The Resilient Investor: Ramon Vazquez’s Transition from Military to Real Estate

Podcast: Ramon Vazquez’s Transition from Military to Real Estate

This time, REsimpli Podcast’s host, Brandon Barnes, was elated to talk to a very successful real estate investor from Kansas City, Missouri. He is none other than Ramon Vazquez, Co-owner at Pleasant Real Estate, LLC. In this thought-provoking interview, he imparts invaluable insights into fostering a strong real estate team and prospering within the dynamic landscape of Kansas City.

Are you eager to learn tons of strategies to make tons of money? We can help!

Show Notes

Many real estate investors like Ramon Vasquez agree that the real estate business is a highly rewarding field, both in terms of money and freedom. Do you know why? Read ahead!

Ramon Vasquez was in the military when he moved to California, but then eventually, he figured out through bigger pockets and some other podcasts that he wanted to start investing in real estate, and that led him to real estate. He transitioned into a full-time investor in 2018. He skillfully developed a thriving real estate portfolio. Initially drawn to turnkey properties, Ramon later courageously embraced value-added deals, demonstrating his adaptability in the ever-evolving market.

Departing from his previous government position, Ramon’s decision to become a licensed agent and eventually a full-time investor exemplifies his unwavering commitment to realizing his dreams. Notably, his principled approach to frugality, characterized by judicious savings and modest living, has proven instrumental in his investment journey.

Like many other people, he is one of the biggest fans of REsimpli.

Key Takeaways

- Introduction of the guest

- Real estate investing in Kansas City

- Buying multifamily in the United States

- How to buy a multifamily property

- How to make the leap from real estate to investing?

- Flipping and distributing: How to make a transition?

- Is it illegal to pass off $25,000 as an assignment?

- What to prefer: wholesaling or own marketing?

- Do crawl spaces need inspection?

- How to build a brand through referrals?

- Biggest advice from Ramon

- Why is Ramon the biggest fan of REsimpli?

- Where to find Ramon?

Transcription

Brandon Barnes 00:06

Hey, what’s up, everybody? It’s Brandon here with the REsimpli podcast, and I want to welcome our guest, Ramon Vazquez. How are you doing today?

Ramon Vazquez 00:15

I’m doing great. Thanks for having me.

Brandon Barnes 00:17

Yeah, thanks for hopping on and talking real estate today. Why don’t you take a couple minutes and introduce yourself and let us know kind of where you’re from and what you got going on?

Ramon Vazquez 00:26

Yeah. So I’m out of Kansas City, Missouri. Not originally from here, but this is where my wife is from, so that’s how I ended up in the Midwest, met her in California, so made that transition. But this is where we started buying our first rental, and so went from that and transitioned into a full time investor starting in 2018. And so now this is our primary market, and we’re also doing a little bit in Wichita and growing that market as well.

Brandon Barnes 00:57

Awesome. So you were living in California looking to buy rentals, I’m assuming.

Ramon Vazquez 01:04

Yeah, so I was active duty military when I moved to California, and then I met my wife, and then we eventually got married several years later, and we both were making good income. I knew eventually I figured out through bigger pockets and some other podcasts that I wanted to start investing in real estate, and that’s kind of what led me to figuring out, like, oh, okay. It’s hard to find a cash flowing asset in Southern California, so I started looking at other markets, and naturally, I looked at Kansas City since we visited there quite a bit to visit her family, and the numbers made sense.

So that’s kind of how we picked that market. And even though we wouldn’t move there for several years, we would just invest remotely, as it seemed like a bunch of other people were doing it. And if they could do it, I figured I could learn it, too.

Brandon Barnes 01:57

Yeah, well, thank you for your service.

Ramon Vazquez 01:59

Oh, thank you, yeah.

Brandon Barnes 02:01

And, yeah, the cash flow is a little bit different in California than in Kansas City. And one thing cool about Kansas City is you can get some appreciation and there’s pockets that are really good for cash flows. So you can kind of buy houses that potentially have both because not all cash flow city or not all cities that rent well, the values don’t really go up a ton.

Ramon Vazquez 02:26

Yeah, 100% agree, and it’s been exaggerated with all the inflation, for sure. Everything that I bought in 18, 19, 20, all that stuff, has gone up way more than I think it should have, but that just is what it is. And you’re right. All of it was cash flowing. In the meantime, just because pricing is affordable and you can kind of hit that 1% rule pretty easily.

Brandon Barnes 02:50

Yeah, that’s awesome. And so you started buying remotely. Talk about some of the challenges of finding — were you renovating these? Were you buying turnkey? What was the strategy of out of state investing?

Ramon Vazquez 03:06

Yeah, so I read the Burr books, and that’s kind of what I wanted to do initially, and I did get impatient. I think that’s the hard part about being a virtual investor. You need to build out a really solid team in order to find something that you can add value and then refinance and pull out all, if not most of your you know, while I was looking at those deals, I was looking at just multifamily in general.

And the first deal I bought was a turnkey duplex, but it was in a great area. And at the time it was on MLS too, and I was using an agent. So at the time we ended up paying a little bit over asking, which I was like, Dang, this doesn’t feel like it’s a great deal. I look back now, that’s one of my favorite assets, just because locked in super low interest rates and it’s in a great area.

I think you really can’t go wrong there if you plan on being a long term buy and hold investor where you can get in trouble is buying in not so great areas where you’re speculating a little bit and maybe the cash flow looks better because I’ve done that. And then you realize all the tenants are not great. And so those properties require a lot more reserves, even with a long term mindset.

