They say you make money on real estate when you buy, not when you sell.

Why? Because if you score a great deal on a property, you instantly gain equity. You position yourself to earn a tidy profit by wholesaling, flipping, or BRRRR-ing (if that’s a verb).

You know you need to find motivated sellers. But where do leads and lists of prospective sellers come from?

You can source leads from many places, but here are three that we particularly like.

1. Pay-Per-Lead Companies

Some companies specialize in selling live leads to real estate investors and wholesalers.

They typically excel at online marketing, and run both pay-per-click (PPC) and organic SEO campaigns to drive traffic from motivated sellers. Then they sell those leads to the highest bidder.

How PPL Companies Work

While different PPL companies can have slightly different business models, they usually work like this.

They market to property owners who want to sell fast to a cash buyer. The prospect fills out a form on the PPL company website, and their lead goes out to the current highest bidder for that zip code.

Investors like you and me bid for leads within a specific county. For example, Need To Sell My House Fast starts the bidding in each county at $75. You set both your per-lead bid and a maximum monthly budget. The first leads go to the highest bidder, until they burn through their budget. Then leads start flowing to the next highest bidder until their budget ends, and then the next, and so forth.

When I interviewed Joe Tenenbaum from Need to Sell My House Fast, he recommended starting your bid with at least 50% of the top bid plus $25-$50 as a starting strategy.

Another PPL company to check out is Motivated Leads. To get a better sense for how they work, check out my interview with their founder Bryan Driscoll.

Both companies only sell leads to one bidder. You won’t have to compete with other buyers — at least not from these companies.

How to Maximize Your Closings with Bought Leads

First and foremost, get back to the lead immediately.

The best wholesalers and investors get back to leads within 60 seconds of the lead hitting their system. They strike while the iron’s hot.

How do they do it? With systems like REsimpli’s Speed to Lead, where it alerts not just you but all members of your team when a new lead rolls in. You can set the system to call you to instantly connect you with live leads.

Remember, many sellers go with the first person they talk to, rather than shopping around.

If you don’t reach them right away, put them on a drip campaign to follow up automatically.

Also, the more solutions you offer owners, the more likely you are to close a deal with them. You can and should offer a quick cash purchase. But what if they’d prefer to continue living in the home? What if they want to partner with you on the flip upside?

Those who can wholesale, buy and hold, flip, do a seller-leaseback, do novations, buy subject-to, or list properties outperform single-option investors.

Advantages of Bought Leads

On the plus side, bought leads let you focus on closing sales. Advantages include:

- No need to buy prospect lists.

- No outbound marketing campaigns.

- Highly motivated leads that went through the work to fill out a form asking for a fast cash offer.

You don’t have to buy or source prospect lists. You don’t have to sort or stack or analyze those lists. And you don’t have to do any outbound marketing to those prospects.

You just choose your target counties, set parameters for the types of properties and leads you want, and bid for them.

The leads roll in, and you can start immediately qualifying them.

Finally, these tend to be high quality leads. The owner reached out for help, rather than being marketed to.

Downside of Bought Leads

You guessed it: paying per lead can get expensive.

On Motivated Leads, the bidding typically starts at $300 per lead.

That said, Bryan Driscoll made a great point in our interview. He urged investors to focus on their average cost per deal, not cost per lead.

That’s how you can compare the return on your marketing costs across different campaigns.

Professionalize Your Real Estate Business

Professional athletes don’t duct tape together their shoes. So why are you trying to duct tape together your real estate business?

If you want to earn profits like a professional real estate investor, use the tools your pro competitors are using. That starts with marketing and accounting tools like REsimpli.

Don’t take our word for it. Try it out for yourself with a 30-day free trial.

We look forward to hearing your feedback and successes after your first month running with the big dogs.

2. Lead Sourcing Software

Sure, you could pay extra for software platforms like PropStream and ListSource to identify motivated sellers.

