The real estate industry is always changing, with a range of ever-evolving trends and strategies changing the dynamic of investment strategies.

One such technique that’s been gaining traction among savvy investors is the recent development of “reverse driving for dollars.”

At first glance, the term might seem a little counter-intuitive, especially considering the established reputation of driving for dollars as a way of sourcing new properties.

However, after a closer look, it becomes abundantly clear why understanding this strategy is crucial for anyone looking to maximize their investment potential in the competitive environment of today’s market.

We put together this article to explore what reverse driving for dollars entails, the advantages it can hold over traditional real estate investment strategies, and why it’s an absolute essential for successful investors to grasp its concept properly.

So join us on this journey through reverse driving for dollars, and learn more about how to find those hidden gems that could offer your investment business the returns you’ve been looking for.

What is Reverse Driving for Dollars?

“Reverse driving for dollars” might sound complicated or overly reductive based on your interpretation, but the concept is actually as straightforward as it is useful.

The traditional driving for dollars method involves investors physically driving around neighborhoods that they’re interested in working within, searching for, often off-market, properties that display signs of potential distress or undervaluation.

This is followed by researching these properties and reaching out to the existing homeowners to negotiate a potential deal.

On the other hand, “reverse driving for dollars” flips this process.

Instead of starting with the physical hunt for properties, investors begin with rigorous research, identifying potentially profitable properties from a variety of online databases, tax records, or other sources.

Once armed with this information, they can then drive to these specific locations to properly evaluate the property in person.

There are a few distinct advantages to using the reverse driving for dollars method:

Efficiency: Instead of simply driving aimlessly through neighborhood after neighborhood, hoping to stumble upon that perfect property, investors work from a targeted list, making the process faster and more fuel-efficient.

Preparedness: By doing research ahead of an in-person evaluation, investors go in with a good baseline of knowledge about the property and its history.

This allows for a more informed, meaningful assessment during the visit.

Higher Potential for Discovering Hidden Gems: The efficiency of combining both online research and physical evaluation can increase an investor’s chances of finding off-market or unlisted properties before the competition.

The end goal of driving for dollars and its reverse strategy is to discover those hidden gems – the off-market properties that present a prime opportunity for investment.

However, the reverse method allows for time to be spent more wisely, which is especially beneficial considering all the responsibilities of an active investor.

Finding Off-Market or Distressed Properties

Off-market properties, as the name suggests, are properties that aren’t publicly listed for sale on common platforms or MLS (Multiple Listing Service).

These properties can be huge money-makers for investors for a range of reasons:

Less Competition: With no public listings, fewer buyers are aware of these properties, leading to less competition and potentially better deals.

Negotiation Leverage: Sellers of off-market properties are often motivated to sell quickly, giving investors some leverage in negotiations.

Potential for Higher Returns: Due to less competition and more room for negotiation, investors might acquire the property at a lower cost and gain higher returns on their investment (they also often offer the potential for lucrative “fix and flip” projects).

Knowing how to find distressed properties when driving through neighborhoods is a vital skill, whether employing a traditional or reverse driving for dollars strategy.

Some common signs of distress that savvy investors should look out for include:

- Overgrown lawns or untended gardens.

- Boarded-up windows or doors.

- Visible property damage or signs of neglect.

- Accumulated mail or newspapers, signaling potential vacancy.

- “For Sale by Owner” signs, indicate a homeowner trying to sell without an agent.

Discovering such properties is the first step, which must be followed by identifying and contacting the owner. This can be done through:

Public Records: Many local county assessor websites can provide valuable property owner information based on an inputted address.

Neighbors: Oftentimes, speaking to neighbors is a great way to learn more about the property owner or the reasons for distress – make sure to put your best “people person” foot forward here!

Direct Mail: Real estate mailers are still a viable form of communication, so sending a letter expressing interest in purchasing the property can be an effective way to initiate contact.

Online Services: Platforms like Whitepages can help find contact details based on addresses or names.

Local Real Estate Groups: Networking with local real estate professionals is useful in every aspect of real estate investing, often providing leads on distressed property owners.

In real estate investment, knowledge and strategy need to work in unison. Reverse driving for dollars, combined with knowing how to find off-market properties, is a perfect example of this marriage.

How to Implement Reverse Driving for Dollars

Implementing the reverse driving for dollars strategy requires a mix of research, preparation, and hands-on fieldwork. The steps in an effective approach include:

- Research and Identification of Target Properties and Neighborhoods

Online Databases: Scouring online real estate databases and platforms is the easiest place to start.