Brandon Barnes 04:21

Yeah, because a bad turn can wipe out cash flow for a while on a rental.

Ramon Vazquez 04:28

Yes, I agree.

Brandon Barnes 04:30

All right, so your first one you bought was turnkey. Did you attempt to try to renovate and do some value add over the next couple of years or most of them kind of fell in that same.

Ramon Vazquez 04:42

Yeah, and they were all duplexes, the first….

Brandon Barnes 04:45

Oh, nice.

Ramon Vazquez 04:46

Yeah, the first six I bought and I partnered with some with my mom and obviously my wife, her and I were buying stuff together too. So the last few that we bought were some value add. Like, I was buying them at a discount, but my plan was to do a long term burr, like possibly renovated over the next year or two as I got tenants out, increased rents and all that other stuff. Well, that was like during COVID and I’m still kind of working on those a little bit, if I’m being honest.

But by the time I got this to where I can refi them, the rates have gone up. So it’s almost no point of me refiing to try to replace a 4% interest rate with like a seven and a half or something higher. So right now I’m actively working and seeing if I can get maybe a line of credit on it, which is a little tough because it’s multifamily. And so I figured those are a little bit harder to get a line of credit, but in the meantime, they still cash flow. Okay. Again, it’s a constant struggle with those tenants being replaced. But no, my first, I guess it would be 12 units or doors I should say. They were mostly turnkey. They had tenants in place, and they needed very minor upgrades.

Brandon Barnes 06:00

Nice. That can make it a little bit easier being out of state, not having to do renovations. Necessarily start screening tenants because you buy a house and it takes four or five months to get it renovated, get it on the market and get it rented out, that’s mortgage payment you’re paying.

Ramon Vazquez 06:22

Yeah. And I relied a lot on my property manager, too, which that’s a whole another conversation, too. I’ve been through four property managers now, and I only started in 2018, so not all of them were fired. One of them quit because she ended up selling her business. But it’s tough because you try to go for the cheapest if you’re like me, when you’re getting started to save money, and then you quickly realize, okay, that’s why they only charge 7%. And so it’s a constant growing process.

And some of them get too big. That’s what happened with the next one after that. And they weren’t able to fill them as well, and they weren’t providing the level of service that I think you should provide. And so it’s a constant balance. My recommendation would be get as many referrals as possible, but also, don’t be afraid to fire them if they’re not doing what you think they should be doing.

Brandon Barnes 07:14

Yeah. One thing I’ve always found interesting about the property management industry is in my opinion, and I get it, because you only have so much room for cash flow. But the lower the rent, the less the property manager gets paid and generally, the more difficult the tenant, where the opposite can happen, where you can have a higher price rent, usually a better qualified tenant, and they make more money. That’s always been an interesting balance to kind of see how it works with.

And I don’t know what your averages are, but when I have buying holds in Augusta, Georgia, and they would rent for $800, so paying somebody 9%, they’re making $80 a month to potentially deal with a headache, and then there’s a balance. They have to have so many properties to make money. I’ve always found that industry interesting, the kind of way it’s all shaped up.

Ramon Vazquez 08:19

Yeah, I’ve quickly realized that one, I needed it out of necessity when I was living out of state. But even once I moved here, back to where I could self-manage, it just wasn’t what I liked. And I know it was tough. So I feel, for all the property managers, I try to actually give them a lot of slack because it is one of the hardest things, I think, as a buy and hold investor, is good property management. But you’re absolutely right. Like here, the minute you go under $1,000 a month, the quality of that tenant most likely drops significantly.

And then, like you said, what they’re making isn’t a lie. And so they’re typically charging you for everything else because they have to cover their costs. You just have to kind of know what you’re getting into. And I would just be very cautious if somebody’s like, oh, I’ll manage it for 7% and take care of everything. Because I feel like they’re cutting corners somewhere just to break even. Because it’s not a super profitable business. Unless, like you said, you have a lot of doors and then you run the risk that they’re too big. Like the company I had that I ended up letting go, they had over 1000 doors and they got just too crazy, in my opinion.

Brandon Barnes 09:29

Yeah, the nice thing about it, if you build up enough of your own units, depending on what you’re paying, you can eventually probably hire an employee that only works for you is one of the cool things. You got to get to enough doors to where you’re paying $4,000 a month to a property manager, but then at that point you can pay somebody $60,000 a year and then their only focus is door rentals.

So that is one of the benefits as you grow. And I’ve had a couple of friends that have eventually, once they got to 50, 60, 70 doors as rentals, they just brought that person in house and hired them. So then they have one focus.

Ramon Vazquez 10:08

Yeah, I agree.

Brandon Barnes 10:09

Cool deal. So you got your stuff or you bought your assets in Kansas City, you’re in California. When did you eventually come to Kansas City and then on that move did you go full time investor or were you still had a job in Kansas City?

Ramon Vazquez 10:25

Yeah, so right after the Pandemic hit, my wife got an opportunity to work for the military in Fort Leavenworth, which is just north of Kansas City. And so that’s when she had to leave her W2 a government job, which we were actually both working at a government job in California. So again, we were both making six figure salaries, had a ton of benefits because of the government. And she’s definitely more conservative as far as risk goes than I am. And so she was just like, I’m not going to leave this job just because of all the benefits.

And then she’s also in the Navy Reserves, and so she got that opportunity. The Navy was going to pay for us to move. We just said like, hey, let’s just move and not move back. They’ll hold her job, but at the end of the day when she’s like, hey, I don’t want to move back, they’re probably going to tell her, you know, we’re going to let your job go. And so she was even comfortable saying, well, I’ll find something. I’ll make it work.