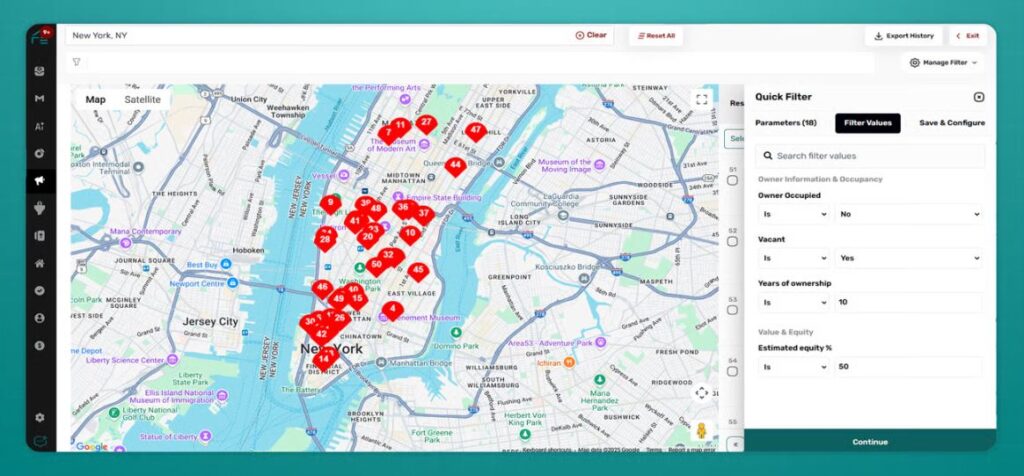

But guess what? Now you don’t have to. We’ve added prospect searches — complete with detailed filters — directly within REsimpli! And the best part is that it doesn’t cost extra.

You can pull lists of prospects, then stack and sort the lists to find the highest-quality prospects. From there, you can launch direct mail and other outbound marketing campaigns with a single click.

The only problem? Your competitors have access to similar data. That’s why we focus not just on outbound marketing, but also on automated follow-up, sales, scripts, and boosting your conversion rate.

The bottom line: software platforms like REsimpli make for a more cost-effective way to generate leads.

How to Filter for Prospects

Unlike PPL companies, you typically pay a monthly membership fee to access lead sourcing software.

When you log in, start by choosing your target geographical markets. From there you can use the following filters to hone in on your ideal prospects.

Distress

Distressed property owners make motivated sellers.

Types of distress can include owners in foreclosure, in tax sale, or in the midst of a divorce. Often they need or want to sell as fast as possible, even if that means taking a lower offer.

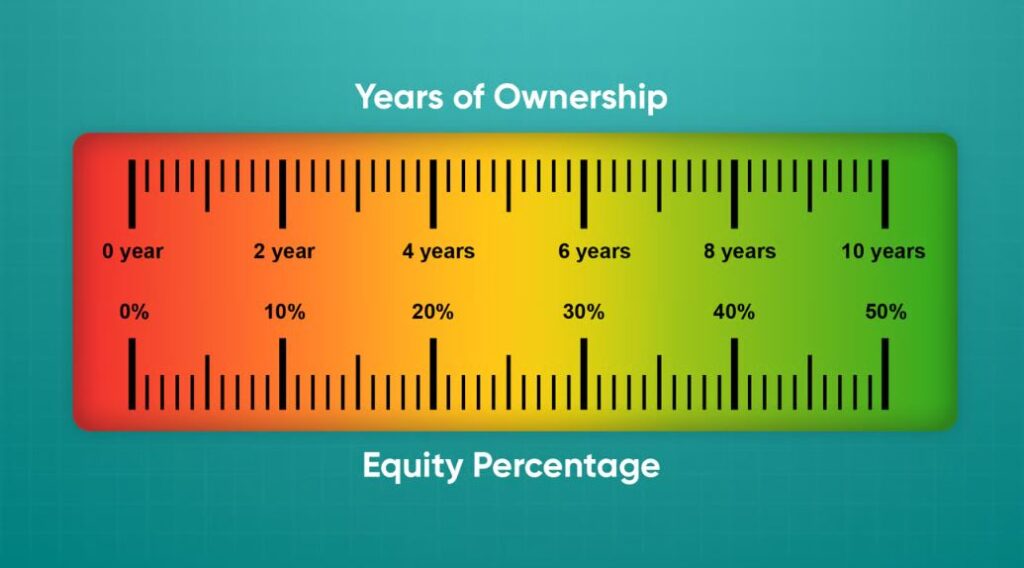

Equity & Ownership Length

Even if the owner wanted to sell to you at a 40% discount, they can’t do that if they owe just as much as the property’s worth.

So, filter for either equity or by length of ownership (or both). Screen for properties with at least 30-40% equity, or which haven’t sold for at least five years.

Non-Owner-Occupied

I like to filter for absentee owners who don’t actually live in the property. Owners who live there tend to be more reluctant to sell and vacate.