Websites like Zillow or Realtor.com can occasionally have listings that haven’t yet become widely publicized, however, this comes with a time limit as the properties will likely soon be noticed by other investors.

Tax Records: Some investors swear by studying tax records to find attractive properties.

Hunting properties with overdue taxes can indicate financial distress, helping investors in finding distressed properties with homeowners who are more receptive to selling.

Real Estate Networking: Join local real estate investment groups, whether online or in person.

A strong network of collaborators gives you access to valuable tips, listings, or contacts that might not be easily available elsewhere.

- Initial Assessment of Target Properties

Once you’ve identified potential properties, you need to evaluate them further.

Historical Data: Checking out how long the property has been off the market, its past sale prices, and any other available transaction history will help you to evaluate the financial potential of a home before investing.

Comparative Market Analysis: Understand the property’s potential value by comparing it with similar properties in the same area – whether its lower, higher, or level with the average, it could offer an exciting opportunity depending on your goals.

- Fieldwork: Getting Behind the Wheel

Plan Your Route: To maximize efficiency, use a route-mapping tool to plot out your targets, ensuring you take the quickest, most direct path possible.

Visual Inspection: When you arrive at each property, take detailed notes on its condition, the atmosphere of the neighborhood, and any other relevant observations that could impact its profitability.

- Researching Property Owners

Public Records: As mentioned earlier, local county assessor websites and databases can provide valuable information about property ownership, such as tax records and things of the sort.

Subscription Services: Some platforms, like PropertyShark, offer in-depth property data in exchange for a subscription fee, which is a worthy investment if you’re serious about this strategy.

- Making Contact

Craft a Genuine Letter: If reaching out via direct mail, make sure that you write your letter from a genuine, empathetic place, expressing real interest in the property without sounding predatory – people don’t want to be treated like a commodity.

Cold Calling: If you’ve obtained a phone number, ensure that all interactions are as respectful and straightforward as possible.

Remember, you might be talking to someone in financial distress, so they won’t respond if you talk to them like an opportunity.

Tips & Tricks for Efficient Reverse Driving for Dollars:

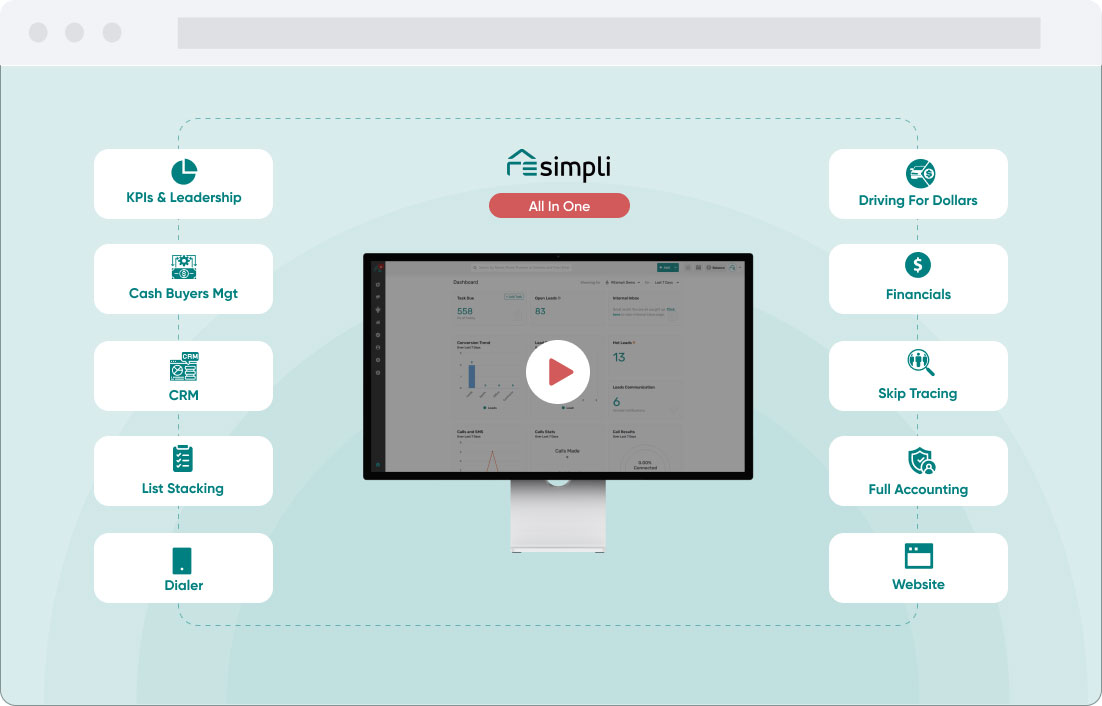

Stay Organized: Use dedicated apps or online tools to keep proper track of properties you’ve identified, contacted, or evaluated. Platforms like DealMachine and REsimpli are designed for this purpose.