And that’s when once we got that news, I was like, all right, let me go get my license in Kansas City or Kansas and Missouri, and then I could just go be an agent if I can’t go full time. And just have that to supplement my income. So when we did move, I went into that role of like, hey, let me go be an investor agent. I did probably, I can’t remember now, 20 some plus deals in like, six months without a state investors as a brand new agent. But I’ve been an investor, and I think that’s what made me successful.

But then I quickly realized that to be a good agent, it’s a full time job. And so that was taking me away from what I wanted to personally do with my real estate investing and the company that I ended up forming a few months prior with one of my partners that I met out of Wichita who was kind of trying to do the same thing as me. Become a full time investor, do some wholesaling fix and flip, but mostly build the portfolio.

So that was a challenge. And it took me a while to just be like, hey, I need to make that leap and just believe in myself that if I put more time into the business, it’s going to be a real business instead of trying to be an agent. Which I got burnt out because I was servicing way too many out of state clients. And it was frustrating. Agents will understand and relate. Like, you only have so much control, right? Like, at the end of the day, somebody else is making that decision on whether they’re going to buy or sell. When you’re an investor, you can make those decisions for yourself, like, will you buy it? If not, move on to the next deal and whatnot.

So made that leap about six months later and went full time. And again, it’s easy when you have income coming in from a spouse to make that leap, for sure, or if you have enough reserves. And we were always savers. That’s kind of just been our mentality and why we’ve been able to purchase real estate. We just save a lot of our income. So that also helped too. We had a bunch of money saved up, and even though we were buying a new house here, we’re like, we’ll make it work just because we know how to save and we know how to live below our means.

Brandon Barnes 13:32

Yeah, which is really important for any business, but especially if your primary focus is buy and hold because it can be very cash intensive on repairs or down payments if you’re purchasing and things like that. So did you start wholesaling or doing some stuff kind of to have some active income in the real estate space outside of an agent?

Ramon Vazquez 13:56

Yeah, actually, I started wholesaling in 2020, so before we even moved, I was virtually wholesaling.

Brandon Barnes 14:02

Oh, cool.

Ramon Vazquez 14:03

But not very consistently. It was like doing one or two deals a month, maybe less, just depending, because I’m still kind of figured out I was cold calling and doing some texting and whatnot. And so once I bought those duplexes, I was like, I need more capital. And that’s when I gave wholesaling a real thought and went completely into it and figuring out, okay, how do you wholesale properly? I joined a mentorship, which is where I met my partner to try to figure out how do you do this right and how do you scale it?

And so once I move here, I’m doing the agent thing and putting the wholesaling thing kind of on pause or not doing it as well, I should say. My partner was also a W2 working full time. And he was, you know, we were trying to run this business pretty much part time after our working day or whatnot. And so, you know, fast forward those six months after I was doing that agent stuff full time, I kind of put a break on that, wasn’t super active on it. And we started focusing on that and then we started doing two to three deals consistently a month.

And so we would try to keep what we could. But at that point, we were building the business so it was putting cash back in. So we were wholesaling a lot more. And eventually, fast forward to today, we’re doing a little bit of everything still wholesaling to build up that capital and keep the marketing going and then keeping the deals that we like that still cash flow given today’s market and where interest rates are at and then flipping the stuff that doesn’t cash flow. And that’s just mostly the best exit to maximize the profit is flip the higher end stuff.

Brandon Barnes 15:50

Got you. You’re mainly – You are wholesaling with a goal to just pay for marketing, maybe give you guys a little bit of pay as far as ownership. And then anything left over is solely focused on putting towards buy and say, are you buying holding in both markets or just Kansas City specifically right now?

Ramon Vazquez 16:13

Right now, everything we hold as a company is in Kansas City or the Metro. We would buy and hold in Wichita because we know that market a little bit better now. We just haven’t found the right opportunity. We’ve done a flip there and a couple other wholesale deals. But right now we’re still looking for those better because again, we’re trying to hold things in B minus or better neighborhoods, which can be hard to find stuff that cash flows or even deals that make sense. And again, the stuff we’re holding right now, it’s a true bird. We’ve gotten to the point where we have the right contractors in place. We know how to do rehabs, we know how to estimate. That took several years to figure out.

So for us, we’re not trying to leave money in a deal like we underwrite all our deals where we have zero or we’re actually getting some money back and it’s still cash flows and it’s in those good areas. So those deals are a little bit harder to find. But we have been adding around one property a quarter right now is kind of our pace and trying to scale that up. But mostly single family, which is a little bit harder to scale doors just because you got to go find more of them than if you found one apartment building or something like that. But it’s what we know and how we market to get those wholesale deals. So it’s just easy at this point.

Brandon Barnes 17:35

Yeah, for sure. I always find this interesting. Every buy and hold investor is a little bit different. Is your focus to get the houses paid off or a certain percentage of them paid off and leave them paid off? Or is your goal to then maybe pull out a line of credit to then start snowballing the mortgages to get them?

The reason I asked one of my friends in Alabama who built up a portfolio of probably 300 homes said the key was he bought his first one aggressively, paid it off as fast as possible, went and got a line of credit or mortgage on it, then was able to buy two. And then he had two doors paying one mortgage and then kind of snowballed and grew. What’s your strategy as you continue to go?

Ramon Vazquez 18:24

So our strategy is obviously through the Burr method is we’re able to leave a decent amount of equity. Right? But we are trying to highly leverage our capital just because we can find more opportunities that make sense. And so we’re pretty aggressive. And I think that probably goes with the nature of we’re all under 40, so we have a longer investment horizon at this point. So we’re not as aggressive as paying them down but making sure we have cash reserves and they’re all cash flowing really well.

