Want More Profit in Your Real Estate Business? Do this before Scaling

Not seeing the money you want? Start with profit first

Too many real estate investors and wholesalers grind away month after month, but don’t actually take home much money.

Why?

Because they think they can grow their way to profitability.

News flash: you’re doing it wrong. Profit comes first, not later.

If you scale before your business earns much profit, you’ll just build bad habits into your business. Volume won’t save you — it’ll just make it harder to fix your business’s problems.

Profit First

Start by setting a target profit margin and operating expense budget.

For example, healthy real estate investing businesses often have an operating expense budget in the 60-65% range. The rest goes to the owner’s salary, taxes, and profits that can be taken as owner distributions or invested in personal assets.

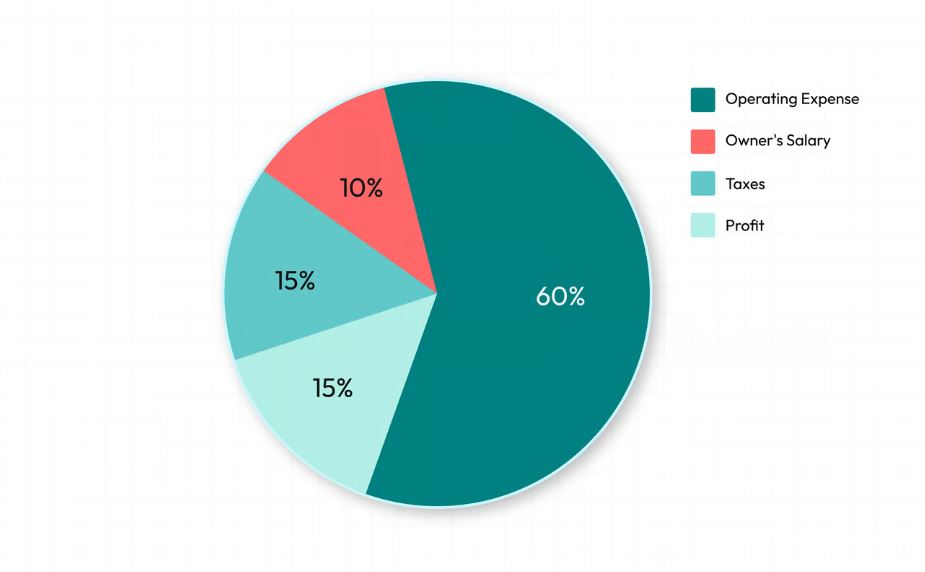

Here’s a broad outline of how your profit allocation should break down:

- 10% owner’s salary

- 15% taxes (adjust based on state & income bracket)

- 10-15% profit (gradually increasing to 20%)

You can opt to reinvest profits into major business growth initiatives too — but only after stabilizing your business’s systems and profit margin.

Insisting on a minimum profit margin also keeps your expenses and revenue clear in real-time. If revenue drops or your expenses rise, you see it (and feel it) immediately. You can adjust and adapt in real-time, rather than sweeping it under the rug.

In other words, you can just say “Oh well, guess I’ll take home less this month.” You instead have to make the hard decision about which expenses to cut that month.

Formula for success

Most business owners use the following formula for accounting in their business:

Sales – Expenses = Profit

They’re doing it wrong.

Instead, your business should use the following formula each month:

Sales – Profit = Expenses

If your business generates $20,000 in gross revenue, and you set a total profit margin of 40%, that means $8,000 gets subtracted for profits. That leaves you $12,000 for operating expenses.

Were you planning on spending $13,000? Too bad — find $1,000 to cut.

That could mean ditching marketing channels that aren’t delivering high ROI, or letting go of employees that aren’t producing far more revenue than they cost, or any number of other expenses to slash.

Remember, more profit only comes if you hold your expenses steady, relative to your sales. If you grow your revenue by $5,000 and grow your expenses by the same amount, you have nothing to show for it at the end of the month.

Trimming the fat

Not sure where to start with reining in your business expenses?

Start here.