Vacancy

Property owners part with vacant homes more easily than occupied ones. Consider filtering for vacant properties.

You can also segment your lists with vacancy data from the US Postal Service. If need be, you can use list stacking to compare prospect lists with vacancy lists from the USPS.

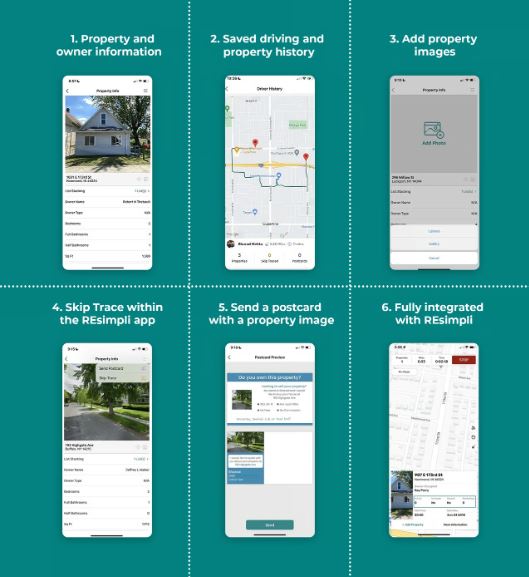

3. Driving for Dollars

An oldie but goodie, driving for dollars involves physically driving around your target neighborhoods and looking for vacant homes.

These homes are costing their owners money, month in and month out. That makes owners more receptive to fast closing to walk away with quick cash.

How It Works

As you drive around your target neighborhoods, look for the following signs of vacancy:

- broken windows

- peeling paint

- overgrown grass and unkempt landscaping

- stuffed mailboxes

Jot down the property addresses for you to add to your driving for dollars list on REsimpli later. REsimpli’s driving for dollars feature lets you collect up to 500 free leads per month, automate list creation and integrate it with lead management.

You can also check out mobile apps like Deal Machine and The Driving For Dollars App. These can instantly pull up the property’s public records, the owner’s contact information, and more. Some apps even let you click a button to send your customized postcard to that property’s owner.

How to Refine Your D4D List

When you load the addresses you found from driving for dollars into REsimpli, you can compare against any known property equity or ownership length data to find properties likely to have lots of equity.

You can also use our skip tracing feature to find absentee owners.

Use list stacking to identify run-down properties that also show up on your lists of distressed properties. That can help you find the highest-quality prospects, to spend your precious marketing budget reaching.

Bonus: Failed Listings

One other source of prospect lists include MLS listings that expired or were taken down by the seller. The would-be sellers often feel discouraged, and are sometimes receptive to a fast sale for a low price.

It helps if you can reach the owner directly, rather than going through their real estate agent. Agents will push for a higher amount, and of course take their cut. Owners can sell for less if they don’t have to pay a Realtor commission.

Before Spending a Cent

Remember, your home city might not make the best market for investing.

Before you spend a cent on leads, lists of prospects, or outbound marketing, make sure you feel confident in your target market.

That starts at the state and city level. You can then drill down to individual neighborhoods.

Real estate investors typically classify neighborhoods grading them A-D:

- Class A: High-end, expensive, not ideal for cash-flow investing

- Class B: Good for starter homes, young families, solid school districts

- Class C: Mixed homeowners and renters, decent cash flow opportunities

- Class D: High percentage of absentee owners, riskier investment areas

Try checking Roofstock.com to see how quickly turnkey rental properties are selling in specific cities and neighborhoods. Note that they don’t support every city or state.

Also speak with local property managers, landlords, and real estate agents who operate in the neighborhoods you’re considering. They can give you a ground-level sense for the market.

Tying It Together

Profits come from deals, and deals come from leads. You need great leads if you want to earn great profits.

So how do you plan to get those leads?

You can buy them, or you can build out your own lists of prospective sellers.

The three strategies above are far from the only ones. In the next few weeks we’ll keep exploring inbound versus outbound marketing strategies, and digging deeper into each.

As a final thought, if you’re new to real estate wholesaling or investing, don’t buy leads. Refine your sales system before you shell out hundreds of dollars per lead. Work on closing more of the leads that come in, and improving your conversion rate.

And of course, REsimpli can help at every stage. Take a 30-day free trial to start refining your prospect lists, looking up owner contact information, automating your outbound marketing, and processing leads.

It’s how I’ve built a seven-figure real estate investing business, and how you can too.