And then, yes, eventually I think we would take out and, I mean, we’ve already applied for some and have some. They’re okay. They’re not like traditional lines of credit. They’re more like commercial ones where you can use that. And again, we would use that to fund these rehabs so that we can refinance out and not have to use hard money on the front.

And that’s kind of something we’re working on now very aggressively, is how do we replace our hard money with private money or other lines of credit where we can do stuff for cheaper than paying two, three points and 12% to a hard money lender, which there’s a time and place for those, but it gets expensive and adds up quick.

Brandon Barnes 19:34

It does, yeah. And I think you’re doing it right away is take little pieces away. So I’m primarily a flipper, and we used to use hard money for the whole thing. Now we just use hard money for the purchase. And our goal is to continue to dwindle that away so that I think our main lender is like 12.5 and 2 points. We’re at a point now where they fund 100% purchase 100% rehab. So it’s really nice. But if you can get it a little bit cheaper or kind of start working that way, it starts saving money in the long run.

Ramon Vazquez 20:13

Makes you more aggressive too when you offer, which is always like you’re always trying to find a competitor, especially if you’re flipping because there’s a ton of people trying to do it and I always wonder, how are you offering so much more than us? And again, you’re either doing it for cheaper than we are or you have access to a lot cheaper capital or you’re not really good at running your numbers. But I like to think a lot of people are at this point that we compete with because they’ve been in the business for a while.

So yeah, that’s something that we know. We’ve been doing quite a few deals, we have a lot of folks who follow us and understand and trust what we’re doing and so we just need to tap into that money that’s out there available and like you said, try to cover part of it, if not the whole thing when possible.

Brandon Barnes 20:54

So let’s talk about the transition. Do you have any tips for somebody looking to transition? Some stuff that helps? You obviously having a good job and having reserves is a benefit, but not everybody has that opportunity necessarily. So is there any kind of advice or tips you have for that?

Ramon Vazquez 21:14

I think for me was you have to kind of look into the mirror and figure out how serious you’re going to take this. Do you feel like it’s going to be a business that will make you excited? For me, it was very easy. I was making good money, not excited and was really bored. So I’m like real estate was something I was passionate about, so I knew I wouldn’t quit within two months because I got frustrated. For me, I was like, I’m going to make this work, there’s hundreds of people doing it.

So if you don’t have the benefit of cash reserves or a spouse that has an income, figure out what you need to do to cover those basic living expenses so that you’re not, for lack of better word, desperate when you’re trying to do this business and make offers and talk to sellers. I think if you come at it from a scarcity mindset because you need a deal today or yesterday, then I think that does impede you.

So I would figure out what can I do to supplement that cost of living that I need for my basic necessities. So it might be get a job on the side and still try to devote as much time as you can to your real estate business. For me, that’s what I was doing. I was doing them in tandem and I could see that if I put more time to it, I was probably going to make more money. Right?

And so to me, consistency is a big deal. So making sure you have processes in place to be consistent is huge. And I’m one of those folks that would want to do it for at least six months because I feel like you can do it for a month and get lucky and do a deal really quickly and then that becomes your expectation and that’s also not realistic. Or you could do it for three months and nothing happens. And that’s okay because that happens to a lot of folks. Like, it took me almost three months to do my first wholesale deal.

And then once you do the first one, you’re like, okay, wholesaling is real. It’s not something that somebody made up or something illegal. So you got to be consistent and you got to figure out which strategy makes the most sense for you. If you just like to buy and hold and like your W two job, that’s perfectly fine too. Use that leverage that I mean, loans are way easier to get when you have a W2 job. I know that from personal experience.

So there’s pros and cons to each one for me was like, I don’t have a ceiling. If I work for myself, that’s always been my thing. And I didn’t want to have a regret looking back. And if I did 20 years of the government and I had a pension, sure I’d be fine for the rest of my life, but I probably would be like, hey, what if, right? What if I would have took that leap?

So just be consistent. Try it for, I think, at least six months before you make any rash decisions and figure out what’s that one strategy that you want to focus on. Don’t try to do multiple strategies. I tried that at one point, and it’s just very difficult. Like if you really like fix and flip, maybe just try to be a good flipper first before you try to wholesale or do buy and holds or whatnot. And I think once you get really good at that, you can systematize it before you go on to a different strategy.

So I went from buy and hold to mostly focusing on wholesaling and then focusing back on, okay, now I could take these wholesale deals and figure out how to leverage them to get the max profit, whether it be hold them long term or flip them. It’s nice to have those options when you wholesale. But I think wholesaling, you know, it’s like a full marketing business in itself. And I think folks are like, I’m just going to try wholesaling for a few weeks and see how and I’m like, no, don’t do that. You’re going to get frustrated.

And there’s plenty of people making way more money than me. And they don’t market to any sellers. They just network and buy deals from other wholesalers. So everybody has a place, I think in the industry. You just got to figure out what fits with you and what makes the most sense.

Brandon Barnes 25:08

And I agree with you. You’re really spot on as a cold caller or direct mail or anything. Literally your first phone call can result in a deal. It can be that simple or it can be the complete opposite where you send thousands of postcards or make thousands of phone calls and they lead to nothing. So definitely trying to do it for six months or so and just kind of understanding what the pace of it’s like, what it’s like, and then focus on your budget. You started cold calling. Is that kind of where you?

