Real estate investing is a numbers game.

You need to kiss 500 frogs to find five princes (or, you know, deals). By tweaking the ponds where you find those frogs, maybe the number drops to 400. Maybe blue frogs work out better than yellow frogs. The metaphor is falling apart, but you get the point.

That begs the question though: which metrics matter most to real estate investors?

Start tracking the following real estate KPIs (key performance indicators) to get a better pulse on your investing business. You can use a real estate CRM like REsimpli to track these numbers automatically, so you can check them any time.

New Leads

Real estate deals start as leads. If your leads stop coming in, you stop closing deals.

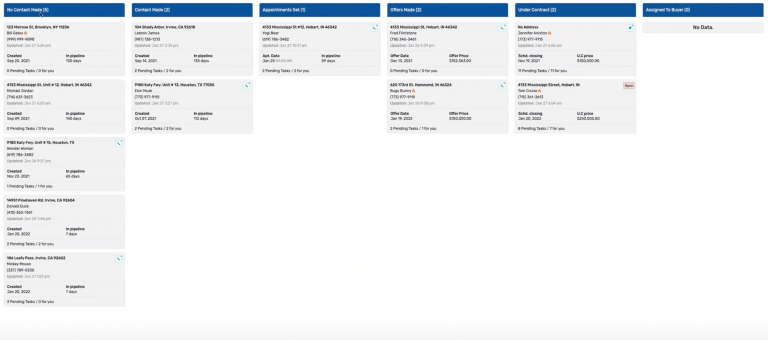

When you first log into REsimpli, you’ll see your New Leads listed front and center on the dashboard. You can track their volume over time, to keep an eye on their flow and consistency.

Abandoned Leads

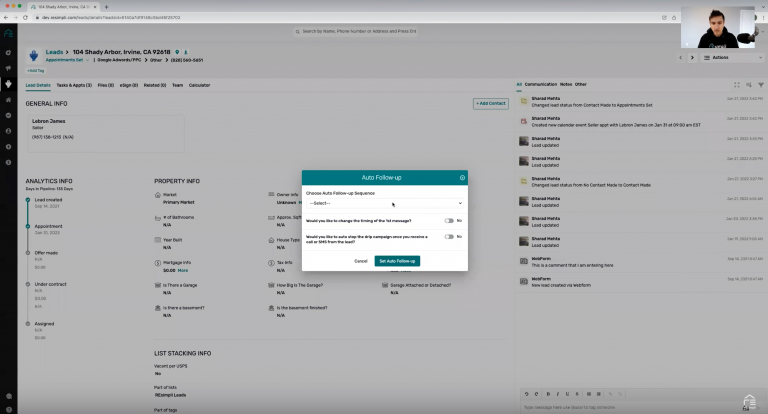

You can stay in touch with leads through an automated drip campaign, or manually contact them on a regular rotation through scheduled tasks.

But what happens if a lead isn’t hearing from you through either scheduled tasks or automated drip campaigns?

They aren’t hearing from you at all, and they become abandoned leads. They subsequently lose all value to you.

REsimpli automatically tracks these abandoned leads for you, so you can quickly identify them and get them back on a drip campaign or assign a task of contacting them. You paid good money in your marketing campaigns to collect these leads — don’t let them go to waste.

Seller Appointments

Likewise, you need to track how many seller appointments you’re making. And how many appointments successfully result in you or your team member seeing the property.

Appointments help move your leads further down the funnel toward closed deals. REsimpli lets you filter these by time period, and track appointments for each of your team members.

Completed Deals

How many deals are you actually closing each month?

This metric starts getting to the heart of your results. The more deals you close, the more money you can earn in a given month.

Revenue

Speaking of which, what was your gross revenue last month? Last year?

Without revenue, you don’t have a business. You have an expensive hobby.

Net Income (Profit)

The ultimate goal isn’t actually revenue — it’s profit. After all, your business could earn $100,000 per month, but if you spend $101,000, you’ve lost money.

You can track your completed deals, gross revenue, and net profit on the KPI Analytics page in your REsimpli dashboard.

Leads Per Channel

Not all marketing channels are created equal. You may have raked in 20 leads from one channel and 100 from another, even if you spent the same amount of money on each.

REsimpli helps you track the source of all leads, through dedicated landing URLs, email addresses, and tracking phone numbers.

Cost Per Lead

How much do you pay for each lead on average?

At the top of your marketing funnel sit your leads, and they cost you money.

Cost Per Deal

Meanwhile, the bottom of your funnel is your closed deals.

How much does each deal cost you on average?

