Financing Your Deals

Most investors don’t want to pay cash for the real estate they purchase. Even if you have $100,000 or so in the bank it doesn’t make sense to use it all on one deal. Interest rates these days (2017) are still at very low levels. That means if you use all of your own money to buy a property, you are really only saving yourself 5-6% max versus taking out a loan.

We’ve all seen the ads on the internet for ‘No Money Down’ real estate deals. That’s ideal. Theoretically, you would only be limited by your time in how many deals you could do if they all were ‘No Money Down’. The truth is ‘No Money Down’ deals that work are difficult to find. And when you do find them, you may be paying in other ways. The concept is a good one though. The more you can use OPM or ‘Other People’s Money’ to finance your deals, the more deals you can do. More importantly, using OPM leads to bigger returns on your own money.

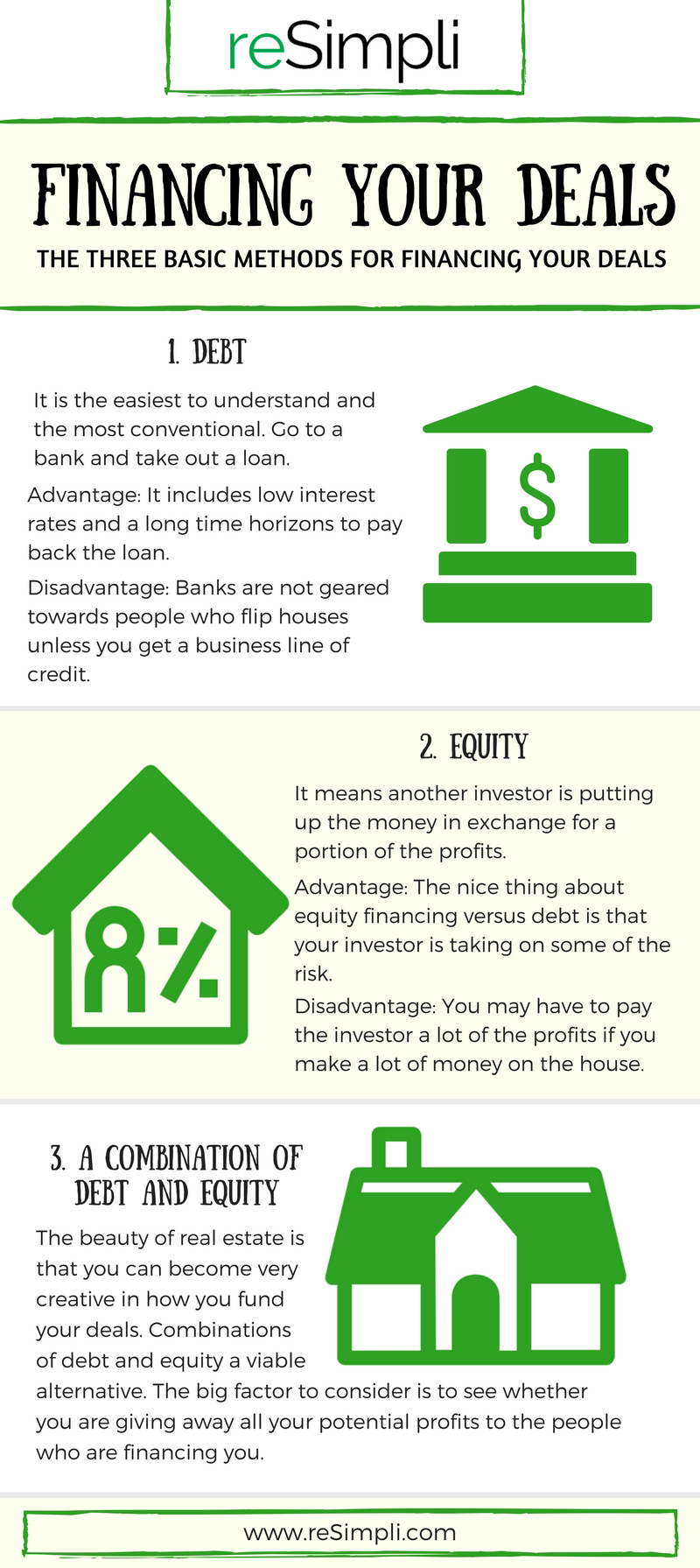

There are basically three methods for financing your deals. Each one has their advantages and disadvantages:

- Debt

- Equity

- A Combination of debt and equity

Debt is the easiest to understand and the most conventional. Go to a bank and take out a loan. The advantages of working with a bank include low-interest rates and long time horizons to pay back the loan.

The trouble with a bank is that they are not geared towards people who flip houses. They want the traditional family with a secure job who will stay in a home for many years. Many banks don’t want to extend loans for a flip nor do they want you to pay back the loan quickly when you sell the home unless you pay a penalty. They can also be very slow to process the loan. Meanwhile, the desperate homeowner is going to your competition because he needs his home sold fast.

Hard money can come in and help you if you need the money quickly. Hard money is a form of debt that can help you buy a flip house in as little as a couple of days. The trouble is that you will pay for the convenience in the form of high-interest rates – sometimes north of 13-15% interest.

Sometimes you can also convince the current homeowner to extend a ‘loan’ to you in the form of owner financing. This can be very convenient, particularly if the homeowner has a short-term problem he needs to solve with an injection of cash. A medical bill could be an example. You solve this problem and consider it a down payment on their house. Then you make payments to the owner during the rehab. Just make sure that owner is using your money to make his mortgage payments so his bank doesn’t take the house from you.

Equity financing means another investor is putting up the money in exchange for a portion of the profits.

The nice thing about equity financing versus debt is that your investor is taking on some of the risks. If you don’t make any money on the house, you don’t have to pay any interest to the investor. The downside is that if you make a lot of money on the house, you may have to pay the investor a lot of the profits. How much you pay all depends on what you negotiate up front. Like hard money, equity investors can fund deals very quickly. That means you become much more attractive to motivated sellers who need the cash right now.

The beauty of real estate is that you can become very creative in how you fund your deals. You just need to find the money, and negotiate with the person, or company, who has it. ‘No money down’ deals are possible, but you will have to become very creative.Combinations of debt and equity such as a down payment from an equity investor and a loan for the rest of the purchase is a viable alternative. Any other combinations of debt and equity can also work. The big factor to consider is to see whether you are giving away all your potential profits to the people who are financing you.