Ramon Vazquez 25:46

Yeah. So that’s a great point. Like not only your personal living budget, but your business budget. We have progressively gotten bigger. We didn’t go from one hundred dollars to ten thousand dollars. Our overhead now is over ten grand. But it was gradual. We were at 1500, then 3000. I was cold calling myself. Then I met my partner. We brought in a VA. We leveraged that. Then we added texting. It’s kind of been layered. And we did start with the cheapest forms of marketing because the risk is lower, right? Like you don’t have to blow through $10,000 in pay per click or direct mail ad spend in a month. You can use $10,000 over six months if you’re doing it yourself or whatnot.

And so I’m with you. Do it slowly and just put that back into the business if you can. And it is a struggle at first because we weren’t pulling money out of the business for I think, the first year because it was just going right back into more marketing and leveraging other people. And so for us it was okay because we had other jobs during that first year and so we were okay. If that’s not you, you got to figure out what makes sense. And again, you might also want to pick a market where it’s more conducive to whatever strategy you’re doing. Right?

If you want really big checks and you won’t want to do as many like, I would say don’t go to the Midwest because the assignment fees are not going to be as high as maybe the coastal markets. But understand the coastal markets is more competitive and so you’re not going to get as many deals. So some people, I think it was Lauren Hardy say this like do you like to hunt squirrels or elephants? Right? And so that’s also like a personality thing.

At the end of the day, I think look at your back market if you can. I think it’s always easiest when you’re local, but then if you want to go virtual, figure out one where you actually want to hold things long term. That’s probably a good market to start in if you’re going to do wholesaling, because that can lead you to better deals.

But for me, having more deals consistently, I guess it’s easier for me to predict. Cash flow and income for the business that way than sure, maybe we could do like a $60,000 deal in SoCal. But is it going to be once a quarter? Is it going to be once a month versus doing like four to five deals a month consistently? Which is kind of we’ve gotten to that point, and it’s a little bit easier to predict cash flow and kind of grow slowly. That’s kind of been our motto.

Brandon Barnes 28:22

I think. I like the hunting squirrels or elephants. I haven’t heard that one. I’m a coastal market, so I live in Charleston, South Carolina.

Ramon Vazquez 28:30

Okay.

Brandon Barnes 28:31

And when I first started in the industry, I was in Augusta, Georgia, and two completely different price points. And to your point, the assignment fees in Augusta were a lot smaller, but they were a lot easier to get. I found deal flow to be more consistent where Charleston generally, if we assign one or flip one or do something with it, there’s more profit tied to it, but we don’t get as many of them.

And so it’s balancing that and even a $25,000 assignment. Yes, it is the proof of concept wholesaling works. It’s real, it’s not illegal, but that can go really quickly if it’s your only deal and you don’t have more things coming in with marketing, with depending on your own budget to live whatever’s going on, 25 grand doesn’t go a long way, potentially. Let’s talk about how you decide your wholesale from your buy and hold. So you’re doing most of your lead gen. Are you still buying from wholesalers or do you pretty much buy just from your own marketing?

Ramon Vazquez 29:37

No, we actually do. We still do kind of all the free stuff that I call, like, network with agents. We look at wholesale deals. It’s harder for me to pencil a wholesaler deal just because we can get our deals a little bit cheaper, but they still exist. And we love to joint venture with wholesalers in our market too, if they maybe have a hard time moving a deal or they need help underwriting and stuff like that.

So I guess to your question, how do we determine what to do with it? So, for us, based on the current interest rates and kind of what we’re refinancing into, which is a DSCR type of loan which is based on debt service and cash flow, we typically.

Brandon Barnes 30:21

What’s the – So people can understand that service. Basically, the rent has to cover the mortgage by a certain percentage. What DSCR are you seeing or underwriting for?

Ramon Vazquez 30:34

Yeah, right now our lender does 1.2.

Brandon Barnes 30:38

Okay.

Ramon Vazquez 30:39

So I think that’s pretty common for….

Brandon Barnes 30:40

It is.

Ramon Vazquez 30:41

Yeah. For single family, we’re getting 75% loan to value, and we can actually do a cash out and the rate goes up a little bit. So we kind of see if there’s enough meat on the bone there to do a cash out and get some money back. But those rates are like they were hovering in the seven and a half range plus or minus some percentage. So for us to make it worth it, for a cash flow perspective, the minute after repair value is like over 240, it just doesn’t really make a lot of sense.

And so the minute we see a property and again, we’re not taking stuff down that needs like a six figure rehab, we wholesale those because we have that opportunity. So we’re looking for stuff that’s pretty straightforward. Or if it needs a big rehab, we’re buying it super deep. Like, we have one under contract now at 25 and the house is worth 140, but it needs like 65 or 70, I think.

And so that’s not a typical deal for us. Typically our rehabs are like under 60. They’re usually like the stuff that’s easy to rent, three, two’s with a garage preferably, and they usually rent for 1250 plus. But again, the rents don’t usually match or make sense with the after repair values once you get over 240. So that’s kind of been our sweet spot, which again puts us in like B minus neighborhoods, maybe C plus, like those kind of fringe neighborhoods, which we’re okay with because we understand.

And actually within our business, one of our partners actually does property management, so we have that luxury of being more hands on instead of leveraging that to somebody else. So with that being said, if the property is like 350 is adaptive repair value, we’re most likely going to flip that or wholesale it to somebody else who wants to flip it. And then again, if it’s turnkey and we really can’t pull our money out because we can’t buy it steep enough, we’ll wholesale those as well if we can. Or we were selling some of those to hedge funds a year ago when they were buying like crazy.