Marketing ROI Per Channel

For every dollar you spend on leads from each marketing channel, how many dollars do you earn?

You may discover that you earn $3 for every $1 you spend on marketing to probate leads, but earn $10 for every $1 you spend on preforeclosure leads. By accurately tracking the return on investment (ROI) for each marketing channel, you know where to double down versus where to scale back.

As a general rule, the longer you run a marketing campaign, the better you can optimize it. Aim to focus on marketing channels that you think you can keep running for longer periods of time.

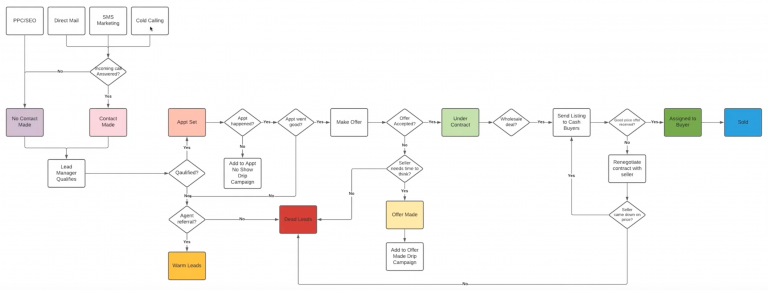

Success Rates at Each Phase of the Funnel

Leads come in at the top of your funnel. To move them toward your ultimate goal of closing a deal, you first need to meet the owner for an appointment at the property.

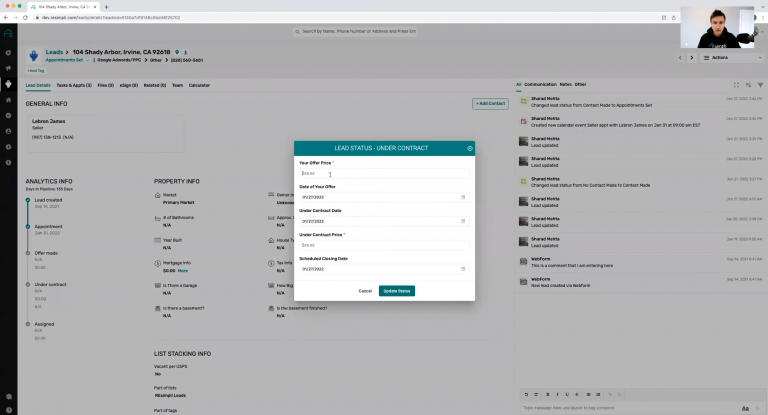

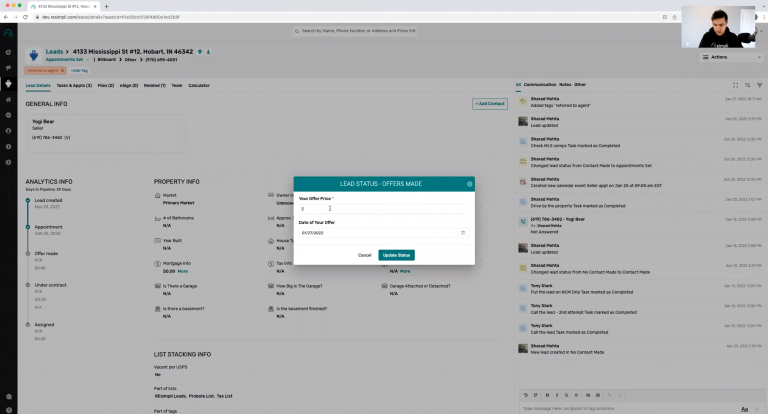

The next step in the funnel is to make an offer — for the properties that warrant it, that is.

And at the bottom end of your funnel, you need to close on the deal by buying the property.

So how do your conversion rates look at each step down the funnel?

- Leads/Appointment: The percentage of leads that result in an appointment.

- Appointments/Offer: The percentage of appointments that result in an offer.

- Offers/Deal: The percentage of offers that result in a closed deal.

Then step back and look at the funnel as a whole. What percentage of leads can you close as deals? What percentage of appointments?

Ultimately, you want to put each of these conversation rates under the microscope and look for ways you can improve them. By closing more deals for every 100 leads, you reduce your cost per deal, and become a leaner, more efficient, more profitable real estate business.

The Big Picture

Your numbers tell a story about your real estate investing business. The better you are at reading these numbers, the better you’ll diagnose both problem areas and opportunities in your business.

Use a real estate CRM to track your real estate KPIs automatically, so you can review them at a glance. As time goes by, you’ll get better at reading their story — and using that information to grow your profits.