math: Fewer Dials, More Contacts, Cleaner Data

Every bad record wastes time — wrong number, duplicate, owner moved, or someone else already bought it.

But once you dedupe and stack properly, your contact rate climbs fast.

Let’s put it in numbers:

| Dataset | Contacts per 100 Dials | Cost per Deal (Est.) |

|---|---|---|

| Single-Source List | 8–12 | High |

| Double-Stack | 18–22 | Medium |

| Triple-Stack | 30–40 | Lowest |

Stacked lists don’t just give you more conversations — they give you cleaner, faster ones.

That’s why teams using REsimpli’s unified data tools routinely see contact rates 2–3× higher than patchwork systems built on exports and Zapier zaps.

“One app. No duct-tape stacks. Pull, stack, skip trace, dial, and drip without exporting CSVs.”

The S.T.A.C.K. Framework (Step-by-Step)

The S.T.A.C.K. Framework is a repeatable 5-step operating system for building high-converting seller lists.

It’s built around one idea: stack first, then scale.

Most investors scale bad data. We scale the signal.

Below is the full breakdown:

S — Source

Pull three core lists that represent distress from different angles:

| List Type | Data Source | Export Format | Minimum Fields |

|---|---|---|---|

| Tax-Delinquent | County Treasurer or Assessor portal | CSV | Property Address, Owner Name, Mailing Address, APN, Delinquency Date, Amount Due |

| Code Violations | City Code Enforcement or Open Data Portal | CSV | Property Address, Owner Name, Violation Type, Date Issued |

| Vacant Properties | USPS Vacancy Database, Utility Records, or REsimpli List Builder | CSV | Address, Owner, Mailing Address, Last Update |

At minimum, your file should include:

Address, APN, Owner, Mailing Address, County, Source, Source Date, Last Activity, DNC Flag, Opt-Out Flag, Skip Trace Count.

Pro Tip: Export in UTF-8 CSV to avoid character mismatches during import.

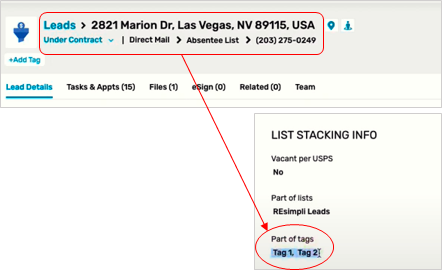

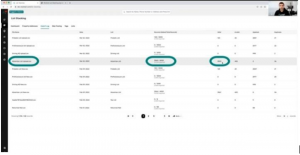

Once imported, REsimpli’s List Stacking automatically identifies overlaps across lists and flags duplicates — no spreadsheets required.

T — Tag

Tagging is what turns raw data into a living, trackable asset.

Use consistent, human-readable tags to trace every lead’s origin and age.

Example naming convention:

TD|PHX|2025-Q3 → Tax Delinquent | Phoenix | Pulled in Q3 2025

Each record should carry:

- Source Tag: TD, CV, or VAC

- Market Tag: City, County, or Zip (e.g., PHX, MARICOPA)

- Recency Tag: Quarter or Month of import

- Activity Tag: Last outbound or inbound action

When REsimpli syncs these tags, every call queue, drip, and report becomes filterable by recency and source.

A — Append

Now it’s time to fill in the blanks.

Run a one-click skip trace inside REsimpli Skip Tracing to pull verified phone numbers and emails.

The system automatically adds them to the same record — no separate uploads.

Best practices:

- Batch vs On-Demand: Batch for large lists (10K+), on-demand for daily leads.

- Quality tiers:

- 3+ verified phone numbers → high-quality contact

- 1–2 valid phones → medium quality

- 0 valid phones → push to Direct Mail fallback

- 3+ verified phone numbers → high-quality contact

Skip tracing inside REsimpli also auto-tags by match rate, giving you instant visibility into which leads are call-ready.

C — Clean

Cleaning separates professionals from amateurs.

Every dial, drip, or mail piece costs money — so you call clean data, not clutter.