So we try to look at the exit strategy that makes sense and see what’s the best return for our investment. Obviously we can’t hold everything because we don’t want to kill the wholesale business. And I have a bunch of assignments coming in, even though we could assign it to ourselves in theory, but in every deal, that doesn’t necessarily make sense. So we have a very specific criteria. So a lot of the stuff that we get under contract doesn’t meet it, and so it just naturally leads to us flipping and wholesaling more anyway, and again puts us back to that. We’re buying one every quarter or so that we’re holding.

Brandon Barnes 33:28

two things on that a, it’s amazing that your average rehab is under 60. We can’t even touch a $60,000 rehab. It feels like down here I have like a cosmetic one with new roof and HVAC that’s running me like 75 right now.

Ramon Vazquez 33:44

Okay.

Brandon Barnes 33:45

It’s crazy.

Ramon Vazquez 33:46

It is. If I can ask what’s the age of the property? Because I feel like that has a huge.

Brandon Barnes 33:51

This one might be in the 90s.

Ramon Vazquez 33:53

Oh, really? Okay.

Brandon Barnes 33:55

It’s in a planned neighborhood. It’s a vinyl track home, but just our cost of labor is skyrocketing pretty much. When I see a wholesaler send a deal through and it’s $30,000 renovation. I can tell you’re not renovating in Charleston because there’s very few people who are doing a quality product.

But the thing I want to talk about, you have a very specific criteria or buy box, and I think that’s really important for people to understand that’s how you can prevent yourself from getting in trouble is if it checks all the boxes that you know and understand and have experience with. Yes, there’s still risk in every asset you ever buy and every tenant you put in the house, but you increase your likelihood of success by following your core competency on kind of what you guys need to own.

Ramon Vazquez 34:53

Yeah, I agree. The reason I asked about age was I think one of my partners is more open to it. I like things built after 1950 just because there’s more unknowns once you go to those older properties. One of my partners was buying before we became a business, so I don’t know that she owns anything, pre 1945, maybe, but typically everything else we’re looking at is newer than that. And again, it goes back to those areas are usually rougher because those homes are not well maintained and that’s not where we’re trying to hold stuff in. I mean, we wholesale there all the time, or you can even do a flip in the right neighborhood.

But you’re right, those bigger rehabs are not something we target because the risk is higher. A 5% increase in $100,000 rehab is more significant than like, a $30,000 rehab. But yeah, we are lucky in the Midwest for our cost of labor to be probably significantly cheaper than the coastal markets. But then again, there’s plenty of houses here where you can get upside down really quick as a seller, even if they’re like, hey, I’ll give you my house for 10K, because it needs so much work that those values like that neighborhood might be $110,000 neighborhood.

And so there’s a lot of deals that are just not worth messing with. And we’ve stopped targeting certain parts of the Casey metro just because when those after repair values are sub 130. It’s unfortunate, but it doesn’t make a lot of sense for an investor to go in there unless there’s some kind of government incentive to go in there or if you’re like. I’m not even going to say this is a good strategy, but there’s plenty of people who take the slum Lord strategy, and they barely do any rehabs, which is not something I would ever condone, but that happens all the time.

And those people may make those houses work, and we’ve been on the other side buying from them when they realize that’s a terrible idea and they have to sell their house for super cheap or whatnot. But it’s also the houses that we’ve seen like the worst living conditions.

So again, like you said, a very specific buy criteria is really useful and it’s hard because when you’re getting started you don’t want to throw any deals out the door or eliminate anything that could be a potential deal but it just makes it so much easier. Your risk is so much lower when you do have a specific one.

Brandon Barnes 37:22

Yeah. And your buy criteria is for what you buy personally. You don’t have to necessarily everybody has different buy criteria. People buy different stuff. If you can find buyers that like certain houses and are okay with these certain things. That’s their criteria. That’s not your job to worry about that, which is important to understand. Yeah, the ARVs, so us, I don’t know that we, I’m trying to think I don’t even know that we have houses that really exist under 200 here at all anymore even it’s unless, it’s 600 sq. ft. Maybe like a one-one in rough shape.

But fortunately most of our homes are built 1950s and newer unless you go into the historic parts like downtown Charleston. But fortunately there you’re talking 800 plus thousand dollars ARV so you can have the money to renovate them but they are probably year long projects and you have historical societies and your paint’s got to be approved, your wood’s got to be approved.

It can take two months just to get a permit and that’s part of knowing your — can we see virtual wholesalers come into Charleston all the time and it’s in every market. You’ll see it in Kansas City, you’ll see it everywhere. They come into this area and they send you a house and you’re like there’s no way it’s worth that or there’s no way your renovation is even close. And I appreciate you pulling a house from a mile away. That might be something, but it’s not even close to.

Ramon Vazquez 38:57

Yeah. Probably one of the most important things you can do when you’re starting out is like understanding value. And it is difficult when you’re virtual and don’t really understand the neighborhoods or maybe don’t even have access. In Kansas, it’s non-disclosure, so it’s actually pretty hard to comp unless you have access. So yeah, you’re absolutely right. Don’t ignore comps within a half mile just because it’s a pretty nice one a mile away.

And that’s why I’m a big fan of doing your back market as much as you can because I know people who are successful in San Diego, LA and that’s probably one of the most competitive markets in the country. So I think it’s possible everywhere. It just may take you a little bit longer. But again the fees are going to be bigger in those competitive markets. But being there makes a huge difference for us. Like meeting with sellers is kind of, you know, that’s our competitive advantage for sure over a virtual guy.

