Other People’s Money Part 2: Private Loans & Equity Sharing

Most of us don’t have millions of dollars sitting around collecting dust, ready to buy up investment properties.

Want to flip more houses at a time? Or build a portfolio that cash flows?

You need access to other people’s money.

Last time, we talked about traditional financing such as conventional mortgage loans, hard money loans, and portfolio loans. We also broke down seven creative financing strategies, including:

- Seller financing

- Business credit lines

- Credit cards

- HELOCs

- Retirement accounts

- Private loans

- Equity sharing and syndications

We dug a little into the details of seller financing. But how do you build a network of private lenders? How do you structure those loans legally?

And how does equity sharing work? What options do you have there?

Get your goggles ready, because we’re about to dive deep.

How to Build an Army of Private Lenders

Sure, you could pay a hard money lender their exorbitant fees for borrowing money.

Or you could borrow from your sweet Aunt Sue and keep the money in the family. (Or your Friend Lisa, or Neighbor Bob, or Coworker Colin.)

Start with these tips to build an ever-growing network of private lenders who can fund all your deals.

Ask for Referrals, Not Money

Let’s face it: asking for money feels awkward for both parties.

You don’t want to approach every friend and family member with your hand out. It feels desperate and needy. They’ll feel like you’re asking for a favor.

Don’t ask “Do you want to lend me your money? Pretty please, with a cherry on top?”

Instead, explain the projects you’re working on, ideally as part of the natural flow of conversation when they ask how you’re doing. Mention that you’re paying tens of thousands of dollars in interest to banks and hard money lenders, and would rather pay interest to people in your network.

Tell them you’re paying 10% interest (or whatever) on loans secured by real estate, and ask, “Do you know anyone looking to earn regular interest payments like that?”

Emphasize Your Track Record

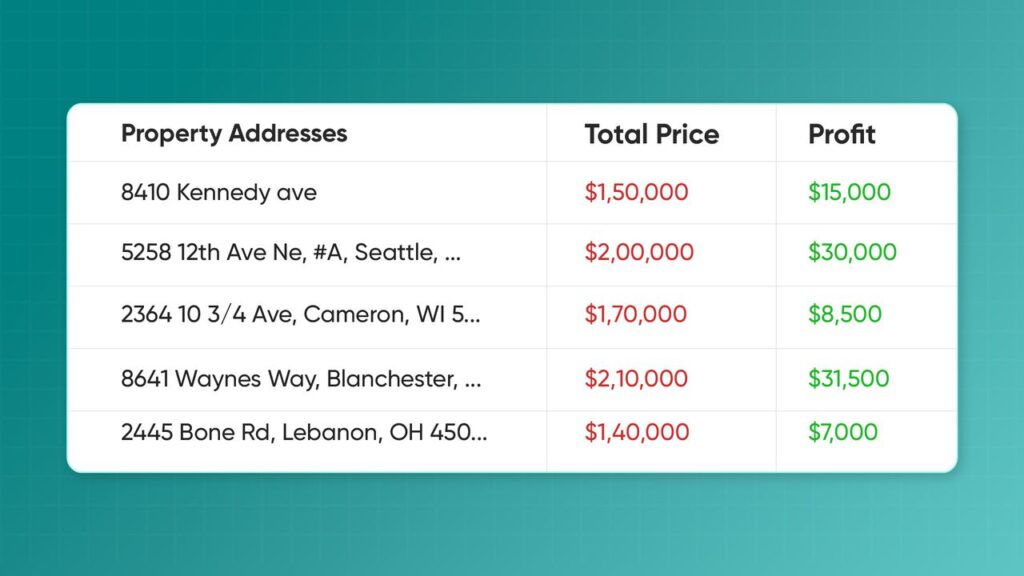

When speaking with potential private lenders, answer their biggest question before they ask it: “What kind of results have you had?”

No one wants to lend money to a novice investor just starting out. But what about a house flipper who’s done three dozen deals, and made money on every single one?

That’s another story.

When you first start explaining what you’re doing, weave your results into the narrative. “We’ve been flipping houses for the last couple of years, and done about 15 so far. It’s a lot of fun, and we’ve been averaging about $50,000 in profit on each flip. We’re getting to the point where we want to stop paying interest to banks and start paying private lenders.”

Now they’re wondering how they can get in on the action, not feeling pressured to give a handout.

Show them photos of houses you’ve bought. Tell them stories about case studies and quirky deals. Color in the fine details, make it real, bring them into your world.

Start with Your Existing Network

You know more people than you realize. Between friends, family members, coworkers, neighbors, second cousins twice removed, and all their friends, you have plenty of money you could tap into.

Again, aim to work it into the conversation organically. When people ask you what you’re up to these days, or how work is going, that’s your opening.