Here’s the hygiene process every team should follow:

| Step | Description |

|---|---|

| 1. Deduplicate | Use normalized Address + APN + Owner Name as the de-dupe key. REsimpli’s List Stacking automates this logic. |

| 2. Address Hygiene | Validate using USPS CASS & NCOA. If you send mail, Direct Mail includes free NCOA cleaning. |

| 3. Opt-Out / DNC Check | Automatically suppress “Do Not Call” and owner-requested opt-outs. Never call them. |

| 4. Bad Data Removal | Drop incomplete or duplicate rows; flag disconnected numbers. |

| 5. Normalize Owners | Merge “John A. Smith” and “Smith, John A.” as one entity to avoid repeat touches. |

Compliance first: Scrub against DNC/opt-outs. Follow TCPA and state wholesaling rules. Educational content only — not legal advice.

When you’re done cleaning, you’ll have one record per property, fully enriched, ready to dial or drip.

K — Kickoff

Now comes execution — turning your clean data into action.

Inside REsimpli, you can auto-build call queues, assign leads, and launch sequences in minutes.

Here’s the process:

- Queue Build: Create rules to prioritize triple-stacked leads (more below).

- Drip Enrollment: Auto-enroll uncontacted or low-score leads into Drip Campaigns.

- Speed-to-Lead: Enable instant callbacks for new inbound forms using Speed to Lead.

- Backup Channels: Use Direct Mail for leads with no valid phone match.

Within minutes, your list moves from static CSVs to dynamic call queues, synced across phone, SMS, and drips — all in one dashboard.

“One app. No duct-tape stacks. Pull, stack, skip trace, dial, and drip without exporting CSVs.”

Call Queue Logic

This is where your stacked data turns into action.

After you’ve sourced, tagged, appended, and cleaned, it’s time to prioritize who gets called first.

The rule is simple:

If a record shows up on Tax-Delinquent + Code + Vacant, it gets called first.

Stacked leads carry higher distress signals — and distress converts.

That’s why call queues in REsimpli aren’t just lists. They’re scored systems that push the right leads to the top automatically.

Below is the exact queue priority logic block used by advanced REI teams.

Paste this directly into your process sheet or internal SOP:

Queue Priority Score =

+3 if appears in all three (Tax-Delinquent + Code + Vacant)

+2 if appears in any two of the three

+2 if skip-traced & ≥3 phone numbers found

+1 if appears in one source only

+1 if owner-occupied = No (absentee)

+1 if last activity ≤ 90 days (recency tag)−2 if DNC/opt-out

Then sort DESC by score; push top decile to manual dials; enroll the rest to drips.

This logic makes sure your most motivated sellers get human contact first — not lost in automation.

Inside REsimpli, once the list is sorted by score, it automatically pushes:

- Tier 1 (Triple Stack): Manual dial first. Highest urgency.

- Tier 2 (Double Stack): Send to dialer follow-ups or SMS-first outreach.

- Tier 3 (Single Source): Add to Drip Campaigns or Direct Mail queue.

Example:

If a property is tax delinquent, code-violated, vacant, skip-traced with 3 numbers, and absentee, it instantly scores 9 points and enters Tier 1.

That lead should hit your phone team the same day.

Speed beats volume. The right 100 calls out-convert the wrong 1,000.

Scripts & Touch Plan

Once your queue’s ready, execution speed determines ROI.

Stacked leads have higher distress — which means you must sound informed, not generic. The tone should be empathetic but direct, acknowledging the signal without over-talking motivation.

Opening Line for Stacked Distress (Mandatory)

Every outbound rep should lead with this or a close variant:

“Hi [Name], this might sound out of the blue — I came across your property on [Street Name], and noticed a few updates on it recently.

I’m local, and I’m interested in buying properties that need some attention.

Is that something you’d consider talking about?”

This phrasing works because it’s:

- Non-aggressive (doesn’t expose list source)

- Neutral (“updates” instead of “violations”)

- Conversation-focused, not script-focused

When you’re calling stacked distress (Tax-Delinquent + Code + Vacant), your goal isn’t to sell — it’s to verify intent and ownership clarity. Once confirmed, your CRM and follow-ups handle the rest.

3-Touch Fallback Plan

Even with high-signal leads, not everyone picks up the first time.