Calculate ROI for each marketing channel

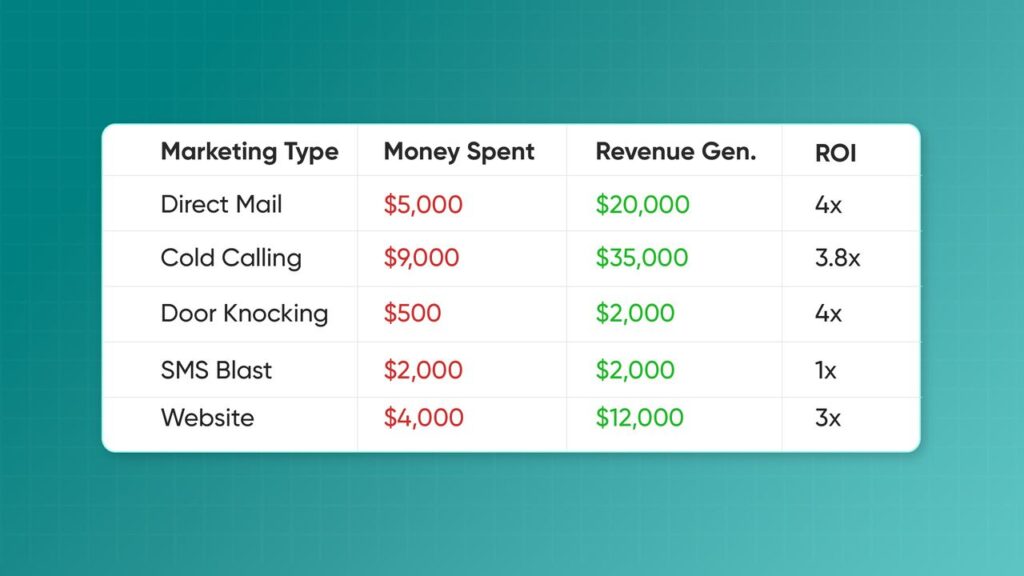

Every dollar spent on marketing needs to generate far more money in the form of revenue. If it doesn’t, then stop wasting money on it.

REsimpli’s CRM lets you track the return on investment (ROI) for every marketing campaign you run. You can instantly see how much you spent on each marketing campaign — and how much revenue each has generated.

You set that up by using different tracking phone numbers and lead URLs for different marketing channels. Read more on tracking ROI for different marketing campaigns if you have questions.

If you spent $1,000 on a direct mail campaign and it generated $2,000 in revenue, then you earned a 100% return on those marketing dollars. If you also spent $1,000 on PPC ads but they only generated $750 in revenue, then you had a -25% return.

One glimpse at your REsimpli dashboard and you can compare your ROI for all marketing channels. Stop wasting money on channels that aren’t performing.

When you’re ready to scale, ramp up the channels producing the highest ROI.

Start with the highest-quality prospects

You already have more useful data than you realize.

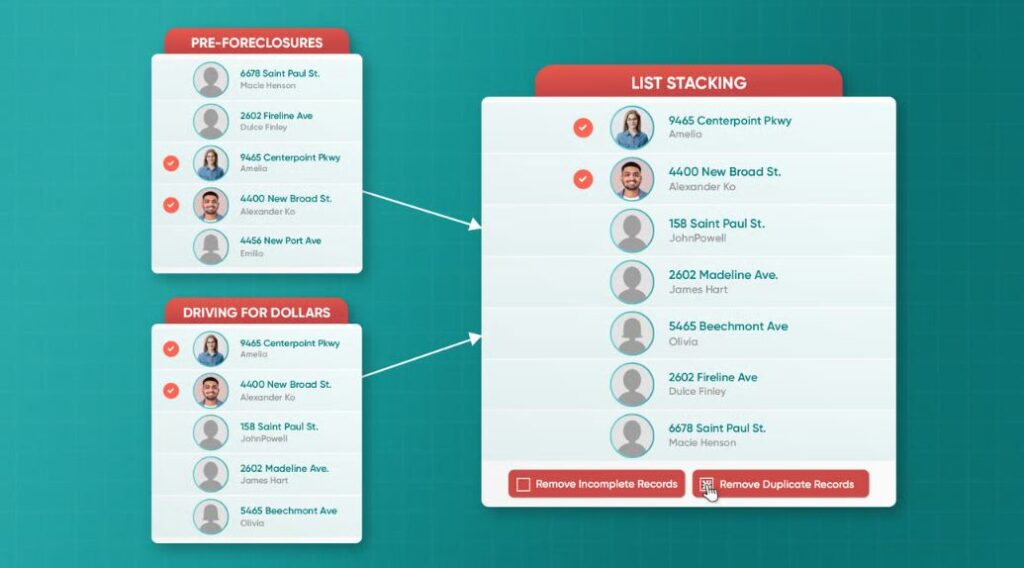

Take all of your various lists of prospects and upload them to REsimpli’s CRM. Then use our list stacking feature to identify the most motivated prospects.