But even a local wholesaler, whoever has the best appointment can connect with the seller. The most is probably going to get that deal and if you can solve their problems, that’s the name of the game. If you’re going direct to seller, if you’re using a team and buying from agents, that’s very possible. That agent can definitely do a lot of that heavy lifting for you because they’re going to understand the neighborhood and whatnot. But yeah, virtually wholesaling is tough.

I would highly recommend you partner with a local wholesaler or investor and then you can have that partnership go as long as you want until you feel comfortable. We went virtual into Indianapolis for a little bit and we’ve kind of pulled it back just because it was strictly a wholesale market. And so it’s harder to get opportunities that make sense because you’re constantly having to go the lowest possible offer so you can still make a profit.

But again, we relied on somebody else because all the tools we had access to was still kind of difficult to pinpoint value. A lot of times you find these comps and they would tell you like, oh no, that’s an anomaly because of XYZ and it’s probably easier to figure out if you had that MLS access.

So I like partnering with other folks when I get deals outside of our market, because we still get those deals on accident when we’re marketing. And it just makes you a lot more confident, in my opinion, when you’re making those offers to make sure you’re not messing it up or having to go back for a price reduction. Because that’s another thing we don’t like to do, canceling or asking for price reductions.

So not everybody operates that way, but that’s how we operate. Like we have a pretty low cancellation rate and a pretty low price reduction even though we tell them there’s an inspection period and all that other stuff and the typical stuff that you deal with MLS property, but we don’t drag it out as long. We do everything pretty short and condensed like I think most wholesalers do. So you just got to figure it out and be able to make those offers confidently.

Brandon Barnes 41:55

Yeah, man, that phone call, thankfully we haven’t done it a bunch either in our business. The phone call of having to cancel a property or a price reduction, I think is one of the most gut wrenching ones that I ever have to make. It is, especially if they’ve gone down the line of potentially moving or depending on why they’re selling the home, they’ve kind of come at peace with it and then to have it pulled from under them or changed is not enjoyable.

Ramon Vazquez 42:33

Yeah, I agree. And if you do this long enough, you have probably a brand and a social media presence. And so we’re constantly building that up and we don’t want sellers to go on there and be like, hey, they just came back and load ball me after their inspection period or something like that.

And I do think there’s some mentors and gurus or whatever you want to call them coaches out there that teach that, just get under contract and then figure out where you need it after your buyers walk the property, you know. I’m sure we’ve lost deals because we didn’t take that approach, but I think we’re okay with it because at the end of the day, our reputation, especially in the Midwest, I feel like reputation and your word means a lot.

Not saying that it doesn’t in California, but it’s a smaller market. And so you mentioned some folks that you know in Kansas City before we started recording, and I know them, and you probably know a bunch of others, too. And so you don’t want your name to be out there like, oh, Ramon, he’s the guy that just goes out there and locks deals up way too high, and then there’s retrades later. You know, that to me, probably means more than making a bunch of money.

And I’m actually not the greatest at negotiating with sellers because I’m always trying to give them the best deal. And so I’ve had to replace myself in some of those conversations with one of my partners just because they can be a little bit more detached, because maybe they didn’t meet with the seller or whatnot.

And so while we’re still trying to run a profitable business, like you said, nobody wants to make those awkward phone calls when you’re supposed to be providing convenience, speed and certainty. And now you’re trying to — and again, I don’t think it’s bad when you do it really fast at the beginning, but I know plenty of people that have 30 day inspection windows, and they’re closing on the 31st day. And I’m like, you got to change that. You don’t want to do that to sellers. It’s just not a good look.

Brandon Barnes 44:22

Yeah. And it’s also different. I’ve contracted a house telling them it’s contingent. So we have crawl spaces here. I know you guys have basements are a big thing. So our crawl spaces are a big thing. And I have lost, I remember there was one stretch last year, we lost like $38,000 in crawl space inspections, selling homes. And we thought we had remedied some stuff, and they found more stuff, and it was like back to back to back.

And so I have gotten to the point where I’m comfortable going in a crawl space. I also have my crawl space, company will come do it. But there are certain homes, if I have a price and they have a price, and we figure out something in between, I tell them, this is based on your crawl space, checking out the way that it should. I was like, because that’s one thing that I know what roofs, HVACs, plumbing, electrical, I know what all that stuff costs. Anytime I think a crawl space is good, I’ve been hit for $7,000, $8,000, $9,000.

And if you have those conversations up front, it’s completely different when the seller when you call them and say, hey, this credible crawl space company went under your house, the repairs are going to be $9,000 because you have x, y and z. How do we make this work now? And that’s different than streaming them along for 30 days and then what’s cool about doing what you’re supposed to do?

So you kind of mentioned this a little earlier. There are people who do no marketing and just kind of referrals network. That’s how our business is. So we do no direct to seller marketing. We’ve built a brand for ourselves, and then I’ve wrapped my truck, my wife’s truck, and my 16 foot trailer, and we continuously get deals from it. I just got one a couple of weeks ago just sitting in a parking lot. A guy walked up to me and then two days later is contracted.

Ramon Vazquez 46:20

Nice.

Brandon Barnes 46:21

But because of that and doing what we’re supposed to do, those people have led to referrals, and we’re starting to see a chain of, hey, you bought my friend’s house six months ago. They said everything went really smoothly. They told me to call you here. Our dumpster guy gives us referrals. Everybody now knows and knows that we’ll close, and so they call us before they call anybody else, which has made a big change as well.

