With enough passive income, working becomes optional

Want to reach financial independence, with enough passive income to cover your living expenses?

Rentals can help.

But while there’s obviously some overlap with flipping and wholesaling — namely finding great deals — rental investing comes with its own skill set. A skill set you need to build before you start buying.

Rental investing is a business, and each property is inventory in that business. Before buying any inventory, build your business systems for acquiring, managing, derisking, and scaling your portfolio.

6 Ways Rental Properties Generate Wealth

How do I love thee? Let me count the ways.

1. Cash Flow

The most important way rental properties build wealth is by cranking out cash flow each month.

But here’s the thing: cash flow is not the rent minus the mortgage. You have to average in irregular expenses like repairs, maintenance, vacancies, accounting, legal costs, and so forth.

As a general rule of thumb, many investors use the 50% Rule: that non-mortgage expenses add up to half of the rent. Beyond those listed above, these include property taxes, landlord insurance, and property management costs.

Use a rental income calculator to forecast cash flow for any property before buying.

2. Equity Capture

As a flipper or wholesaler, you get this one intuitively: buying properties below market value earn instant equity.

3. Forced Appreciation

Likewise, flippers understand how to force appreciation by renovating properties.

The BRRRR strategy involves buying, renovating, renting, and refinancing the property — then repeating the process to keep building a portfolio of properties. Do it right, and you can pull your down payment back out of the property. More on this next week.

4. Market Appreciation

Over time, real estate tends to increase in value. Property appreciation outpaces inflation in most markets.

Just make sure you invest for cash flow first, rather than speculating on appreciation. Plenty of rental investors went bankrupt after 2008 by relying on appreciation rather than income.

5. Mortgage Pay-Down

Your renters will gradually pay down your mortgage balance over time. Every month that goes by, you gain more equity not just from appreciation, but also from paying off your loan.

6. Tax Advantages

Rental investors get to write off depreciation, to show a loss on their tax return even as they collect cash flow in real life.

Because they hold properties long-term, they also pay the lower long-term capital gains tax rate on profits. Or punt those taxes into the future, by doing a 1031 exchange to swap one property for a bigger, better cash-flowing property.

Professionalize Your Real Estate Business

Professional athletes don’t duct tape together their shoes. So why are you trying to duct tape together your real estate business?

If you want to earn profits like a professional real estate investor, use the tools your pro competitors are using. That starts with marketing and accounting tools like REsimpli.

Don’t take our word for it. Try it out for yourself with a 30-day free trial.

We look forward to hearing your feedback and successes after your first month running with the big dogs.

Choosing the Right Market for Rentals

I get it: you have a market you like and already work in, flipping or wholesaling houses. Maybe you live locally. Either way, you figure you’ll just keep a few of the deals that you might otherwise wholesale or flip.

That might work. Or your current market might be terrible for rental investing.

Follow these steps to find the right rental market to invest in.

Step 1: Choose a Landlord-Friendly State & City

Some states make life relatively easy for property owners. Other tenant-friendly states make investing a nightmare.

That can include onerous security deposit rules and limits, restrictions on late rent fees, and nightmarishly long eviction timelines. It took me 11 months to remove a tenant in Baltimore, Maryland once.

If a state hates landlords, don’t invest there.

Step 2: Check Price-to-Rent Ratios, Affordability & Inventory

Besides being outrageously tenant-friendly, San Francisco is a terrible place to buy rental properties.

To begin with, the properties just aren’t affordable. With a median home price of $1,180,795, it’ll cost you a pretty penny to buy a single property.

Even worse, the price-to-rent ratio is awful. Tenants complain about the high rents in San Francisco, but they’re a bargain compared to the seven-figure median property price.

