What Real Estate Investors Need to Know About Loans in 2026

Interest Rates Are Up—Here’s How Investors Are Still Winning

Financing investment properties has gotten a lot more expensive over the last few years.

Entering 2022, 30-year fixed mortgage rates cost around 3% interest. By October they cost more than 7%.

And that was for homeowners. Many investors have paid double-digit interest rates in the years since.

As we near the end of 2025, what do investors need to know about borrowing loans? How can you trim your borrowing costs? How can you put down less cash as a down payment?

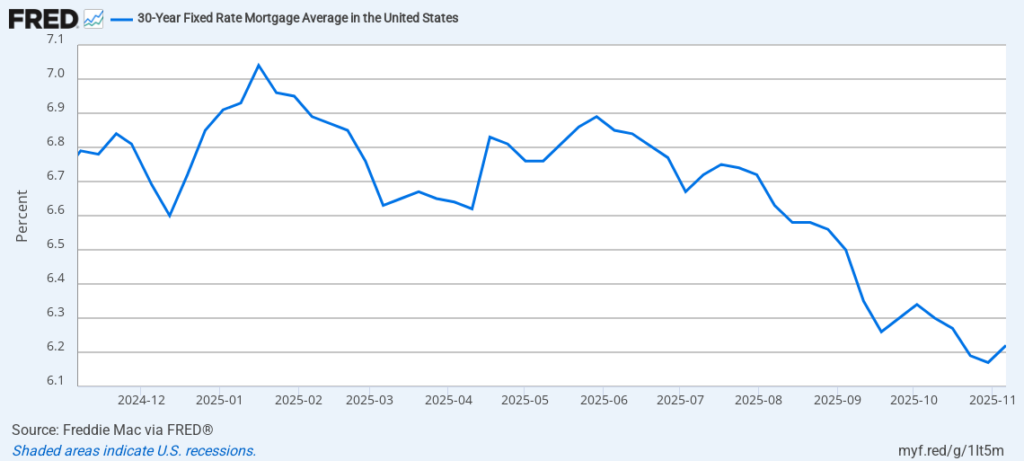

Interest Rate Trends

Over the last year, interest rates started dropping sharply — then popped back up again amidst renewed fear of inflation.

Will interest rates rise? Fall? No one knows, because there’s so much uncertainty around tariffs, inflation, bond markets, and even the relationship between the White House and the Federal Reserve.

Don’t Wait on the Sidelines for Lower Rates

You can’t control interest rates, and neither can I. But we can control our own investments.

Don’t just stand around on the sidelines waiting for interest rates to come down. They may keep rising, or hover at current levels for a while, or they might come down. We just don’t know.

Instead, keep looking for deals that make money.

For flippers, that means solid profit margins. For rental investors, that means solid cash flow.

Consider Other Markets

If rental properties in your market don’t pencil well, look at other markets.

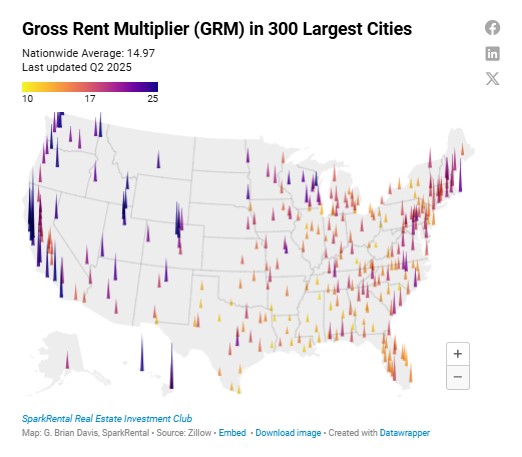

In particular, check out markets in Middle America that don’t have the meme-level growth that some Sun Belt and coastal markets have seen. These slow-and-steady markets often offer high cap rates and low gross rent multipliers (GRM).

Check out this map, breaking down markets by by GRM:

Cities are colored based on GRM (lighter = better), and sized by median home price.