Ramon Vazquez 46:50

Yeah, those are the best deals. Like, nothing better than getting a free deal because it makes everything a little bit less stressful. Yeah, I agree. You would be the buyers that I would want to connect with if I was a wholesaler in that market, because you do what you say you’re going to do. Like, I’d rather sell a deal to somebody I know who’s going to perform and assign it and know they’re not going to come back like a day before closing and be like, I got no funding, and now I have to figure out an extension than make 5k more with some guy that I’d never heard of. That’s a huge deal.

And again, if you’re going to do this long term, you got to think about your reputation. I mean, there’s plenty of people who are still in the business and they have a bad reputation, and they’re probably doing deals, too. But you’re not going to get, like you said, all those referrals, all those free leads if you have a bad reputation.

Brandon Barnes 47:41

Right. Yeah. So again, it just goes back to just do it the right way in the beginning, and it will benefit you long term in your business, especially as you grow. If you think about it as a one off transactional business, then it’s a little bit different. But if it’s something you’ve been doing it now for five, six years, I think we’ve been doing it full time. July 8th. I mean, as you grow, it, it’s something that can benefit for a long time. Well, Ramon, I appreciate it, man. I had a good conversation with you. I don’t know if there’s anything else you want to leave the audience, but I thought you gave some really good information on people transitioning, buy and hold and things like that.

Ramon Vazquez 48:19

I appreciate it. I’m happy to connect with anyone. I get a lot of DMs on Instagram about getting started or what should I do with x amount of money. If you’re in the Kansas city market, definitely love to connect with you. If you’re thinking of investing out of state or even if you’re local, probably the best way to get a hold of me is probably on Instagram, which my Instagram handle is ramonv underscore rei (ramonv_rei).

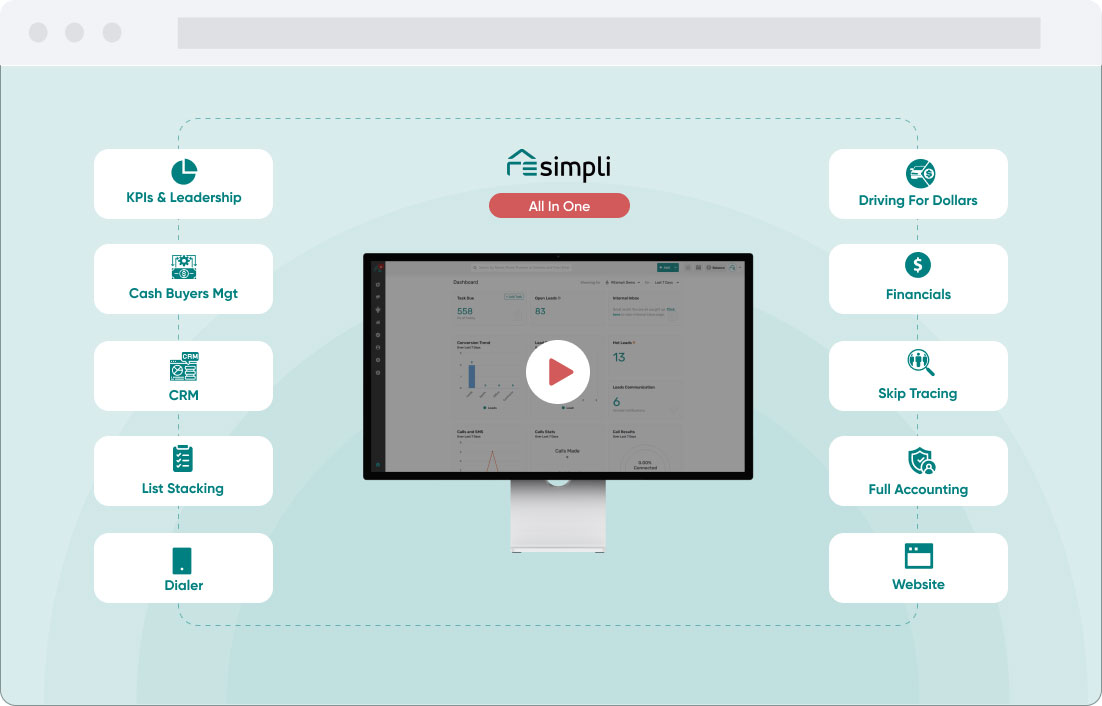

And yeah, I’m pleasure being on here and obviously a big fan of REsimpli. And that software, we use it every day in our business. And we have a saying, like, if it’s on a REsimpli, it probably didn’t happen. A good CRM is huge for any business, for sure. But again, we didn’t have REsimpli day one. Right? Like, everybody starts somewhere, and I feel like if you’re like me, you’re like slow and steady. You just constantly grow. But as you would say, the possibilities are kind of endless. In real estate, there’s a ton of way to make money. There’s a ton of extra strategies. My biggest piece of advice is just focus on one.

Brandon Barnes 49:30

Yeah take action. I appreciate mean it is. And that’s what Sharad to the founder of REsimpli, and we’ll end it on know, we talk all the time. And what’s his favorite book? What’s the one thing that he talks about? And it’s the one thing that’s one of his superpowers is being able to just dial in one thing at a time. And I’ve been a REsimpli user since its beginning, since I met Sharad five years ago.

Ramon Vazquez 50:00

Yeah.

Brandon Barnes 50:01

So I’ve been with it since the very beginning because of that focus on that. It’s allowed it to grow to where it is now, and people’s business will do the same thing by just having so awesome, man. Well, I appreciate it. You guys connect with Ramon in Kansas city, and if you’re ever up there, go eat some barbecue as well.

Ramon Vazquez 50:23