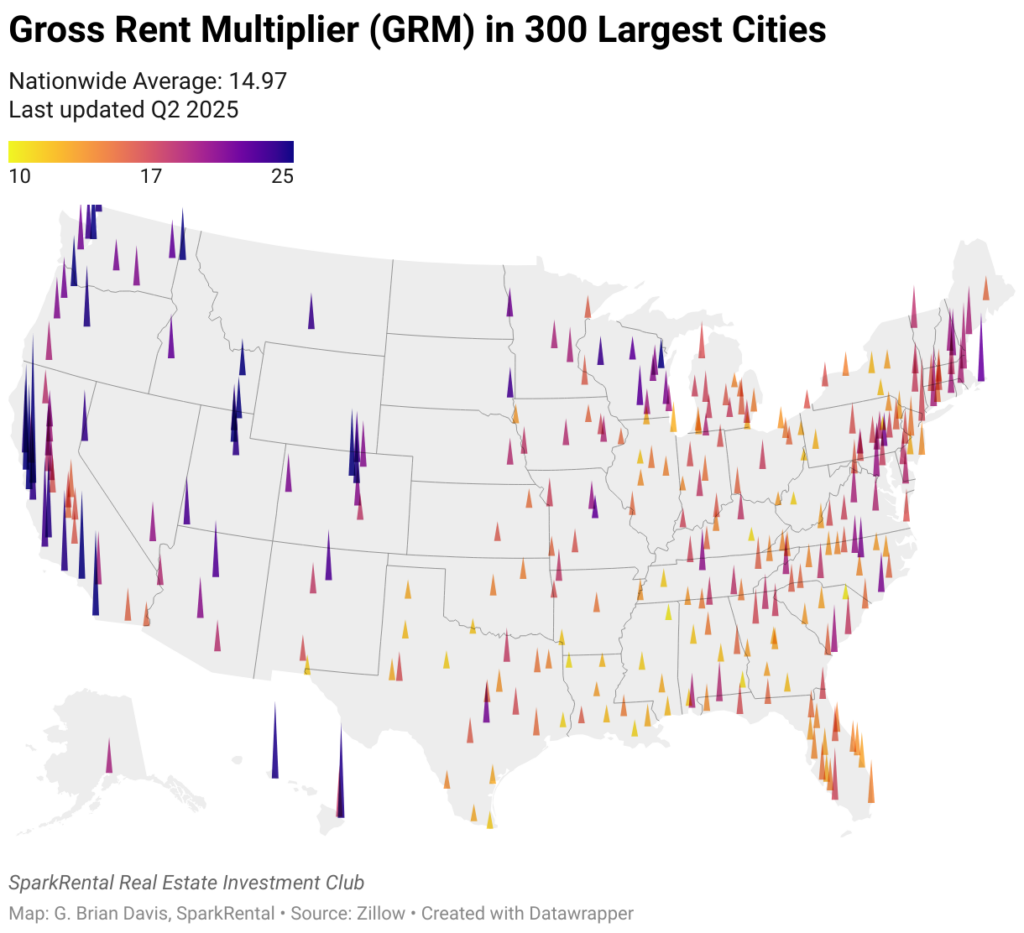

Investors measure this ratio by gross rent multiplier (GRM): the price divided by a year’s gross rents. The lower the multiplier, the lower prices are relative to rents. The national average is 15.14, but in San Francisco, it jumps to a hideous 31.67.

Look for cities with affordable properties and relatively high rents.

Step 3: Assess Local Job Market

How stable and diverse is the local job market?

Look for cities with many different types of employers, rather than those that rely on one primary industry. Look no further than Flint, Michigan and what happened when the auto industry pulled out for an explanation why.

Step 4: Identify Ideal Neighborhoods

Once you’ve found a city with strong fundamentals for rental investing, drill down to the neighborhood level.

Use NeighborhoodScout.com to check affordability, rental saturation, and economic trends. There’s a sweet spot in the middle for rental saturation. Too many homeowners, and homes become unaffordable (they sell “retail” to homebuyers). Too many renters, and it indicates transience, lower income, and less economic stability. Look for a balanced owner-occupant ratio, ideally in the 50-65% range.

Avoid areas with high crime or vacancy rates. They may pencil well on paper, but they come with plenty of hidden costs and risks.

Look for neighborhoods with excellent local public schools. Families tend to stay longer, which means lower turnover rates and higher profit margins. Better schools also attract better renters, and create demand for housing.

Finally, look for locations near employment hubs. The more local jobs, the more the demand for nearby housing. Ideally invest near socioeconomic anchors like Fortune 500 companies, universities, and military bases that ensure a stable rental market.

Step 5: Connect with Local Property Managers, Realtors, and Investors

Get on video calls with local real estate agents, property managers, landlords, and investors.

Ask about the city itself, about local landlord-tenant laws. Ask about neighborhoods and what it’s like to own and manage properties there. Try to get a sense for what kind of people live in each neighborhood, and how easy they are to work with.

Ask open-ended questions. Listen not just to what they say but also read between the lines of what they don’t say.