Know the Local Market: The more up-to-date you are with local market trends, the easier it is to spot anomalies or opportunities in the space.

Build Relationships: Real estate isn’t just about about properties – it’s about people.

Cultivating real, trusting relationships with local agents, neighbors, and other investors can open doors to off-market opportunities.

Always Be Ethical: Remember, you’re not just dealing with distressed properties, you’re often going to be dealing with distressed homeowners.

Approach every interaction with the same empathy you’d want, so all dealings are ethical and above board.

Reverse driving for dollars combines targeted research with physical verification, allowing investors to unveil potential opportunities hidden from the broader market.

With the right tools, approach, and mindset, this strategy can be a potent addition to your real estate investment arsenal.

How Reverse Wholesaling and Driving for Dollars Work Together

The world of real estate investing is laden with a massive range of strategies designed to meet every professional’s goals.

Among these strategies, reverse wholesaling and driving for dollars have become increasingly popular due to their proactive, efficiency-based approach to property acquisition.

When combined, they can form a potent, highly profitable strategy that utilizes the strengths of each method.

What is Reverse Wholesaling?

Reverse wholesaling is a real estate investment strategy that flips the conventional wholesaling process on its head.

Traditional wholesaling involves finding a discounted property, putting it under contract, and then selling said contract to a buyer at a higher price.

In reverse wholesaling, the process starts by identifying potential buyers, understanding their property preferences and budget, then searching for properties that fill the bill.

Synergy Between Reverse Wholesaling and Driving for Dollars

Targeted Property Search: By knowing what buyers are looking for (through reverse wholesaling), the driving for dollars process becomes more streamlined.

Investors can reduce their driving and research time, by focusing on specific neighborhoods or property types that align with their buyers’ criteria.

Efficiency in Deal Closure: Since you’ve already identified potential buyers in reverse wholesaling and a suitable property through driving for dollars, deals can be closed and hands can be shaken more quickly.

Extensive property marketing is unnecessary, as you have a list of interested buyers to work from.

Risk Mitigation: The biggest risk in traditional wholesaling is finding a property and being unable to offload it. By identifying buyers first, this risk is all but eliminated.

Benefits of Using Both Strategies Together

Increased Deal Flow: When identifying potential buyers and then actively searching for properties that match their preferences, you can curate a continuous flow of potential deals, and in turn a strong stream of income.

Higher Profit Margins: Given the targeted approach of reverse driving for dollars, there’s a higher likelihood of acquiring properties below market value, which means you can then sell them at a profitable premium to eager buyers.

Building Stronger Relationships & Reputation: Regularly providing buyers with properties that match their criteria helps build trust and fosters long-term relationships, while also growing your standing in the real estate community.

Over time, this should lead to repeat business and referrals.

Diversification: While each strategy is potent, combining them offers investors a diversified approach, tapping into off-market properties and a ready pool of potential buyers all at once.

The similarly proactive nature of both strategies helps to build a seamless workflow, from property identification to deal closure, all the way to successful transactions.

A reverse driving for dollars wholesale technique should be part of any investors business plan.

Conclusion

There are numerous strategies and approaches one choose as an investor to get an edge over the competition, and reverse driving for dollars is one that should be on every professionals radar.

Unlike traditional driving for dollars, the reverse method begins with research, cutting out hours of potentially aimless driving.

By first identifying promising properties, investors can visit these locations with focused eyes, for more efficient evaluations.

Combining this strategy with a focus on finding distressed properties, not publicly listed for sale, investors can face even less competition while gaining negotiation leverage, and potentially higher returns.

To effectively harness such strategies, investors should start with comprehensive research, followed by an on-ground assessment, and finish by personally reaching out to property owners.

Leveraging tools, understanding local market trends, and building real, trust-based relationships are crucial to this approach’s success.

By first identifying potential buyers and their property preferences, reverse wholesaling complements the reverse and traditional driving for dollars strategy.

By combining these approaches, investors can build a continuous flow of deals, higher profits, and foster long-term relationships with repeat buyers.

Understanding and implementing reverse driving for dollars is a step beyond traditional investing strategies, allowing investors to streamline a sect of their operations.

Discover everything you need to know about driving for dollars in our comprehensive guide.