For example, say you have a list of vacant properties that you found by driving for dollars. You have another list of properties in pre-foreclosure. Through list stacking, you can find the overlap: the vacant properties that are in pre-foreclosure.

Those owners need to sell, and pronto. Market to them first, to focus your marketing dollars on the prospects most likely to drive revenue.

Stop marketing to low-quality prospects

Know how else list stacking can help you maximize revenue per prospect?

By preventing waste.

The REsimpli CRM can spot inaccurate or incomplete mailing addresses, so you don’t waste money sending direct mail to them.

Likewise, you can avoid sending duplicate mailings to owners who appear on several of your lists.

Look twice at PPC prospects

Many pay-per-lead and pay-per-click (PPC) prospects are properties already listed on the market for sale.

Read: waste of advertising money.

And that says nothing of the money you spend on a marketing agency to run your ad campaigns. Without becoming a black belt in PPC advertising, you can probably learn the fundamentals and manage these campaigns in-house.

Word to the wise: old-school marketing tactics like direct mail and cold calling still usually work best for finding off-market deals.

Professionalize your real estate business

Professional athletes don’t duct tape together their shoes. So why are you trying to duct tape together your real estate business?

If you want to earn profits like a professional real estate investor, use the tools your pro competitors are using. That starts with marketing and accounting tools like REsimpli.

Don’t take our word for it. Try it out for yourself with a 30-day free trial.

We look forward to hearing your feedback and successes after your first month running with the big dogs.

Look for cash drags

I get it — you want to keep some of the deals you find, rather than wholesaling all of them.

There’s nothing wrong with flipping houses yourself or keeping some as rentals. But it can add a cash drag to your accounting.

If flipping projects stay on your books for six months or longer, they’re tying up precious cash too long. Sure, the profits come eventually, but at what opportunity cost?

Put another way, what else could you have done with that cash to generate even more profits? Perhaps with less risk and fewer headaches, to boot.

In your flipping business, aim to reinvest the same capital three times each year. That’s a four-month average hold time. If you can’t sell off flips within six months, you probably need to plug some holes in your flipping business.

Double check ROI on rentals

Plenty of wholesalers and flippers aim to keep some properties as rentals with the BRRRR strategy.

But rental properties can add real headaches to your investing business. Repeat after me: rents are not passive income. They’re semi-passive at best, and need to justify the extra labor with significant cash flow.

When you calculate the cash-on-cash return for rental properties, make sure you include all long-term average expenses. Include average annual maintenance and repair costs, vacancy rates, and property management costs even if you self-manage. It’s a labor expense, even if you do the labor yourself.

You may be tying up cash and labor on properties that don’t actually create much revenue for you.

Action steps

Let’s get down to brass tacks: What steps can you take right now to boost the bottom line in your business?

1. Allocate your profit and salary first

Set a target profit margin in your business. I recommend 35-40%.

Within that, designate some for your personal salary as the founder. Set aside some for taxes, and leave the rest tagged as profits.

That raises the next question: How do you earmark and separate these in your business?

2. Open multiple bank accounts

You can set up payroll for yourself to go out weekly, biweekly, or monthly. That can automatically leave your business checking account and transfer to your personal checking account. No sweat.

But you’ll need to open some new bank accounts for other portions of your revenue.

First, open a high-yield savings account for your tax payments. As a business owner, you need to make estimated quarterly tax payments to the IRS.

No really — if you don’t, Uncle Sam will hit you with nasty penalties and late fees. Set aside 10-15% of your revenue (or more if needed) for estimated tax payments.

You should also open a separate account to hold your profits. Move your designated percentage of revenue into this account, every time you get paid.