Get referrals for local contractors of all specialties, for local lenders, for home inspectors.

Most of all, when you speak with landlords and real estate agents, ask about who the absolute best local property management companies are, and whether they have direct experience working with them.

Property Management Matters More Than You Think

It sounds counterintuitive, but find an outstanding property manager before you buy any rental properties. They’re your most important hire as a rental investor.

Why? Because without top-notch property management, your rental investing venture is doomed to fail.

Not every neighborhood has good property managers willing to work in it. As a general rule, the lower-end the neighborhood, the lower-end the property managers who are willing to take properties there.

It’s one more reason why you need to find those sweet spot neighborhoods with both enough cash flow and easy-to-manage renters.

Hiring a poor property manager can ruin your rental investing business. Bad property managers are lazy in their tenant screening, often installing bad renters who default on rents and damage your properties. They’re lazy in their property inspections, missing maintenance issues until they cost a fortune to fix, and missing tenant violations. Some nickel and dime you with hidden fees, or take kickbacks for hiring shady contractors with your money.

Word to the wise: hire slowly and fire quickly when it comes to property management.

Financing Rental Properties

You don’t finance rental properties with short-term hard money loans. At least not after the initial purchase and renovation, if you’re buying fixer-uppers.

No, you need long-term loans for buy-and-hold properties. Here are a few options on the table.

Local Banks

Often local community banks offer better loan terms than national lenders. Take the time to research and contact local banks and credit unions to ask about their loan options.

National Portfolio Lenders

Portfolio lenders keep their loans within their own portfolios rather than bundling and selling them — hence the name.

Often local banks offer portfolio loans, but many nationwide lenders do too. Research options like Visio and Kiavi to get a sense for their pricing and terms.

Seller Financing

Everything in life is negotiable, including seller financing.

Take the time to learn how to explain owner financing to wary sellers. As you get better at explaining and pitching it, you can secure relatively modest interest rates with no fees.

Private Loans

Sellers aren’t the only private parties who can lend you money. Your friends, family members, colleagues, and even strangers you meet online can all fund your deals.

Like seller financing, you can negotiate your own terms, from interest rates to fees to the loan term. In fact, many private lenders don’t charge fees at all — it never occurs to them to do so.

Subject-To Financing

Did you know that you can sometimes assume the seller’s low-interest loan?

Read up on subject-to deals to learn the pros and cons.

Commercial Loans

Buying a multifamily property with five or more units? You’ll need a commercial loan rather than a residential one.

Don’t be intimidated. But do start networking with commercial lenders before a deal comes along that you need to finance with a commercial loan.

Niche Rental Strategies

Yes, you could sign a typical one-year lease to long-term tenants. But that’s not the only rental strategy available to you.

House Hack

You could buy a multifamily property, move into one unit, and rent out the others.

Conventional mortgage loans allow properties with up to four units. You can score a low-interest, low-down payment mortgage and still buy an investment property.

Oh, and you only have to live there for a year to meet conforming loan requirements. That means you could theoretically buy four new units every year with owner-occupied loans.

Do it right, and the rent from your neighboring units cover your entire mortgage payment plus repair costs.

Short-Term Rentals

Chances are, you’ve stayed at an Airbnb, so you know the drill.

In some markets, short-term rentals outperform long-term rentals — sometimes by a wide margin. They do require more labor on your part however, and some cities restrict them, so do your homework before choosing this strategy.

Mid-Term Rentals

Fewer investors are familiar with the mid-term rental strategy.

It involves renting out a furnished unit for extended stays, typically two-to-six months. Common renters include travel nurses and other professionals on temporary assignment.

You get the premium rental income without the headaches of constant turnover. Investors who master this niche say that they earn dramatically higher returns than long-term landlords, and they don’t have to put in the labor that Airbnb hosts do.

Tying It Together

Real estate wholesaling and flipping make for great business models. They can generate strong profits.

But they won’t build your net worth, beyond the cash flow they generate. Consider keeping a few properties for yourself, to grow your long-term wealth and passive income.

Just beware that rental investing comes with its own risks and required skill sets. Master those, and you can thrust your real estate investing machine into high gear.

Next week, we’ll dig in deeper to two rental investing strategies: BRRRR versus turnkey investing. In the meantime, try REsimpli for a 30-day free test drive, to supercharge your lead acquisition, deal flow, and profits!