Miscalculating: The Most Overlooked Mistake Made by New Real Estate Investors

When you make a mistake at your day job, you embarrass yourself, perhaps earning yourself a stern talking-to.

If you really mess up, you might get fired as a worst-case scenario.

When you blow your numbers as a real estate flipper, you could lose tens of thousands of dollars.

You need to get the numbers right before you ever make an offer, much less sign a contract or take out a fix-and-flip loan.

Watch out for these common mistakes as you calculate your numbers on a house flip.

Understanding Maximum Allowable Offer

How do real estate flippers avoid overpaying for a property?

Simple: they calculate their maximum allowable offer (MAO) before, well, making offers!

It doesn’t take advanced math, either. As a broad rule of thumb, many flippers and wholesalers follow the 70% rule to calculate their MAO.

They take the after-repay value (ARV), multiply it by 70%, and then subtract the repair costs.

As a formula it looks like this:

(ARV x .7) – Repairs = MAO

To use easy numbers, imagine the ARV is $100,000, and repairs will cost $20,000.

That leaves you with a maximum allowable offer of $50,000:

$100,000 x .7 = $70,000

$70,000 – $20,000 = $50,000

Thank you, middle school math teacher.

Miscalculating MAO

You can mess up the MAO calculation in a few different ways.

First, you could overestimate the ARV.

Take the example above, and imagine that you falsely believed the ARV to be $120,000 rather than $100,000.

You’d run the numbers like this:

$120,000 x .7 = $84,000

$84,000 – $20,000 = $64,000

In negotiating with the seller, you let yourself get talked into paying $64,000 for this property when you shouldn’t have spent a penny over $50,000. You overpaid by $14,000.

Alternatively, you could get the ARV right but miscalculate the repair costs.

If you only think the repairs will run you $10,000 instead of the full $20,000, your numbers look like this:

$100,000 x .7 = $70,000

$70,000 – $10,000 = $60,000

Once again you end up overpaying, this time by $10,000.

Worst of all, you could get both of these wrong.

Combing both mistakes in the example above, that would mean overpaying by a dangerous $24,000.

How to Avoid Overpaying for Properties

Captain Obvious: “Get your numbers right when you estimate the after-repair value and the repair costs!”

But as a novice investor, you don’t always feel confident in your numbers.

So how can you shore them up to feel confident that you used conservative estimates?

First, get really comfortable with researching comparable property sales (comps). In doing so, come up with a range of after-repair values for each property.

Then use the absolute bottom number of that range when calculating MAO. Perhaps even build in an additional buffer of 5-10%.

The same goes for estimating renovation costs. Talk to as many contractors as you can to collect quotes.

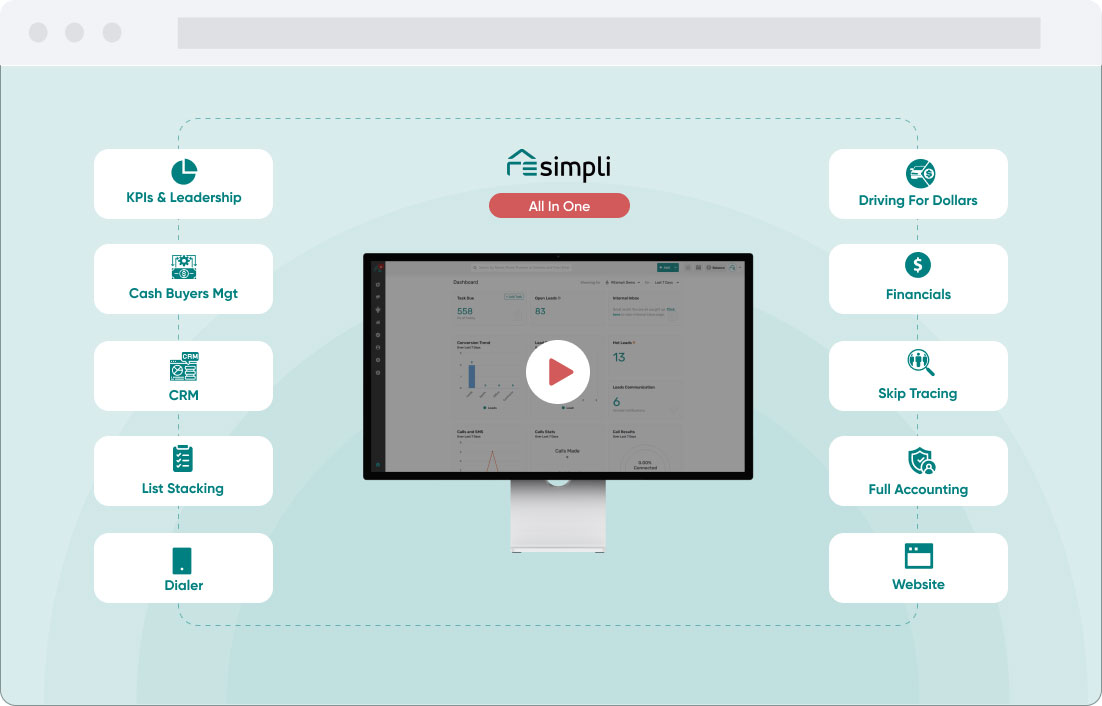

Estimate on the high end of the range, and again, build in a buffer — in this case as much as 20-30%. Use a tool like the REsimpli rehab cost estimator.

Then run these numbers past a more experienced real estate investor. It could be a mentor, coach, senior partner, or simply someone you know and trust.

Finally, run the numbers through a real estate investing calculator.

Try the REsimpli wholesaling calculator, or our advanced calculator.

Final Thoughts

Don’t make an offer or negotiate purchase price before quadruple checking your numbers.

Get your numbers right, and you stand to make a tidy profit on a flip. Get them wrong, and you’ll potentially put in hundreds of hours simply to lose money on the deal.

When in doubt, get a second (or third) set of eyes on the numbers to make sure you ran the comps and estimated rehab costs conservatively.

That five-minute conversation can save you five figures in losses on a bad real estate flip.