Don’t force it into the conversation. Your conversation partner will ask about your life sooner or later, and you can then answer honestly about what you’re working on.

Lean Into One-on-One Conversations

If you want people to trust you with tens of thousands of dollars, they’re going to want to sit down with you and chat a few times.

They’ll ask dozens of questions, perhaps about your track record, or the types of properties you buy, or your average turnaround time. But they’re really asking a dozen forms of the same question: Can I trust you with my money?

Don’t get impatient with them. Answer their questions. Reassure them. You can even cut to the chase and say “I get it — you want to know if your money is safe with me. And that kind of trust takes transparency to build. So ask me anything you want, and we can have a frank conversation.”

Create a Social Media Presence

At a certain point, you’re going to want to expand beyond your own friends and family. Start laying that groundwork now, before you’re ready.

Post on social media about what you’re working on. Share wins, vent about challenges. Ask questions, both of other investors and of laypeople.

Share posts about housing market data, trends, charts, and graphs. Establish yourself as knowledgeable in the real estate industry.

Eventually, you can start establishing yourself as an expert. Aim to network with bloggers and journalists, to provide quotes for their stories. I get quoted all the time as a real estate expert — it makes it that much easier to borrow money!

Don’t ask for money over social media. Instead, use social media to build an email list, build trust with them, and schedule those one-on-one calls.

Network Within the Industry

The path from “stranger” to “private lender” is a lot further and harder than starting with people you actually work with, or at least share your industry.

Start with the people you already know in the industry. Write a list of every real estate agent, title company contact, contractor, handyman, home inspector, appraiser, and anyone else you know in the industry. Reach out to them to catch up and reconnect over coffee or a happy hour drink.

Once you sit down with them one-on-one, the conversation can organically move toward what you’re doing.

Don’t stop there, though. Ask them for referrals for other industry contacts. Just make sure you ask it in the context of actually hiring them for their work, not hitting them up for money as a lender.

After all, you can never know too many contractors, or Realtors, or other industry personnel as a real estate investor!

Seek Out Whales

One private lender with $100,000 is worth 20 potential lenders with $5,000 apiece. More, actually, since people with just $5,000 to lend or invest are more reluctant to part with it.

As you network with potential private lenders, look for those with plenty of capital to lend. Attend networking events for high-net-worth individuals. Filter for higher-income earners on LinkedIn. Join higher-end mastermind groups for millionaires (or aspiring millionaires).

Working with a few high-ticket private lenders also takes far less work than working with dozens of small-dollar lenders. Always prioritize networking with wealthier prospects when you can.

Use a CRM for Consistent Follow-Up

You use a CRM like REsimpli in your real estate investing business (right?). You can also use it for your private lenders.

Enter potential private lenders as contacts in the system. Then create drip campaigns to consistently follow up with them periodically so that they don’t forget about it.

It may take five, ten, 15 touches before they reach back out to you. But if you keep earning high returns and paying your lenders back on time, many of your potential lenders will offer you their money — if you stay in touch with them.

Professionalize Your Real Estate Business

Professional athletes don’t duct tape together their shoes. So why are you trying to duct tape together your real estate business?

If you want to earn profits like a professional real estate investor, use the tools your pro competitors are using. That starts with marketing and accounting tools like REsimpli.

Don’t take our word for it. Try it out for yourself with a 30-day free trial.

We look forward to hearing your feedback and successes after your first month running with the big dogs.

How to Structure Private Notes

Right about now you probably have a dozen questions running through your head, such as:

- What should you pay your private lenders?

- How long should the term last?

- What kind of security should you offer them?

- How often should you pay them interest?

In today’s market, many beginner-to-intermediate real estate investors offer 10-12% interest for private notes. As they build a sterling track record, they become a lower-risk borrower and can often get away with paying 8-10%.

Speaking of risk, take as much risk out of the equation as you can for your lenders. Offer them a personal guarantee on the note. If you can, offer to secure their note with a lien.

That lien doesn’t have to be in first position (although that helps). Add a second lien if need be.

The repayment term is entirely negotiable. You can repay it in six months or six years or anything in between. You could even make the term flexible — I’ve lent money to an investor with a rolling six-month term. I can call the note at any time, with six months’ notice.

Often, private notes are interest-only, although you can amortize them if your borrower prefers.

Likewise, the payment period is negotiable too. Some borrowers prefer monthly payments, others don’t mind quarterly payments, or receiving all the interest at the end of the term.

Equity Sharing

Borrowing a loan isn’t the only way to invest with other people’s money.

Alternatively, you can offer your investors a piece of the pie: equity in your property. A part of the profits.

There are a few ways to do this, but we’ll focus on the two big ones today: joint venture (JV) partnerships and syndications.