If high interest rates means you can’t find strong cash flow in your own market, look further afield.

When to Refinance

Many rental investors wonder “At what interest rate does it make sense to refinance?”

As a general rule of thumb, when rates are a full percentage point lower than you’re currently paying, it’s a good time to consider refinancing.

But bear in mind that you’ll have some fixed closing costs, regardless of the loan amount. So, the smaller your loan amount, the greater the difference in interest rates needs to be to justify refinancing.

Lending Incentives

As you look into new markets, ask lenders about incentives for certain districts or Census tracts.

Sometimes the government subsidizes loans to spur investment in underserved areas. You could qualify for lower interest rates, reduced closing costs, or smaller down payments.

Just make sure you actually want to hold real estate in these areas. The best loan in the world won’t matter if you’re constantly hassling with crime, rent defaults, and high turnover rates.

Professionalize Your Real Estate Business

Professional athletes don’t duct tape together their shoes. So why are you trying to duct tape together your real estate business?

If you want to earn profits like a professional real estate investor, use the tools your pro competitors are using. That starts with marketing and accounting tools like REsimpli.

Don’t take our word for it. Try it out for yourself with a 30-day free trial.

We look forward to hearing your feedback and successes after your first month running with the big dogs.

Looking for the Lowest Down Payment?

Every investor, from the greenest newbie to the most experienced veteran, faces a bottleneck of how much cash they have to invest.

If you’re feeling a cash crunch and want to minimize your down payment, keep the following options in mind.

House Hacking

Lenders offer much smaller down payments for owner-occupied properties bought by homeowners.

So? Buy a multifamily property and move into one of the units for a year.

You can buy a property with up to four units, with just a 5% down payment under Fannie Mae’s new guidelines.

And you only have to live there for a year. After that, you can move out and keep the property as a rental.

Live-In Flip

If you want cheaper financing to flip a house, you could move in while you renovate it.

You qualify for owner-occupied financing with a low down payment and interest rate, and they finance 100% of your renovation costs. Check out Fannie Mae’s HomeStyle renovation loan or Freddie Mac’s Renovation Mortgages.

Just beware that the property must technically be in habitable condition if you want to move in while you renovate. The lender’s appraiser classifies the property as habitable or not, based on functioning mechanicals and whether the property meets the local occupancy code.

When you sell, you can turn around and do it all over again. As long as you don’t mind living in a construction site, of course.

Single-Family vs. Multifamily

Lenders typically require higher down payments on multifamily properties compared to single-family homes. So, if you’re low on cash, look at single-family homes first.

That said, if you borrow more than 80% LTV (loan to value ratio), conventional lenders will require you to pay for private mortgage insurance (PMI). That eats into your cash flow every month.

Check out my interview with Nate Mack for more tips on reducing your down payment:

Lower Down Payment, Higher Interest Rate

As a general rule, lenders charge a higher interest rate for loans with a lower down payment.

Why?

Because lenders price their loans based on risk. And the lower the LTV they lend, the lower their risk.

Get clear on your priority. You can sometimes find lenders willing to give you a higher LTV loan, but expect to pay extra for it.

BRRRR: Recycle Your Down Payment

The BRRRR strategy stands for buy, renovate, rent, refinance, repeat.

You buy a fixer-upper, add value by renovating it, but instead of selling it as a flip, you refinance into a long-term mortgage and keep it as a rental.

Here’s the kicker: when you refinance, lenders base your loan amount on the new after-repair value (ARV) — not what you paid for the property.

That means if you add enough value to the property, you can pull out your initial down payment.

Example BRRRR Deal

Imagine you buy a property for $200,000, putting down $40,000 as a down payment and $10,000 in closing costs and carrying costs. You put $50,000 in repairs in it, financed by your hard money lender.

The ARV is $325,000, and you refinance it at 80% LTV to take out $260,000. That pays off your hard money loan of $210,000 and the $50,000 of your own cash in the deal. Now you have $0 of your own money tied up in the property.