Does that leave your business operating account strapped? You’re probably blowing too much money in expenses. See the section above about trimming the fat.

The point is to keep your business profits, owed taxes, and personal salary sacred. Move them out of your business operating account so that you don’t spend them.

Check out Ally Bank, Mercury Bank, and Relay Financial for free business banking services.

3. Cut expenses

You already got this memo, but it bears repeating here as an action step.

Keep cutting aggressively until you hit your target profit margin. You can grow your expenses only as you can afford it, based on profit-first accounting.

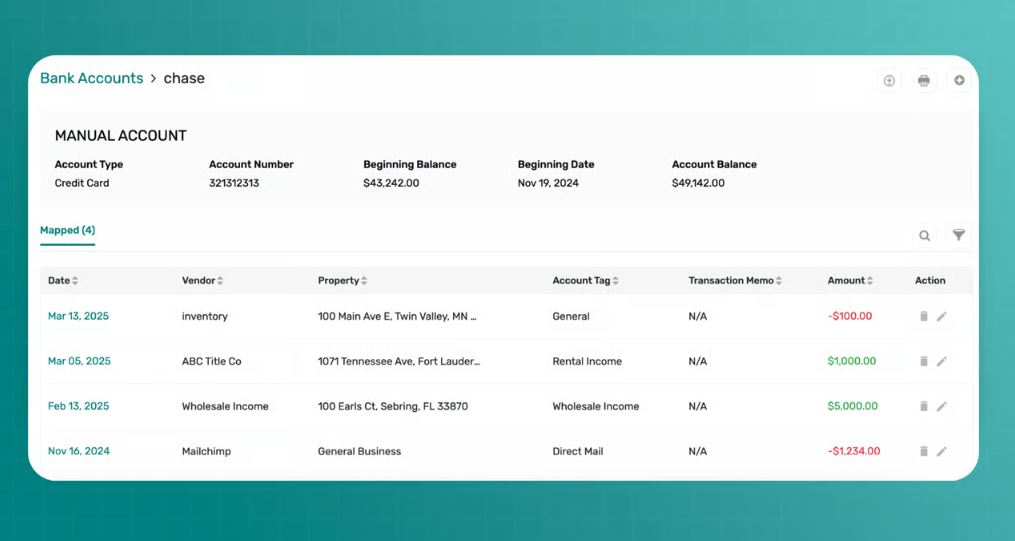

4. Monitor financials monthly with REsimpli’s accounting tools

How much did you earn last month? How much did you spend? After pulling out money for your salary, profits, and taxes, did your business stay above water?

Cash flow is the lifeblood of every business, and you need to keep your finger on its pulse. If you don’t know how your money is flowing, you don’t have a handle on your business.

Fortunately, we can help keep that part simple. The REsimpli CRM integrates with Plaid to track all of your transactions.

At the end of each month, you can look back over not just your total income and expenses, but also how much you spent on each category of expenses. That makes it easy to spot where you overspent.

Know your business health by knowing your numbers. Bury your head in the sand at your own peril.

5. Review your cash drag from flips & rentals

Run the numbers on how long your flips are taking and how much profit you’re earning on average. Are you turning your flips over fast enough? Is the juice worth the squeeze, for all the work involved?

Do the same thing for your rentals. Are they actually worth all the time and money they drain away from your main business?

There are truly passive ways to invest in real estate, from syndications to private notes to JV partnerships to debt and equity funds. Running a real estate business takes plenty of work on its own — be careful about splitting your attention too many ways.

Bottom line

Running a business for profit first keeps your lights on — both personally and for your business.

You don’t need to have a degree in accounting to know your numbers. You do need to track your income and expenses, and move your allocated profits, salary, and taxes out of your operating account before you spend it.

It’ll probably make you uncomfortable at first. Expect it to shine a spotlight on your business’s weakest areas.

That’s not fun, but it is necessary if you want to grow your income. And you need to do it before scaling, because the larger your business grows, the harder it is to fix bad habits and practices.

Switch to profit-first accounting in your real estate business, and lean on REsimpli’s accounting tools to help. Sign up for a 30-day free trial today to both earn more revenue and cut wasted expenses.

You’ll thank us in a month from now when you’re sleeping easier on a salary from your business.