Joint Venture Partnerships

Imagine I go to my sister and say, “I want to flip this house, but I’m short on cash. Want to partner with me on it? I’ll find the deal, I’ll arrange a hard money loan, I’ll handle all the permits and oversee renovations, and marketing the property for sale. You cover the down payment, and we’ll split the profits 80/20.”

We each bring something to the table. We each get a piece of the profits.

You know what I don’t need to bring? I don’t have to put up a cent of my own cash.

While family and friends are an easy starting point for JV partnerships, you don’t have to stop there. You can partner with other flippers on deals, for example. Maybe one of you has money but no time, and vice versa.

You can partner with strangers on deals, of course. But like borrowing money, it requires trust.

Structure these deals any way you like, with any profit split. These work best for short-term investments such as flips, however. Avoid JV partnerships on long-term rental properties, as it just add far more room for things to go wrong. It also ties you together for longer.

Who pays for that $5,000 roof repair that hits you unexpectedly? Who manages the property manager, to make sure they don’t put a “professional tenant” in your property?

If you need to raise higher amounts for longer investments, consider syndications.

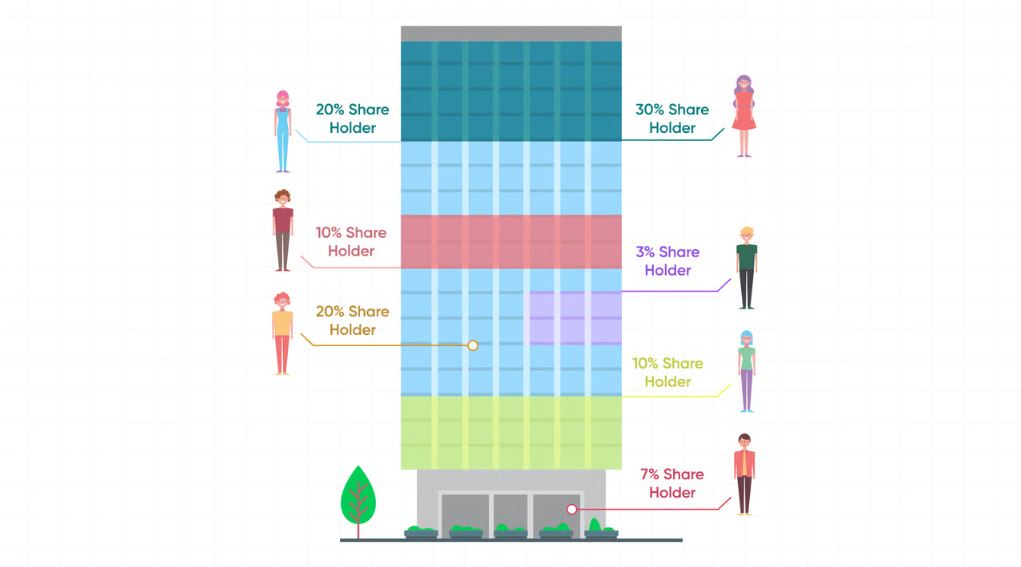

Real Estate Syndications

As real estate investors scale, they quickly learn they can earn more money with less work by buying one big property rather than many small ones.

Put it this way: say you could buy one 20-unit property for the same price as five four-unit properties. They both produce the same cash flow. Would you rather go through five sets of closings, renovations, permits, and so forth? Or just one?

The problem: that 20-unit property costs more money — and you don’t have it all. Even maxing out your network of private lenders, you couldn’t cover the down payment.

Often investors handle this by raising private capital through syndications. The offer goes like this: “You put up part of the down payment, and I’ll make you a fractional owner in this property as a Limited Partner (LP). The first 8% of cash flow and profits will go to you as a preferred return, before I see a dime. After that, we’ll do a 75/25 split, where I keep 25% of the profits for my trouble, and the other 75% gets split up proportionately to how much we each invest. Sound fair?”

Investors quickly get confused by syndications, getting snared in the details of “waterfall profit splits” or terminology like the “pref” and “promote.” But at their core, syndications are just another way to offer investors a share of profits.

You do all the work as the General Partner (GP). You make all the decisions. And you get to keep more of the proceeds in exchange.

Just beware that syndications require more legal work and restrictions. You’ll need an attorney to draw up the documents and explain rules like how to raise capital from accredited versus non-accredited investors.

Tying It Together

As you gain experience as a real estate investor, build out your “financing toolkit” of options.

The goal: to be able to borrow and raise money in many different ways, from many different people. You want to be able to pay for any great deal that comes your way — even if it’s a huge commercial property.

Build relationships with private lenders and potential equity investors. Lay that foundation of trust before you ever ask for a cent. Set up a drip campaign on REsimpli to stay in touch with them.

When the time comes, approach them with an investment opportunity, not a request for a handout.

Start simple, and earn more money as you scale. It doesn’t have to be complicated.