You can recycle the same cash again… and again… and again. Each time you do so, you add another cash-flowing property to your portfolio.

Over time, your tenants pay down your mortgage loan. And every year that goes by, your cash flow improves as you raise rents while your mortgage payment stays fixed.

Beyond the 4- or 10-Loan Limit

Most conventional mortgage loans only allow you to have up to four or ten mortgages appearing on your credit report.

So what do you do when you hit that limit?

You start borrowing from lenders who don’t report on your credit, of course. Here are a few of the most common options that real estate investors use.

Portfolio Lenders

Conventional lenders bundle and sell off their loans almost immediately after they issue them. That’s why they have to stick with conforming loan programs from Fannie Mae, Freddie Mac, or government programs like VA loans, USDA loans, or FHA loans.

In contrast, portfolio lenders keep their loans within their own portfolio (hence the name).

That lets portfolio lenders be much more flexible in their underwriting. They can do deals that make sense financially, even if they don’t fit neatly within government loan programs.

And they don’t typically report to the credit bureaus, or put limits on your loans. Quite the opposite: they want to build relationships with real estate investors, and often offer discounted interest rates and points to investors who they’ve worked with successfully before.

Private Lenders

Want even more flexible financing?

Borrow from people you know personally. Your friends, your family, your neighbors, your coworkers, your second cousin thrice removed — they’re all potential private lenders.

They’re looking for strong and stable returns for their money. You’re looking for investment capital. It’s a win-win, if you learn how to approach them tactfully.

Read up on borrowing private money for more tips and information.

Seller Financing

Another type of private loan is seller financing, AKA owner financing.

Most sellers aren’t familiar with how it works, or the benefits to them. That means you’ll have to master your presentation, so you can explain it in a compelling way.

While sellers will probably want a higher interest rate, they may not ask for any fees. That can save you thousands of dollars right there.

All of the terms are negotiable. You and the seller simply come up with a term and rate that work for both of you.

In most cases, owner-financed loans come with a balloon payment. You’ll make monthly payments, either interest-only or based on a 30-year amortization. But you’ll need to pay off the remaining balance in full when the balloon term ends, usually after two to five years.

How to Borrow the Down Payment

While conventional lenders don’t allow you to borrow the down payment, hard money lenders and portfolio lenders usually don’t mind.

That means you can borrow 75-95% of the purchase price through them, then cover the down payment from other sources.

That could include private lenders or seller financing. It could also mean borrowing against a business credit line, business credit card, or home equity line of credit (HELOC).

When you sell or refinance the property after renovating it, you can pay back all of your lenders.

Just be careful not to overleverage yourself. You can get in trouble quickly if a deal goes over budget.

Common Loan Mistakes

Real estate investors often make the same few mistakes when it comes to borrowing. In particular, they often mess up their tax reporting for rental properties — which impacts their ability to borrow.

Lenders look at your tax returns. If you report your income and expenses wrong, it can lead lenders to turn down your loan application.

Start by working with an accountant who knows real estate investing well. In fact, try to find a CPA who specializes in working with real estate investors.

Make sure they document the rental income properly, so the property reads like an asset and not a liability. That can include reporting the fair rental days accurately.

Perhaps most important of all, make sure that they report depreciation properly. If they don’t, you’ll still pay depreciation recapture when you sell — effectively getting taxed twice. Accurate depreciation reporting also helps you qualify for loans.

You can also use accounting software for real estate investors, to keep your CPA bill both low and accurate.

Tying It Together

A few weeks ago, we talked at a high level about leveraging other people’s money.

Building your “financing toolkit” involves not just understanding the different options at your disposal, but also when to use each. Depending on how interest rates move, you may find better bargains from private lenders versus banks or portfolio lenders, for example.

Keep an eye on interest rates. Even if you only borrow money short-term to flip houses, interest rates still impact your buyers.

And as always, REsimpli is here to make your life easier as a real estate investor. Get started with a free 30-day trial to start streamlining your marketing and tracking the ROI of every marketing channel you use.