Empowering Data-Driven Success

Skip Tracing

Efficiently source contact information like phone numbers and email addresses with our skip-tracing tool, and make your outreach more effective!

REsimpli Features

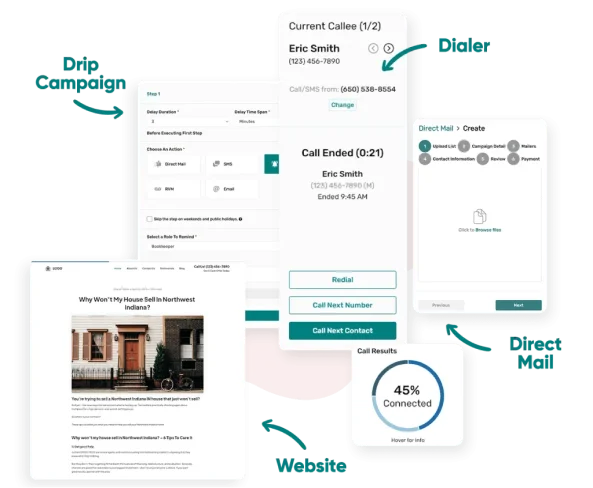

Dialer

Boost your real estate success with our Cold Call and Lead Dialers, offering seamless list stacking integration, customizable scripts, advanced dialing options, and efficient lead conversion.

Website

Enhance your online presence with our free high-converting website tailored for real estate investors, designed to optimize lead generation and conversion.

and much much more...

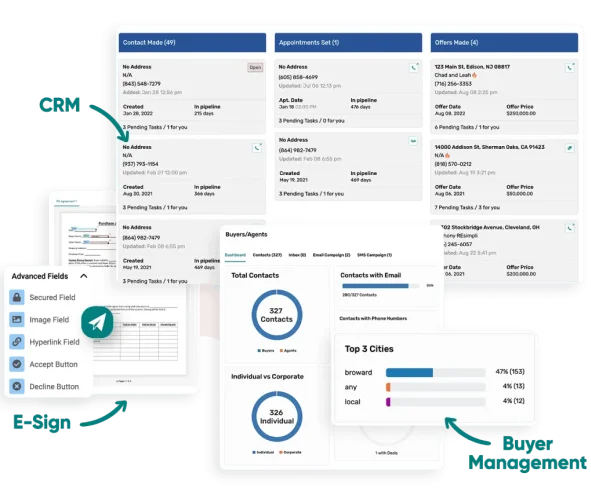

Other features include Task Management, Skip-tracing, KPI/Leaderboard, Vendor Management, Speed-to-Lead, e-Sign, File Storage, In-app Answering, SMS much more....