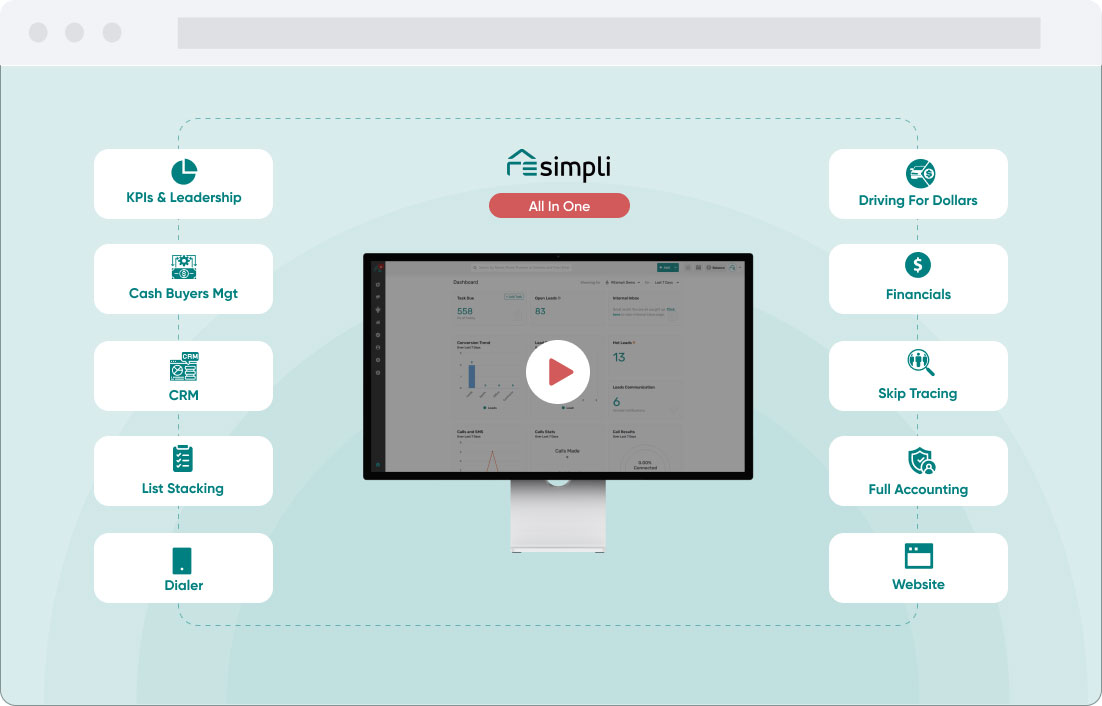

REsimpli’s Dashboard Secure Financing Real Estate Investing

How REsimpli’s KPI Dashboard Helped Secure Financing for Real Estate Investing

This is a chat with Dan Evers, a real estate investor who used REsimpli’s KPI dashboard to secure financing from two private money lenders.

In this blog post, we will give details about Dan Evers, a real estate investor who has been in the industry since 2013.

Over the years, he has dabbled in various forms of real estate investing, including lease options, rent-to-own, subject-to-contracts, and more. In 2016, he discovered wholesaling and has focused on that niche ever since. Recently, Dan used REsimpli’s KPI dashboard to secure financing from two private money lenders. Let’s learn more about his story and how REsimpli helped him achieve this milestone.

The Power of KPIs:

Dan emphasizes that understanding his key performance indicators (KPIs) has been crucial for his business’s success. However, in the past nine years, he had never been able to track his KPIs accurately – until he started using REsimpli. Thanks to the platform, he could easily break down his cost per deal, leads to offer ratio, offers to contracts, contracts to close deals, and more.

Securing Financing Through REsimpli:

Dan’s brother, who has connections to an affluent group of friends, introduced him to a potential investor interested in their real estate business. The investor wanted to know the cost of doing a deal, which Dan could easily provide, thanks to REsimpli’s KPI dashboard.

Using the data from the dashboard, Dan broke down the following metrics for Q4:

- For every ten leads, 10 of them received an offer.

- Offers to contracts ratio was 87.5%.

- The contracts-to-close deals ratio was 42.5% (higher than it should be due to a specific anomaly during Q4).

- The cost per lead was $134.

- The cost per offer was $1,300.

- The cost per contract was $1,400.

- The cost per deal was $3,500.

The investor was impressed with these numbers, noting that they could potentially get three dollars out for every dollar invested.

Conclusion:

REsimpli’s KPI dashboard played a significant role in helping Dan secure financing for his real estate investing business. By providing him with a clear understanding of his key performance indicators, he was able to impress potential investors and showcase the potential profitability of his deals. For real estate investors looking to grow and scale their businesses, leveraging a platform like REsimpli can prove invaluable in tracking vital metrics and securing financing opportunities.