That’s why every REsimpli workflow should run this 3-touch fallback sequence before pushing a lead to automation:

- Dial: Manual or dialer call attempt (mark result).

- SMS: Send a short text immediately after a missed call:

“Hey [Name], I tried reaching you about your property on [Street]. Is now a good time to chat?” - Voicemail: If SMS is undelivered or ignored, drop a quick voicemail:

“Hey, this is [Your Name]. I was reaching out about your property on [Street]. Call or text me back if you’re open to talking.”

If there’s still no response after 24–48 hours, the system should auto-enroll the lead into a drip follow-up.

Drip & Backup Automations

Inside REsimpli’s Drip Campaigns, your uncontacted or cold leads stay alive through scheduled SMS, ringless voicemails, and emails — without human effort.

For leads without valid phone numbers, trigger postcards or letters through Direct Mail, which includes free NCOA cleaning to prevent bad addresses.

“If a record shows up on Tax-Delinquent + Code + Vacant, it gets called first.”

Everyone else gets dripped, not dropped.

Call Team Tip:

Use Speed to Lead for every new inbound — especially from your website or forms.

The moment someone fills out a form or texts in, REsimpli auto-dials them within seconds.

That single setting can double your appointment rate.

For tone and cadence training, use REsimpli’s built-in call grading tools and review your reps’ approach. A simple reframe can mean one extra deal per week.

Want more sample dialogues?

Check out Cold Calling Scripts and Tips for Real Estate Wholesalers.

Metrics That Prove It Worked

You don’t need to guess whether your stack is working — your KPIs will make it obvious.

The S.T.A.C.K. Framework isn’t about feeling organized; it’s about producing quantifiable lift across your contact and conversion metrics.

Here’s what to track once your call queues go live in REsimpli:

| Metric | What It Measures | Target Range (after 4 weeks) | Why It Improves |

|---|---|---|---|

| Contact Rate | % of dials that reach a live person | 25–40% | Stacked leads are cleaner and skip-traced; fewer bad numbers. |

| Appointment Set Rate | % of live contacts that agree to an appointment | 10–20% | Higher distress overlap = higher seller motivation. |

| Time-to-Live Contact | Avg. time from list import to first real conversation | <48 hours | Speed to Lead calls new leads instantly. |

| Cost per Deal | All-in cost (data, calls, drips) ÷ closed deals | ↓ 30–50% | Less waste, fewer missed touches, tighter follow-up loops. |

You’ll know your system’s working when your team starts talking to fewer people but closing more deals.

Example:

Before S.T.A.C.K.

- 10,000 records → 800 contacts → 4 deals

After S.T.A.C.K.

- 3,500 stacked records → 1,200 contacts → 6 deals

Same spend, 3× faster feedback.

How REsimpli Tracks It for You

You don’t need spreadsheets to measure progress.

REsimpli’s built-in KPI Dashboard automatically reports:

- Dials vs. Contacts

- Appointment Conversions

- Call-to-Deal Ratios

- Cost per Lead/Deal

- Channel-level ROI

Those insights close the loop — from data to dial to deal.

“One app. No duct-tape stacks. Pull, stack, skip trace, dial, and drip without exporting CSVs.”

Mini Glossary

| Term | Meaning |

|---|---|

| APN | Assessor’s Parcel Number – a unique ID for each property. |

| NCOA | National Change of Address – USPS database for updated mailing addresses. |

| DNC/TCPA | Do Not Call / Telephone Consumer Protection Act – legal standards for outbound contact. |

| CASS | Coding Accuracy Support System – USPS certification ensuring valid addresses. |

| Stacking | The process of merging multiple distress lists (Tax-Delinquent, Code Violation, Vacant) to find overlapping high-signal properties. |

⚠️ Compliance First

Scrub against DNC/opt-outs before dialing or texting.

Follow TCPA and state wholesaling rules.

Educational content only — not legal advice.

Final Thought

Stacking is how serious investors separate noise from signal.

It’s the difference between chasing 10,000 cold records and working 1,000 that actually matter.

“Stack first, then scale.”With REsimpli, every piece — from List Builder to Skip Tracing, Speed to Lead, and Drip Campaigns — lives in one place. No exports. No duct tape. Just signal, speed, and deals.